There’s a right way to go about it. Since we launched our strategy five years ago, in the depths of the global economic crisis, ADCB has been showing our business community and the larger communities around us what we believe to be a better way to run a bank, built on strategic pillars designed to both earn success in the near term and withstand the tests of time. We strive to offer all people living and working in the UAE a better way to bank. We see ourselves as a singular force for sustainable growth in this market. Whatever may come, we will be here for our customers, our owners, our people and the UAE — delivering value and service that always goes above and beyond.

Ambition plus discipline. This is the path we have chosen. This is the ADCB way.

Helping Etihad reach new heights with its first A380 — Etihad Airways, the UAE’s national airline, took delivery of its first Airbus A380, thanks in no small part to ADCB’s speed of execution in financing the transaction. The double-decker superjumbo aircraft has been outfitted with every luxury. Etihad’s first A380 service began flying from Abu Dhabi to London in December 2014.

Etihad is one of the fastest-growing airlines in the history of commercial aviation. Named “World’s Leading Airline” at the World Travel Awards for five consecutive years, it has also become one of the world’s premium airline brands, enhancing the prestige of Abu Dhabi as a centre of hospitality between the East and the West. Along the way, ADCB has partnered with Etihad to facilitate its growth trajectory whilst providing exclusive benefits to our shared customers with the co-branded Etihad Guest Above credit card.

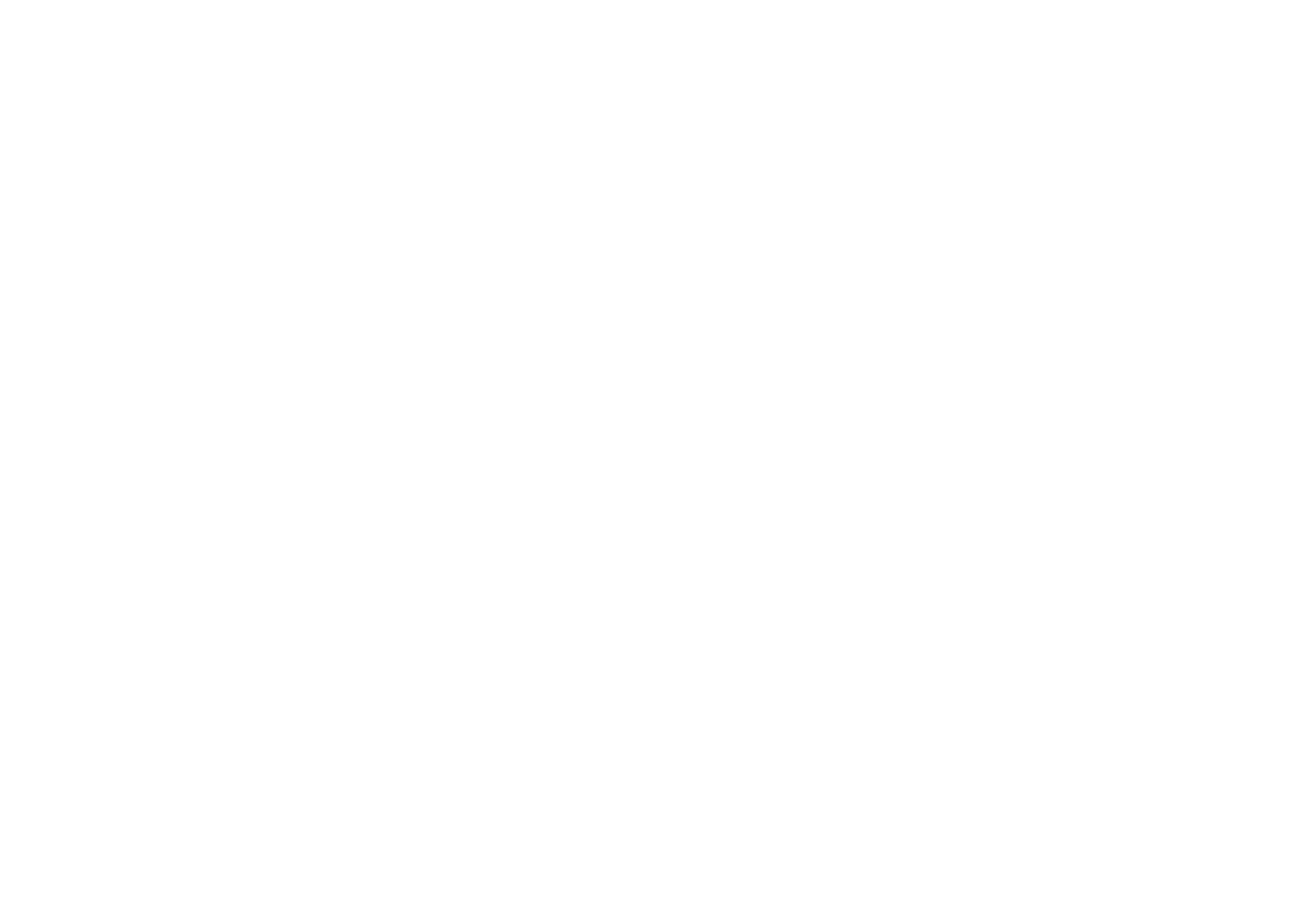

We have made a conscious decision to pursue and stimulate growth from our position of strength within the UAE — a dynamic, growing market of great ambition and vast business potential. Being customer-centric, we follow key customers into proximity markets they favour (e.g. India where ADCB has a branch presence), allowing us to capitalise on global economic trade and investment flows. In this spirit, we have recently opened a representative office in London and have regulatory approval in place to do so in Singapore. That being said, we are a UAE bank, here to serve the people and businesses of the UAE with world-class products and exceptional customer service.

See Our Strategy Summary

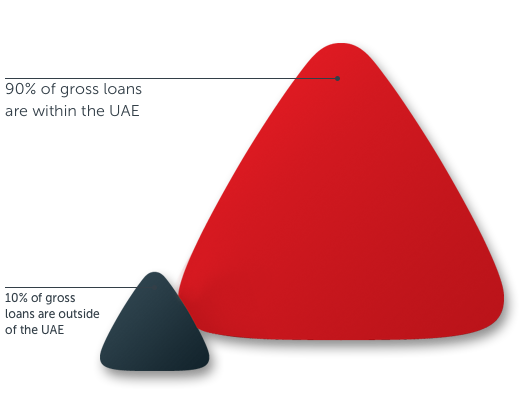

Fuelling balance sheet strength through low-cost current account and savings account (CASA) deposits — Our award-winning and world-class cash management services help clients to make their businesses more efficient and automated, reducing administration and risk. These services also deliver CASA balances for ADCB — a strategic advantage over fixed deposits, as CASA provides stable low-yield/low-cost customer deposits that help to drive down our overall cost of funds. Driven in large part by growth in low-cost CASA deposits, in 2014 ADCB reported significantly lower cost of funds year over year.

CASA deposits improved to 45% of total customer deposits at year-end compared to 39% at the end of 2013. This is a reflection of a large number of cash management mandates from clients who have chosen to bank with ADCB based on our offerings and service standards.

As one of our key strategic levers, we have sought to develop a sustainable cost of funds advantage, seizing opportunities to bolster our balance sheet. In the current low-interest-rate environment, in this time of renewed market confidence, we have increased CASA deposits to further lower our cost of funds as a sustainable way to fuel balance sheet growth and improve returns.

See Our Strategy Summary

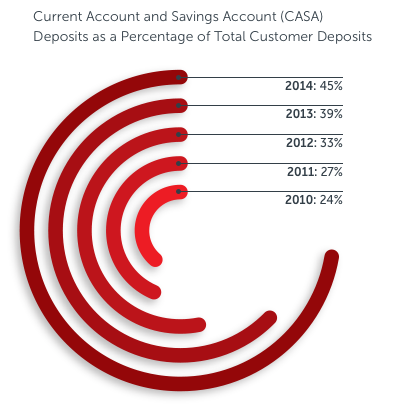

Embedding customer-centricity into our DNA — Embracing the discipline of customer satisfaction, we have adopted Net Promoter Score, or NPS*, as our way of measuring and managing the customer experience. NPS is well-recognised as the ultimate measure of customer advocacy, and provides a good indication of future market growth by recognising the positive impact of ADCB advocates.

We employ NPS as a single currency throughout the Bank. Every member of staff from top to bottom has a measure of at least 30% of their annual performance bonus tied to delivering a superior customer experience. With NPS as our metric, we have implemented real-time, fast feedback loops to ensure we are always delivering customer-centric service excellence.

*"Net Promoter Score" and "NPS" are trademarks of Satmetrix Systems Inc.,

Bain & Company, and Fred Reicheid.

We strive to deliver an unrivalled experience for all our customers in serving any of their banking needs and, with great discipline, focus on controlling costs to ensure that growth in our revenues outpaces expenses. We continue to invest in improving the overall customer experience, elevating quality and simplifying solutions to support our customers at key moments on their individual journeys.

See Our Strategy Summary

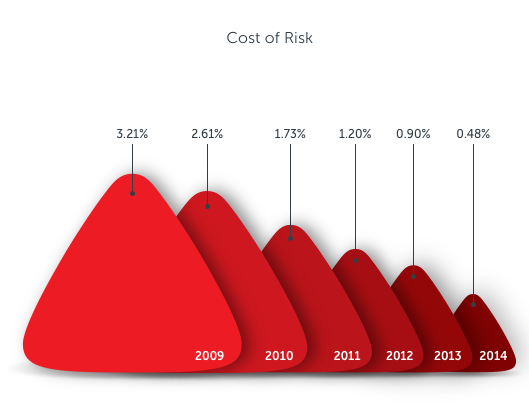

Embracing a comprehensive view of risk — We are risk-aware, not risk-averse, and our growth strategies strike a balance between being ambitious and disciplined. We manage and mitigate risk through an effective control framework, disciplined risk practices and a strong risk-management culture that guides each and every employee. Our risk teams collaborate with the front line to ensure that risk is balanced against profitable growth and to ensure we find the right solutions for both our customers and our shareholders. Together, we find a better way to manage risk.

As we move ahead, we are looking to create greater awareness at the Board and management levels of all manner of risk as opposed to purely credit risk. To enable such a macro-level review of risk, we have adopted a principal risk ownership framework across ADCB.

Effective risk management is fundamental to ADCB’s success. Striking a balance between being ambitious and disciplined, our risk appetite has been designed in partnership with our Board to ensure we see both acceptable and sustainable returns on equity whilst protecting the Bank. We are actively embedding a culture of informed risk management across ADCB to ensure we remain true to our predefined risk strategy and risk appetite. This benefits not only the Bank but also the greater UAE business community.

See Our Strategy Summary

Tamooha — Empowering Emirati women with a unique work group of their own — ADCB has created a highly digitised, women-only work group called Tamooha — the first programme of its kind in the Middle East banking sector.

In this unique work group created for Emirati women, hours are flexible and part-time. Participants work either at home or in a dedicated, women-only workspace, or a combination of both depending on individual preferences and lifestyle priorities.

Tamooha has been an outstanding success. The first Tamooha Centre opened in Al Ain, and we intend to expand this innovative initiative into multiple service centres across the UAE.

All Tamooha Centres will be strictly women-only environments, providing candidates with respectful privacy whilst exercising high levels of cultural discretion and understanding. We have also developed an innovative and secure IT system to ensure maximum information security within a safe digital work space.

At ADCB, we believe that empowering women in the workforce has a positive impact on society. Tamooha embodies our commitment to support the ambition of Emirati women who wish to pursue engaging careers without compromising their social norms — giving them a way to apply their talents and contribute to their families and the national economy.

Tamooha’s support of the career paths of Emirati women is in line with the Abu Dhabi Economic Vision 2030, and with Absher, the initiative launched by His Highness Sheikh Khalifa bin Zayed Al Nahyan to enhance the labour-market participation of UAE citizens. Tamooha recently received “Nationalisation Initiative of the Year” recognition from the Middle East HR Excellence Awards.

Our mission to build partnerships with customers that last a lifetime is entirely dependent upon the talent and tenacity of our people. At ADCB, we recognise that a bank’s primary asset is human capital, and so we expend great energy on attracting, developing and retaining the best talent — with incentives aligned with our strategic objectives. The success of our efforts can be seen in our best-in-class retention rate amongst our peers. Our professional development, function-specific training academies, and career advancement opportunities all work in harmony to promote individual growth and institutional excellence.

See Our Strategy Summary