Management’s Discussion and Analysis

The Difference Is...

Sustainable Growth

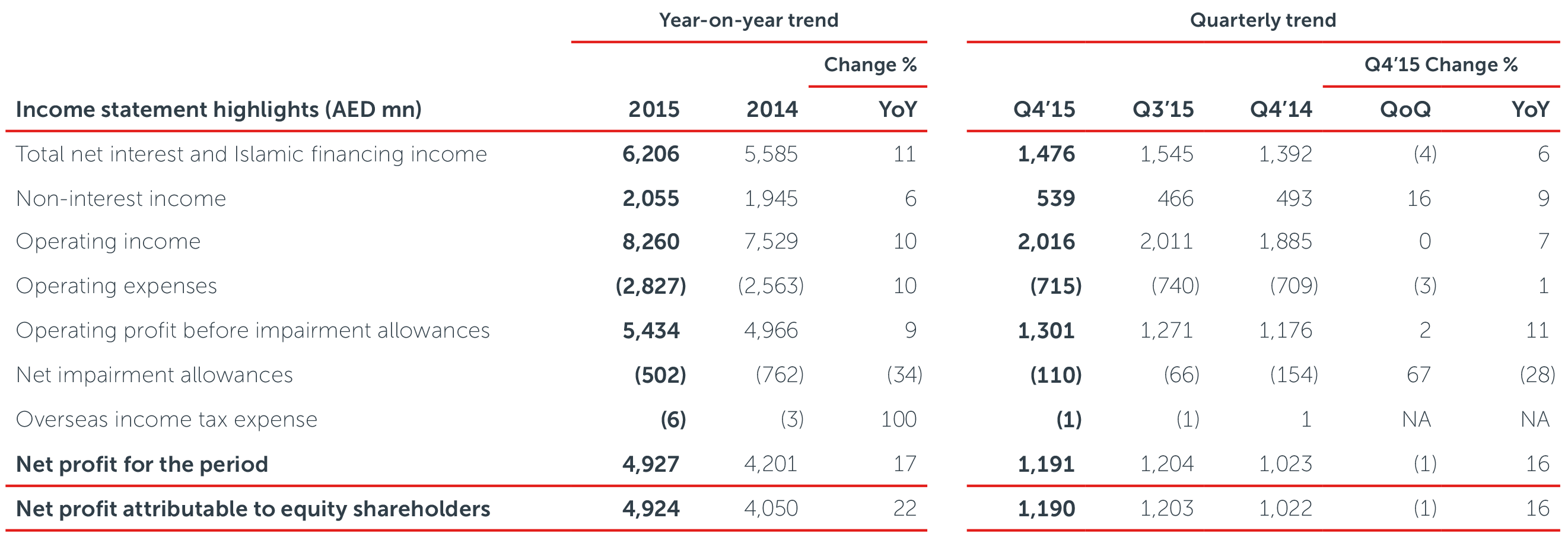

ADCB delivered a year of record financial results in 2015. The consistent application of our strategies, as well as significant contributions by each of the Bank’s businesses, enabled ADCB to achieve profitable growth and maintain a prudent risk-reward balance, despite an environment characterised by increasingly challenging economic headwinds.

Amongst the highlights of our 2015 performance, net profit was a record AED 4,927 mn, rising 17% from the prior year. Net profit attributable to equity shareholders increased 22% from a year ago to AED 4,924 mn. Basic earnings per share for 2015 were AED 0.93, growing 26% from 2014. The primary factors resulting in this strong performance were: record operating income, driven by increases in net interest and Islamic financing income and non-interest income; well-controlled operating expenses, which were stable as a percentage of income; and lower net impairment allowances, reflecting continued improvement in asset quality.

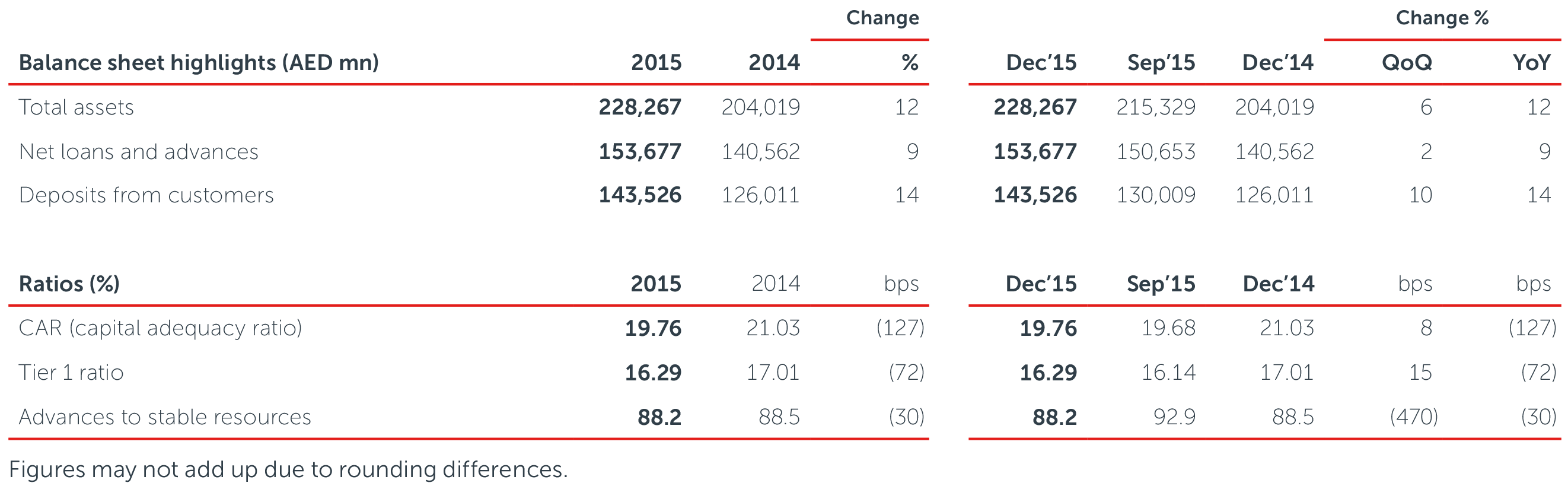

Total assets increased 12% over 2014, to AED 228 bn at 31 December 2015. ADCB’s sustained growth is reflected in the 9% increase in net loans and advances, with both Wholesale Banking and Consumer Banking contributing to the increase, whilst total customer deposits were up 14% over the prior year.

- 2015 VS. 2014

- Key Highlights

- Our Performance

- Capital and Liquidity

- Asset Quality

2015 VS. 2014

Key Highlights

Net Profit (AED mn)

17%

Increase in the

past year

Record Level of Net Profit Despite a Challenging Business Environment

- The Bank reported a record net profit of AED 4,927 mn compared to AED 4,201 mn in 2014, an increase of 17% year on year. Net profit attributable to equity shareholders was AED 4,924 mn, an increase of 22% over 2014.

- Basic earnings per share were AED 0.93 compared to AED 0.74 in 2014, an increase of 26% year on year.

- Despite maintaining a high level of capital and a higher equity base, the Bank delivered a strong return on average equity (ROAE) of 20.3% compared to 18.1% in 2014.

- Return on average asset (ROAA) for 2015 was 2.22% compared to 2.00% in 2014.

Our Performance

- Operating income in 2015 reached a record AED 8,260 mn, an increase of 10% year on year. Total net interest and Islamic financing income for 2015 was AED 6,206 mn, up 11% over the prior year. This was mainly on account of increased volumes and a shift in our asset mix towards higher yielding interest earning assets combined with improved recoveries and higher interest in suspense reversals. As a result, the Bank was able to improve its margins in 2015 to 3.27% from 3.24% in 2014. Interest expense for 2015 was AED 1,591 mn, increased 14% over 2014 due to an increase in liabilities volume. Cost of funds increased slightly from 0.89% in 2014 to 0.92% in 2015, primarily on account of higher EIBOR/LIBOR and higher spreads on time deposits gathered in the fourth quarter of 2015. The increase in customer deposits resulted in an improvement of the Bank’s loan to deposit ratio from 111.5% in 2014 to 107.1% in 2015, whilst the Bank’s current account and savings account (CASA) deposits remained stable year on year comprising 44% of total customer deposits as at 31 December 2015.

Cost of Funds (%)

Asset Yield (%)

Net Interest Margin (%)

- Non-interest income for 2015 was AED 2,055 mn, up 6% year on year, mainly on account of higher fees and commission income, which was offset by lower trading income. Net fees and commission income grew 16% year on year to AED 1,438 mn in 2015, primarily attributable to higher retail and corporate banking fees combined with higher gains from trust and fiduciary fees. Net fees and commission income accounted for 70% of total non-interest income in 2015, compared to 64% in 2014. Net trading income for 2015 was 14% lower year on year, on account of funds de-consolidation on 31 March 2014. Excluding the impact of the funds de-consolidation in 2014, net trading income increased 37% year on year, whilst non-interest income was up 14% over the prior year.

- Cost to income ratio for 2015 was 34%, remaining stable over 2014. Ongoing Bank-wide cost management initiatives enabled the Bank to maintain a cost to income ratio within our target range. Operating expenses for 2015 were AED 2,827 mn, an increase of 10% year on year. The increase in staff costs reflected increases in the personnel needed to support our more granular approach to growth.

Cost to Income Ratio (%)

Capital and Liquidity

Measured and Sustainable Growth, Robust Capital Position and Continued Focus on Liquidity

- Total assets reached AED 228 bn as at 31 December 2015, an increase of 12% over the prior year. Net loans and advances were AED 154 bn, up 9% over 2014. 90% of loans (gross) were within the UAE, in line with the Bank’s UAE-centric strategy. Wholesale Banking loans (gross) were up 7%, whilst Consumer Banking loans (gross) were up 10% year on year.

- As at 31 December 2015, investment securities totalled AED 21 bn and the Bank was a net lender of AED 22 bn in the interbank markets, whilst the liquidity ratio was 25.8% compared to 25.2% as at 31 December 2014, providing a further source of liquidity for the Bank.

- Total customer deposits were AED 144 bn as at 31 December 2015, up 14% over the prior year. As at 31 December 2015, advances to stable resources ratio was 88.2% compared to 88.5% as at 31 December 2014.

- As at 31 December 2015, the Bank’s capital adequacy ratio was 19.76%, and Tier 1 ratio was 16.29% compared to 21.03% and 17.01%, respectively, as at 31 December 2014. The reduction in capital adequacy ratio was on account of higher risk weighted assets which totalled AED 176 bn as at 31 December 2015. The capital adequacy ratio minimum requirement stipulated by the UAE Central Bank is 12% and Tier 1 minimum requirement is 8%.

Capital Adequacy Ratio (%)

Tier I Ratio (%)

Asset Quality

Continued Improvement in Asset Quality, Cost of Risk at Record Low Levels

- As at 31 December 2015, non-performing loan and provision coverage ratios were 3.0% and 128.5%, respectively, whilst cost of risk improved to 29 bps from 48 bps as at 31 December 2014. As at 31 December 2015, non-performing loans were AED 4,834 mn compared to AED 4,611 mn as at 31 December 2014.

- Charges for impairment allowances on loans and advances, net of recoveries amounted to AED 500 mn in 2015 compared to AED 811 mn in 2014, 38% lower year on year.

- As at 31 December 2015, the Bank’s collective impairment allowance balance was AED 2,969 mn, 1.89% of credit risk weighted assets and the individual impairment balance stood at AED 3,376 mn.

NPL Ratio (%)

Provision Coverage Ratio (%)