Risk Management

Risk Performance Overview 2015

ADCB’s investment in risk infrastructure and focus on disciplined risk management continued to pay off and impact ongoing results in 2015.

2015 was a challenging year in terms of market conditions: the year was characterised by sustained low oil prices, increased geopolitical tensions, weakening credit performance in certain parts of the market, well-publicised problems in SMEs’ credit quality accompanied by tightening liquidity, and pressures on funding costs. However, ADCB’s balance sheet and P&L continued to demonstrate resilience. Some 31 December 2015 highlights include:

- NPL rate of 3%; lower than last year’s

- Provision coverage of 128.5% remained conservatively cushioned

- Average portfolio quality has remained stable, notwithstanding a negative trend in credit conditions

- Capital adequacy ratio of 19.76%, which is robust by international and regional standards

- LCR is well above BCBS standard requirements at this time

- Concentration reduction by name and sector

With a continued focus on risk management practices alongside enhanced monitoring, ADCB has managed to improve credit quality whilst also maintaining balance sheet growth.

We continue to invest in our risk management capabilities through expanded portfolio-exposure reporting and analytics techniques, standardised stress tests, assessments of ratings migration, lessons-learned coaching, technical training, model-development capabilities, and tuning/calibration. Strict enforcement of discipline is also applied on the business side using tools such as RAROC (Risk Adjusted Return on Capital), economic capital computation, cross-selling, and portfolio-level returns.

We continue to monitor the impact of international developments and domestic challenges on our portfolio and to make changes as appropriate to our underwriting and policy measures. Continued work on automation and information management will improve both the quality and speed of risk reporting to help ADCB prepare for the anticipated Basel III requirements that the Central Bank of the UAE may implement in the future. ADCB is also continually upgrading its risk infrastructure and recently embarked on projects such as the digitisation of credit approvals and the rollout of a fraud management system to ensure that our risk management practices remain best-in-class.

We track emerging risks closely and have augmented our related IT risk infrastructure accordingly. We also hired a Chief Economist to help ADCB stay attuned to and on top of ever-changing macroeconomic conditions.

Emerging Risk Scenarios

As part of our risk management strategy, we regularly identify and monitor “emerging risks.” These are events that could lead to a significant unexpected negative outcome that could cause the Bank or one of its divisions to fail to meet a strategic objective. When we assess the potential impact of an emerging risk, we consider both financial and reputational implications.

This section describes the categories of emerging risks that could materially affect the UAE banking system and ADCB: macroeconomic conditions, geopolitical risks, the additional rigours imposed by enhanced regulatory requirements, risks related to information technology and data security, and concentration risks.

Emerging risk: Macroeconomic conditions in the operating markets.

Definition and potential impact: Prolonged low oil prices will have an impact on the UAE economy and the GCC countries’ economies. Most analyst reports forecast a slowdown in the GDP growth rates and an associated period of lower credit growth and tighter liquidity conditions.

Mitigation strategy: The UAE economy in general and the Dubai economy in particular are well-diversified away from oil into non-oil sectors, and this will help partially mitigate the impact of lower oil prices across the banking system. ADCB has over 90% of loans in the UAE and therefore expects to be a key beneficiary of this natural mitigant compared to peer banks with more geographically diverse asset books within the MENA region. ADCB’s portfolio diversification in terms of investment in non-GCC bonds, lending to diversified industry groups, and focus on granular and well-structured lending is expected to help soften the impact of macroeconomic conditions.

ADCB is well-capitalised in terms of capital adequacy and regularly runs stress tests to ensure sufficient capital coverage at all times. ADCB also has a proactive approach to liquidity risk, which includes monitoring of positions, regular stress testing, and buffers in excess of the Basel requirements.

Emerging risk: Geopolitical risk

Definition and potential impact: This risk could stem from one of many sources unrelated to the Bank and its business. Geopolitical tension has been a persistent issue in the region.

Mitigation strategy: The Bank regularly monitors geopolitical and economic situations around the world. In particular, ADCB’s Chief Economist centrally assesses the economic impact of changing geopolitical risks and provides key inputs to drive the Bank’s strategy. Where necessary, we adjust our country limits and exposures to reflect our appetite and to mitigate these risks.

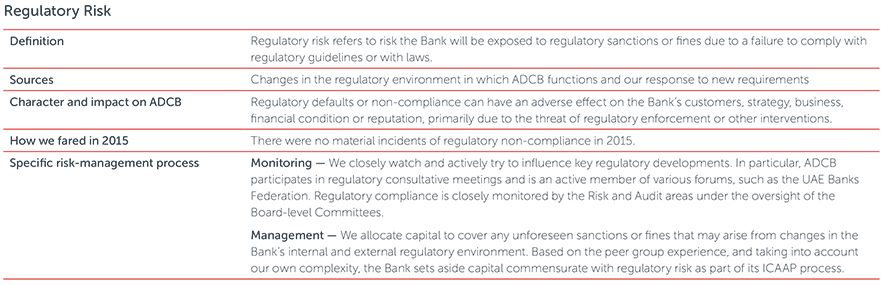

Emerging risk: Regulatory and legal risks to our business model.

Definition and potential impact: Governments and regulators often develop policies that impose new requirements, including in the areas of capital and liquidity management, operational risk, central counterparty exposures, and business structure. These developments may affect our business model and profitability. Should a regulatory change reduce the Bank’s ability to respond to all of our customers’ needs or to achieve fair customer outcomes, we may experience increased costs and reputational damage. Moreover, inability to satisfy our customers would cause the Bank to fall short of strategic objectives, which could have an adverse effect on earnings, liquidity, capital and shareholder confidence. The risk of failure due to emerging unanticipated regulatory and legal changes affects all of our businesses.

Mitigation strategy: ADCB strives to ensure that the Bank’s views are considered when UAE regulatory policy is developed. ADCB either chairs or is a key member of several UAE Banks Federation forums. Internally, we analyse all new pipeline requirements, regulatory consultation, and draft regulations or circulars to measure their impact qualitatively and quantitatively as well as to ensure they can be implemented effectively. We also confirm that our capital and liquidity plans anticipate the potential effects of any changes. We constantly monitor and expand our capital allocation and liquidity management disciplines to incorporate future increased capital and liquidity requirements and to drive appropriate risk management and mitigating actions.

In the past few years, the Bank has launched several initiatives to reduce risk to our business model. For example, our Customer Experience Committee ensures that customers enjoy a superior and consistent experience. We have well-developed policies and procedures to deal with customer complaints, and all front office staff and officers are trained to deal with customer concerns in a timely manner.

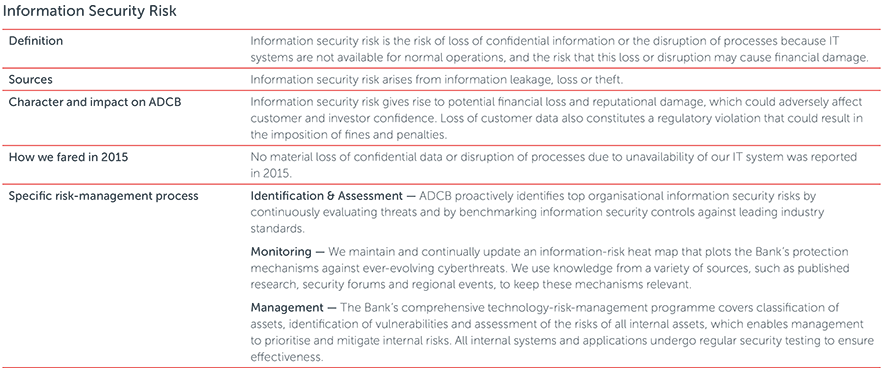

Emerging risk: Risks related to information technology and data security.

Definition and potential impact: Cyberattacks are increasing in frequency and severity across the globe. This risk affects all of our businesses. A successful cyberattack could lead to fraudulent activity or the loss of customer data, leading to adverse business, financial and reputational consequences. The Bank could experience significant losses as a result of the need to reimburse customers, pay fines or both. Furthermore, a successful cyberattack could cause significant damage to the Bank’s reputation.

Mitigation strategy: The Bank has in place a constantly evolving and expanding large-scale programme to improve controls over user access security as well as hardware and data integrity and protection. In addition, we have implemented additional anti-virus protection and engage in regular penetration testing and unusual-activity detection, mitigation and elimination. We are insured against data-security risk and consequential risks and conduct ongoing user and customer education on information protection.

Principal Risks Affecting ADCB and Risk Coverage

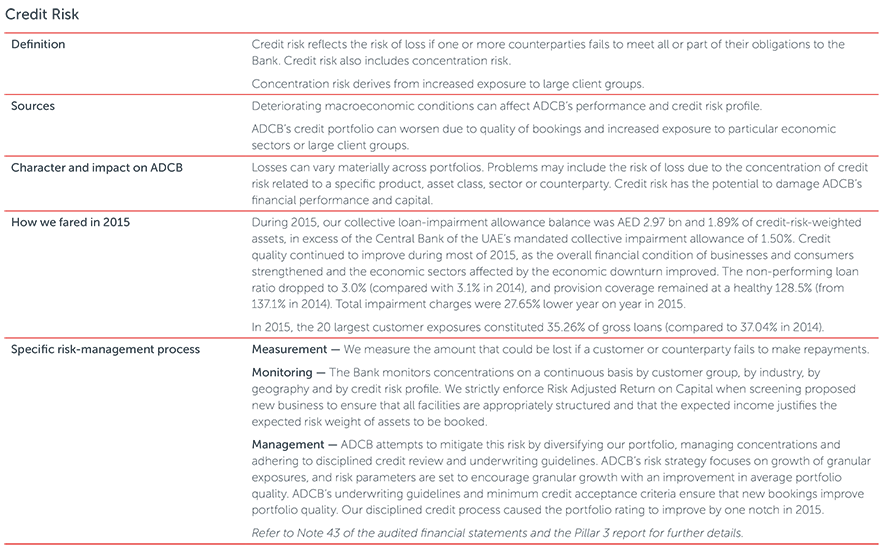

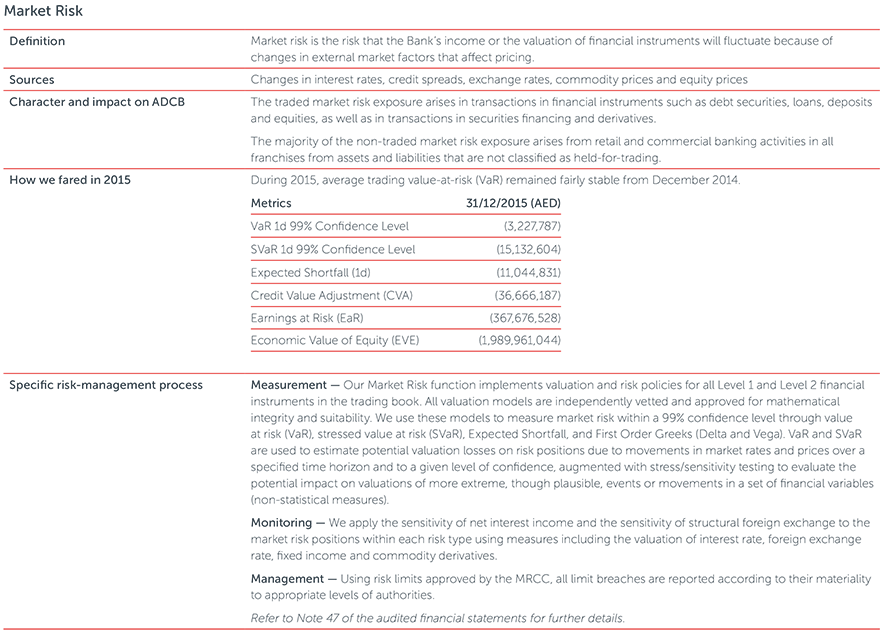

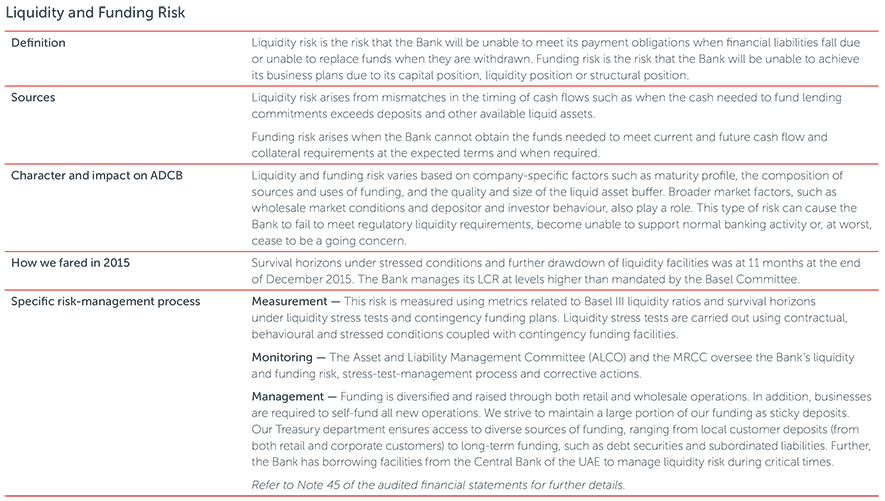

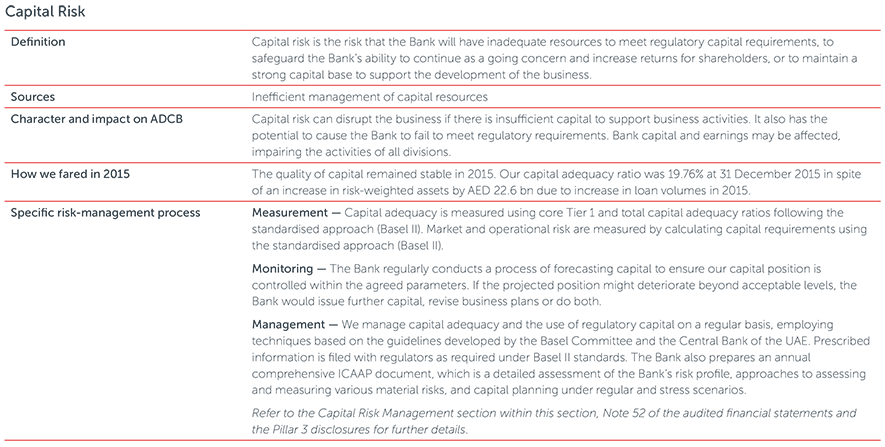

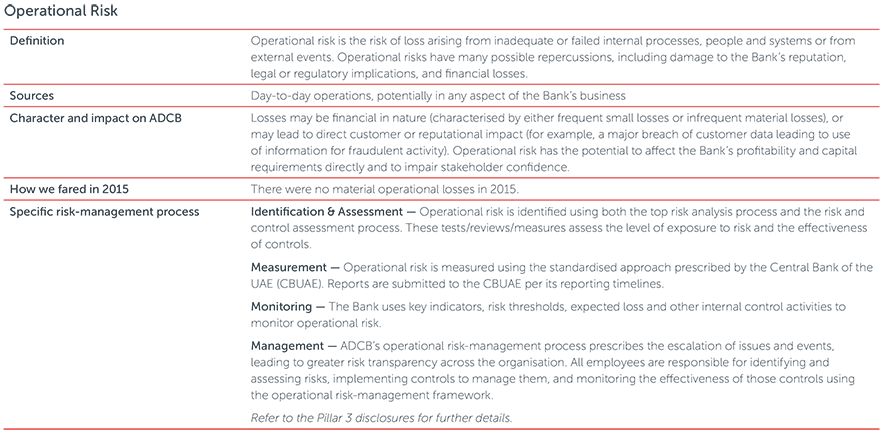

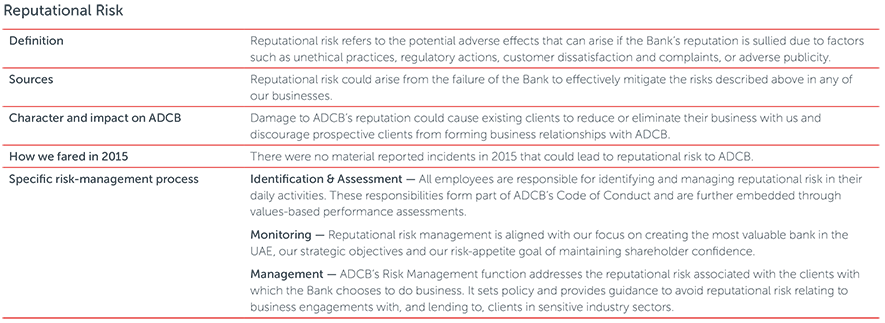

The principal risks faced by ADCB are presented in the following pages, together with a summary of the key areas of focus and how the Bank managed these risks in 2015.

Capital Position as at 31 December 2015

The Bank’s capital position applying prevailing rules as at 31 December 2015 is set out in Note 52 of the audited financial statements.

Leverage Ratio

The Basel III reforms include the introduction of a leverage ratio framework designed to reinforce risk-based capital requirements with a simple, transparent, non-risk-based ‘backstop’ measure. The leverage ratio is defined as Tier 1 capital divided by the exposure measure. The BCBS will test the proposed 3% minimum requirement for the leverage ratio, and expects that final calibrations and any further adjustments to the definition of the leverage ratio will be completed by 2017. Disclosure of this measure may be required as of 1 January 2018.

Liquidity Coverage Ratio

During the crisis of 2008, many global banks experienced severe funding difficulties despite maintaining adequate capital levels because they did not manage their liquidity in a prudent manner. Consequently, the BCBS developed two minimum standards for funding liquidity. The proposed Liquidity Coverage Ratio (LCR) will require banks to have sufficient high quality liquid assets to withstand a 30-day stressed funding scenario that is specified by supervisors. The proposed Net Stable Funding Ratio (NSFR) addresses longer-term liquidity mismatches. These ratios cover the entire balance sheet and will provide incentives for banks to use stable sources of funding. In May 2015, the Central Bank of the UAE published “Regulations Relating to Liquidity at Banks.” Starting 1 January 2016, the minimum LCR is 60%. This coverage will increase by 10% each year to reach 100% by 1 January 2019. The NSFR requirement to be introduced in January 2018 is 100%. The methodology for estimating the LCR and NSFR is based on an interpretation of the Basel standards and includes a number of assumptions that are subject to change. ADCB monitors its position against the anticipated LCR and NSFR requirements to ensure the Bank’s ability to comply with these standards.