Business Review

Strong financial performance reinforces ADCB’s position as one of the region’s leading banks.

ADCB operates through our Consumer Banking, Wholesale Banking, and Treasury & Investments groups. Through these groups, we offer a wide range of products and services to our customers — retail banking, wealth management, private banking, corporate banking, commercial banking, trade finance, cash management, investment banking, corporate finance, foreign exchange, interest rate and currency derivatives, Islamic products, and project finance.

Consumer Banking Group

Our Consumer Banking Group (CBG) offers a comprehensive suite of conventional and shari’ah-compliant banking solutions tailored into distinct value propositions. CBG offers one of the broadest consumer banking platforms and multi-channel distribution approaches in the UAE, including 50 branches, four pay offices, 301 ATMs, a 24/7 contact centre, leading online banking and mobile applications, tele-sales, and a direct sales model.

CBG meets the banking needs of various customers through comprehensively bundled financial solutions that include deposit and transactional accounts, personal and auto loans, mortgages, credit cards, third-party insurance brokerage, and investment products. In addition, we offer brokerage and offshore banking services, and through our Private Accounts unit, wealth management to ultra-high-net-worth individuals as well as financial support for their businesses.

Our consumer business continues to grow profitably, with a year-over-year rise of 5% in operating income (excluding one-off items, operating income was up 10%, with the core retail banking segment growing by 14%) and an increase of 72% in net profit. Acquisition momentum was strong, with healthy balance sheet growth — 14% growth in customer base led to a 22% increase in retail assets book, and a 24% increase in credit card spend drove a 21% increase in outstanding balances.

CBG’s discipline, risk-management capabilities and investment in risk infrastructure supported growth, with a 38% decline in impairment allowances over the prior year. Moving to Scorecard-based decisions and risk-based pricing has led to improved margins with lower delinquency and loss rates in recent years.

ADCB’s core strategy of customer-centricity has helped build a sustainable and profitable Consumer Banking business. To enhance our footprint and impact, in 2014 CBG launched a value proposition for the mass-market segment under a new brand, SimplyLife, focused on tapping the market potential of, and ensuring a wider reach within, the bankable population of the UAE.

ADCB’s Islamic Banking forms an integral part of CBG and holds high significance both in terms of financial contribution to the overall business of the Bank and in allowing customers the freedom to bank in line with their values and tradition. ADCB Islamic Banking remains a prime driver of growth and contributed 31% of retail assets and 42% of retail liabilities sourced during 2014.

The biggest challenge in 2014 was margin compression due to falling interest rates and strong competition in the operating environment. This was overcome by focusing on volume growth and investing in back-end processing.

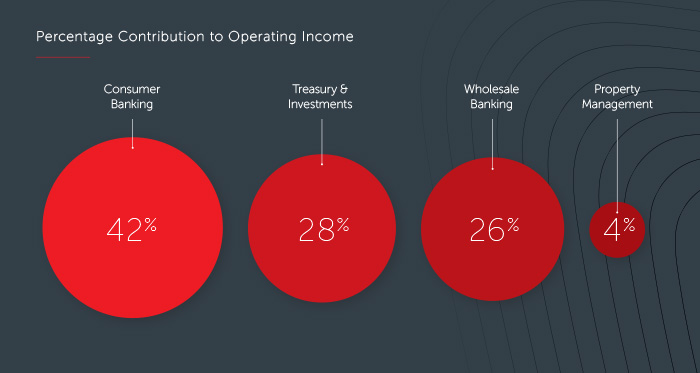

Percentage Contribution to Operating Income

42%

Consumer Banking

28%

Treasury & Investments

26%

Wholesale Banking

4%

Property Management

As a customer-centric bank, we use technology innovation to reduce complexity and make it simple for customers to bank with us. ADCB is the first bank in the region to launch voice biometrics — VOICEPASS™ — as a means of authenticating customers and allowing them to perform banking transactions via phone or mobile devices more easily and securely. ADCB is also the first bank in the world to offer voice biometrics in three languages — Arabic, English and Hindi. Launched in 2014, VOICEPASS™ effectively enhances the day-to-day banking experience of customers in today’s quickly evolving digital-banking environment.

A Better Way to ID

First-to-market with biometric voice recognition

ADCB’s VOICEPASS™ is a first-to-market innovation in ease-of-use: biometric voice recognition. VOICEPASS supports three languages — Arabic, English and Hindi — and allows customers to use their voice as their identification and authenticate via phone and other mobile devices. No keystroking or passwords needed.

Our comprehensive rebranding initiative, launched in the last quarter of 2013 and continued into 2014, encompassed all aspects of the brand, including a redesigned branch experience. The redesigned branches are intuitive, accessible and welcoming — putting customers’ needs centre-stage.

Our strong and leading retail franchise in the UAE has been acknowledged and honoured by a series of awards and accolades from eminent industry observers and authorities from around the world.

CBG remains a key contributor to ADCB’s strategy of sustainable growth. The Group’s proven consistency in financial performance over the years stems from a focus on earning deep customer loyalty and cross-selling efforts, resulting in optimal revenue at the customer level and a healthy risk-return balance on the portfolio.

We offer distinctive advantages to consumers. We are the only local bank that offers ‘free banking’ services to qualified customers. Our customer-loyalty programme offers miles on both Etihad Airways (co-branded programme) and Emirates Airlines (through conversion of TouchPoints) in addition to several other lifestyle benefits through TouchPoints. Our online and mobile banking offer superior functionality and a better experience. Rather than having a product focus, we take a needs focus, with menu-based selling that lets the consumer choose from a full array of options. Our customer service and satisfaction, especially in the Excellency segment, score at the highest levels.

Our consumer business continues to face increasing competition in the rapidly evolving banking industry. Consumer behaviour continues to change, and consumers’ expectations continue to rise.

Customer-centricity remains the cornerstone of our strategy. Investments in enabling technology and data analytics that drive cross-selling and penetration of untapped market segments will be key drivers of growth going forward.

A Better Way to Protect Success

Capitalising on the granularity of the SME segment

Our Small and Medium-Size Enterprise (SME) and Mid-Size Corporate businesses serve critical — and growing — sectors of the UAE economy, giving these vital business owners the banking services and support they need to thrive. SMEs in particular offer the Bank granular growth predicated on deeply involved and mutually beneficial relationships. In early 2014, we acquired the SME loan portfolio of Mubadala GE Capital. This move strengthens our market-leading SME franchise in the UAE, which continues to win new business with award-winning products and customer service.

Wholesale Banking Group

Our Wholesale Banking Group (WBG) provides ADCB’s corporate, business banking, government, public enterprise, and institutional client coverage, as well as cash management, trade finance, financial institution, corporate finance, and investment banking services. WBG is also responsible for ADCB’s Indian branches and its international representative office.

WBG focuses on core clients across these segments to grow domestic share, with an emphasis on growing our transaction banking and investment banking capabilities, and leveraging our strength and market leadership in each area. We are willing to use our balance sheet to support the ambitions of our clients, and to capture an increasing share of their business.

Service is a major priority for WBG, with a goal of improving turnaround time on lending requests and processing efficiency, including the use of electronic channels. WBG operates in a very disciplined manner in terms of risk management and is proactive in helping clients that develop financial problems in their businesses, utilising specialist internal resources.

To drive growth, WBG supports the small and medium-size enterprise and mid-size corporate segments in the economy, ensuring these clients have access to highly trained specialists and effective, dedicated Relationship Managers. WBG also looks to build up ADCB’s trade franchise and support cross-border business in proximity markets such as India, the Kingdom of Saudi Arabia and Oman. ADCB has opened a representative office in London and has received approval to open one in Singapore.

A Better Way to Bank

SimplyLife makes basic banking easy, fast and friendly

In our continued drive to bring banking closer to people’s needs and ambitions, SimplyLife specialises in simple, quick and accessible personal finance products. A simplified application process with reduced paperwork opens access to financial services ranging from personal loans to auto loans and loans for business owners. And a unique emergency service helps customers receive a priority response for urgent expenses, such as medical care. Customers pay no extra charges for settling loans early, giving them greater financial freedom to achieve their goals in life.

WBG’s financial results for 2014 reflected strong performance across all business and product areas, with an increase of 16% in net profit and an increase of 3% in operating income over 2013. 2014 saw record levels of SME lending which is growing in a sustainable way, and similarly high growth for mid-size corporates. Our corporate loan book has reached record levels with reduced cost of risk, and the non-performing loans are conservatively provisioned. We set new highs in trade finance, cash management and current account and savings account (CASA) deposits. In cash management, we have a record number of clients across all segments with payment automation now at 95% of all payment activity. World-class cash management capabilities have been used to build an ever-increasing and low-yield CASA book to support ADCB’s funding needs at low cost and to develop closer day-to-day relationships and alternate, long-term income streams. There is also strong growth in ADCB India’s corporate loan book, with increased profitability.

WBG made some significant changes in 2014. Changes in structure have allowed increased senior coverage in our core wholesale client markets across the UAE. Significant customer-service-model improvements across the business are leading to record levels of customer satisfaction across the franchise, as measured by Net Promoter Scores. We continue to invest in and enhance our cash management and trade finance platforms.

WBG addressed a number of challenges throughout the year. Competition on the lending side remains fierce. This has been managed by driving loan growth across a wide set of clients in different segments and remaining disciplined in the business underwritten.

Growing the wholesale loan book was difficult given the relatively higher level of repayments, pre-payments and refinancing of debt from major borrowing clients. This was managed through a strong, diversified and granular lending pipeline. The result is a stronger loan book and acceptable net lending growth across our business.

Loan pricing has been under material amounts of downward pressure. This has been managed by contributing to lower funding costs through pricing down deposits and by the generation of low-yielding CASA deposits. In addition, the business has been selective on lending transactions and careful to manage yield mix through a multi-segment lending approach at the portfolio level.

The market has also become more competitive in the transaction banking and investment banking space. This has been managed through significant ongoing investment in people, service and systems capability to maintain market leadership.

There has been a very notable pickup in demand for good talent in the market. We continue to emphasise our positive and challenging working environment, improved leadership capabilities, training and development, and the positive benefits created by the changes we made to our structure in 2014 to retain and grow our UAE national and expatriate talent.

Looking ahead, we intend to sustain a suitable level of loan growth across our WBG business segments in 2015, with a focus on business mix, granularity and reduction of loan concentration, whilst continuing to develop our product and channel capabilities to ensure leadership in the market. This includes keeping a close watch on the development of our loan portfolios as they grow and season, whilst ensuring that our discipline and rigour in lending is maintained. Our CASA and fixed deposit books will continue to support a good and cost-effective liability mix for the Bank.

Our success going forward depends on sustaining the trusted advisor status we have with our clients. Our people know we have to earn this every day, in every interaction in our relationship management, and with every solution we develop for and deliver to our clients.

A Better Way to Secure Stability

Dubai R.E. escrow business delivering solid returns

Dubai has seen significant volatility in its real estate market through the last cycle. In downturns this led to some projects not being completed because of a developer’s or construction company’s financial stress. Working to support the Government of Dubai, we saw an opportunity to step into the marketplace with a solution that brings a good measure of stability: creating an escrow business focused on real estate project sales. This allows the money raised or provided for the completion of a given project to be held and used solely for that purpose, no matter what happens to the players involved, protecting buyer and seller alike. With the recent resurgence of development in Dubai, this fee-based business continues to grow, generating predictable profits and current account and savings account (CASA) balances for ADCB.

Treasury & Investments Group

The Treasury & Investments Group (Treasury) continued its strong performance in 2014, with a net profit of AED 1.8 bn. Working in close collaboration with external clients and ADCB business groups, Treasury continues to foster a high-performance culture, investing in staff, products and technology to keep abreast of the rapidly evolving market environment.

On an ongoing basis, Treasury has worked on improving the liquidity and capital position of the Bank. The investment portfolio run by Treasury as part of ADCB’s liquid asset management strategy has exceeded expectations, and the yield on the money market book has been well-protected in a year when the average three-month AED benchmark rate fell by a third.

2014 was an active year for ADCB in the capital markets, with issuances of circa AED 7 bn, leveraging the capital markets three times in one calendar year. ADCB did its first issuance in the Australian dollar market in 2014 with the intent of diversifying our investor base. ADCB opened the US dollar market for Middle East issuers in 2014 with the first issue of the region, followed by a first five-year issuance from a Middle East bank at a spread of below 100 basis points. Through reverse enquiries, the Bank concluded eight issuances in 2014, being the first issuer in the Middle East to issue longer-dated (over 20 years) zero coupons in the market, followed by two more issues.

The Foreign Exchange business has performed well, with increased client flows and trading activities in 2014. Net gains from dealing in foreign currencies reported an increase of 55% over 2013. Treasury new-product launches resulted in execution of the first foreign exchange pivot target redemption forwards and expanded the suite of commodity hedges offered to clients in the energy segment.

On the technology front, Treasury has successfully implemented new Murex modules for derivatives, straight-through processing for fixed income, and collateral management in 2014. Treasury also implemented its e-commerce platform initiative, focusing on connectivity to global platforms, to transact electronically on best-in-market pricing with its institutional customers.

Treasury acts as the gateway for all financial market transactions between ADCB and many regional central banks and sovereign wealth funds, a business that is diversifying well due to increasing cross-sell activities.

A Better Way to Support

Itmam shared services is bringing transformative efficiencies

ADCB has created a centralised, shared-services subsidiary, Itmam, to bring disciplined efficiency to the way ADCB processes, approves and disburses loans and makes payments. Loosely translated, Itmam means, “We get it done.” The subsidiary brings greater focus and speed to the work of data entry, decisioning, and disbursement of loans and payments, and constantly seeks to gain greater efficiencies and improve processes. Gains in productivity and efficiency within Itmam free the ADCB business lines to focus on serving the customer, and delivering a better overall customer experience.

Group Business Services

Group Business Services (GBS) provides the foundation on which ADCB’s business performance and customer service are built. GBS comprises a number of key ‘run the bank’ and ‘change the bank’ support functions that keep ADCB operational and agile. Support functions include Group Strategy and Change, Technology Services, Group Operations, Corporate Services and Workplace Protection Services.

GBS responsibilities include managing ADCB’s ATM network; providing teller services; managing investments in and the implementation of new technology platforms; keeping technology systems operating and agile; helping to protect stakeholders from fraud; operational risk management; safeguarding physical security; processing billions of dirhams worth of payments; and providing comprehensive online and mobile services to ADCB’s customers.

In 2014, GBS processed over AED 4 tn in payments and over 14 million transactions. The Group facilitated more than 14 million online logins, and registered 58,401 new mobile app users. GBS also managed more than 17 million in ATM/CDM transactions on ADCB’s 301 ATMs.

Another key responsibility for GBS is driving the customer service agenda across the Bank. In 2014, GBS instituted an enterprise-wide view of service across ADCB, introducing methodology and the reporting of metrics to ensure the Bank delivers on the critical service imperatives of educate, measure, report, improve. GBS continues to lead this customer experience initiative and maintains ongoing overall responsibility for the service architecture.

In addition to focusing on service and agility, GBS helps to maintain ADCB’s cost to income ratio within our target range. GBS manages the Bank’s capital investment portfolio and is involved in a number of programmes and initiatives aimed at building a robust digitisation foundation to ensure that ADCB maintains its market-leading position well into the future.

Some of ADCB’s key ongoing investment initiatives include the Branch Expansion Programme, the Technology Transformation Programme, and the Treasury & Investments Re-platforming Initiative. The start of 2014 saw the launch of Itmam — ADCB’s new shared-services subsidiary that brings together key processing and customer service teams to offer an enhanced experience for ADCB’s customers.

Property Management

Our Property Management business stands at the forefront of the Abu Dhabi real estate market and comprises the property management and engineering service operations of our subsidiaries Abu Dhabi Commercial Properties (ADCP) and Abu Dhabi Commercial Engineering Services (ADCE), and the investment properties and rental income of ADCB.

ADCP manages more than 61,000 residential and commercial units throughout the Emirate of Abu Dhabi on behalf of the Department of Finance, Government of Abu Dhabi and others. The units managed on behalf of the Department of Finance are part of a Government-sanctioned initiative whereby Abu Dhabi nationals are granted individual plots of land for the development of either commercial and/or residential buildings. ADCE oversees the construction of those buildings and, when completed, ADCP provides facilities management of the properties, whether residential villas and apartments, business outlets, or office spaces and industrial facilities.

Mindful of giving back to the community, ADCP implemented in 2014 a child-safety programme, installing more than 260,000 fall-prevention devices on residential home windows and balcony doors on properties it manages. ADCP is the only major property management company in the Emirate of Abu Dhabi actively installing these safety devices as retrofits to existing properties.

ADCE provides building design and construction property development services with a focus on high efficiency and exceeding customer requirements, for both the bank’s borrowing clients and external parties. This approach has helped make ADCE the partner of choice for complex medium- and large-size regional development projects.

Human Resources

The people of ADCB embody our overarching ambition to create the most valuable bank in the UAE. Our approach to human resources begins and ends with this ambition, and so is founded on a commitment to excellence.

It takes excellence to deliver superior value. We look for high-calibre individuals — people with talent and great ambitions of their own — and provide them with world-class training and support.

Our high-performance culture sets high expectations, but we also enable and empower our people to achieve more every year, both professionally and personally. Our workplace is a welcoming and stimulating environment where people with ambition and discipline can thrive.

Professional development is essential to our future. We have implemented a systematic approach to identifying, developing and deploying our talent to ensure a consistent supply of high performers equipped with the values, skills and experience required for both current and future key positions. In 2014, we continued to build consistency across our learning curricula and to enhance the relevance and depth of our learning programmes. We have endeavoured to achieve a standard of excellence by simultaneously focusing on leadership, values and technical capability.

Our performance management system sets ambitious objectives and offers all the support needed to achieve them, including Ambition University training programmes, continuous performance feedback, and coaching and mentoring in an environment of mutual support that nurtures personal and professional growth.

Performance management is vital in enabling our employees to build long-term partnerships with our customers through outstanding service, as well as strong supporting relationships with one another. ADCB’s performance, reward and recognition strategy is designed to ensure sustainable performance and flawless strategy execution.

Our success comes from a workforce that is diverse, highly engaged and dedicated to constantly building mutually rewarding, long-lasting relationships with our customers. We embrace diversity of every kind and welcome unique perspectives, because we wish to foster open-mindedness and innovation whilst reflecting the extensive diversity of our customer base.

Being purposefully diverse brings together a wide range of experiences and insights within the Bank and acts as a catalyst for creativity. Our workforce is made up of a dynamic group of people across a spectrum of backgrounds in terms of age, gender, nationality, religion, socioeconomic status, and disabilities.

We aim to be recognised as an employer of choice and therefore seek to maintain world-class standards that go well beyond legal requirements — as well as good employee relations at our workplaces. Our policies and practices promote fair, nondiscriminatory behaviour and a collegial atmosphere, as well as physical and emotional wellbeing.

The effectiveness of our efforts can be seen in our employee engagement scores, which rank higher than the global banking index, at par with global high-performance companies.

Our Emiratisation strategy fully aligns with and constantly reinforces the Abu Dhabi Vision 2030. We work hard to create opportunities for meaningful and rewarding contributions to each individual’s success and, thereby, in aggregate, to the sustainable growth of the nation. ADCB employs and empowers UAE nationals through a wide range of award-winning Emiratisation programmes.

Tamooha, a first-of-its-kind programme in this region, offers Emirati women a part-time, highly digitised, women-only work group. Created through a close partnership between the business and the HR groups, Tamooha recently received “Nationalisation Initiative of the Year” recognition from the Middle East HR Excellence Awards. (See page 32 for a fuller description of Tamooha.)

ADCB’s Emirati Graduate Development Programme (EGDP) is a world-class programme for UAE national graduates, taking participants on a journey that will enable them to fulfil their professional and career ambitions. The objective is to prepare recent UAE national graduates to take on full-time job responsibilities within specified business areas across ADCB. The multifaceted programme offers practical business experience through sequential and strategic job rotations, technical-skills training, and professional-qualifications development in relevant fields. During 2014, ADCB developed approximately 80 UAE national graduates of the EGDP and transitioned them from trainees into full-time productive employees.

At a country level, ADCB has partnered with the Ministry of Presidential Affairs through the Absher initiative. This initiative is based on four pillars: creating jobs; training and rehabilitating the UAE national workforce; increasing hiring in the private sector; and developing and encouraging the role of the private sector within the UAE. Through Absher and similar future initiatives, ADCB will continue to provide UAE nationals with the training they need to develop their leadership and managerial skills, providing young and talented UAE national graduates with opportunities to accelerate their careers and hold managerial positions across different lines of business within the private sector, whilst facilitating financial stability and successful career trajectories.

We make all of these efforts to develop and inspire our people because we understand that in our business, like any other, the greatest value arises from human capital.