(click to learn more)

As we did last year, the Board and management continued to focus on ADCB’s five strategic aspirations in 2013. Building a business with profitability, growth and principle requires a balanced strategy, flawless execution and precise measurement:

Our continuing strategy is to create the most valuable bank in the UAE. By prioritising customer relationships, we build maximum value for our customers and shareholders. At the Group level, we outlined strong corporate governance, ambitious but achievable financial goals, and a clear rubric to measure progress. Our goal is to meet or exceed our own standards and establish new benchmarks for the industry, measured against a number of key performance indicators reported in this annual report.

To achieve our strategic aspirations, the Board sets the strategic direction of the Bank, which the senior management uses to design the Bank’s annual strategic plan and prepare the annual budget for their approval. Thereafter, quarterly updates are provided by senior management to the Board to monitor progress and permit any necessary modifications or adjustments in strategic direction.

RETURN ON EQUITY (ROE)

We focus on growing our business where risk-adjusted returns are maximised and capital is efficiently deployed to increase ROE.

TOTAL SHAREHOLDER RETURN (TSR)

TSR is recognised as one of the best measures of achieving a good return by investing in a specific company and is reflective of the company’s performance across various KPIs.

BASIC EARNINGS PER SHARE (EPS)

Efficient capital management is core to our strategic aspirations. In 2013, we commenced our share buyback programme and bought back 7.02% of the issued share capital. This resulted in an improvement to EPS of 7% on a pro-forma basis.

COST TO INCOME RATIO

We made important changes to our core processes and introduced specialist management techniques to do more with less, and thus became more efficient while still investing in our businesses.

CUSTOMER LOYALTY AND SATISFACTION

In 2013, we instituted a change management programme designed to elevate quality and simplify solutions to enhance the customer experience, embracing a new customer-oriented business measure, the Net Promoter Score (NPS). This is currently being implemented and the score will be available in 2014. In 2012, under the previous methodology, the Bank measured customer loyalty and satisfaction, which was 93%. Our philosophy is based on listening to what customers are saying about their experiences with ADCB, and then reacting accordingly to drive meaningful improvements in business performance.

We regularly measure ourselves against our strategy to become the most valuable bank in the UAE using a range of key performance indicators (KPIs) listed below.

is calculated as the profit attributable to equity shareholders as a percentage of average shareholders’ equity.

measures the growth in share price plus dividends paid to shareholders during the year.

is calculated as profit attributable to equity shareholders of the Bank as divided by the weighted average of the equity shares in issue during the year.

is calculated by dividing operating expenses by operating income.

* Figures have been rounded.

comprises asset liability management (ALM), management of the Bank's investment portfolio, and interest rate, currency and commodity deirivitive portfolios.

Treasury & Investments manages the Bank's funding and centralised risk management activities through borrowings, issuance of debt securities and use of derivatives for risk management. It also undertakes trading and corporate finance activities and investing in liquid assets such as short-term placements, corporate and government debt securities.

comprises retail, wealth management and Islamic financing. It includes loans, deposits and other transactions and balances with retail customers and corporate and private accounts of high net worth individuals and funds management activities.

comprises business banking, cash management, trade finance, corporate finance, small and medium enterprise financing, investment banking, Indian operations, Islamic financing, infrastructure and asset finance, government and public enterprises. It includes loans, deposits and other transactions and balances with corporate customers.

comprises real estate management and engineering service operations of subsidiaries — Abu Dhabi Commercial Properties L.L.C., Abu Dhabi Commercial Engineering Services L.L.C., investment properties and rental income of ADCB.

* Figures have been rounded.

* Excludes AED 1,314 mn on sale of investment in associate.

ADCB’s results not only reinforce our position as one of the UAE’s strongest and most successful financial institutions, they determine how large a role we can play in helping our customers, communities and the UAE to prosper with a sense of safety and security in line with the Bank’s long-term strategy.

ADCB delivered record results in 2013. The Bank earned AED 3,620 mn in net profits, compared to AED 2,810 mn in 2012, and basic earnings per share rose to AED 0.59 — up 29% and 31%, respectively, for the year. Total operating income increased 11% over 2012 to AED 7,320 mn. Dividend per share was AED 0.30 in 2013, an increase of 20% over 2012.

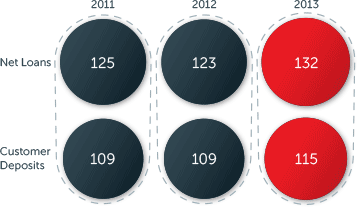

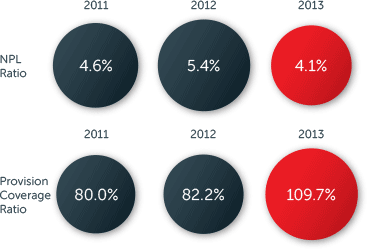

The Bank’s results reflected strong underlying performance throughout its business segments and were driven by strong lending and deposit growth in our Consumer and Wholesale Banking businesses, as well as increased capital markets activity in the Treasury & Investments Group. Customer deposits grew 6% to AED 115 bn and net loans increased 7% to AED 132 bn as at 31 December 2013.

As our results indicate, ADCB has a strong and conservative balance sheet, one that gives us the platform to accelerate business growth and indicate how we optimise the overall quality of our loan book to maximise returns with minimal risk as reflected in our improved provision coverage ratio of 109.7% and non-performing loan ratio of 4.1% at the end of 2013.

*Excludes Dubai World exposure and related provision re-classified as performing loan in 2011.

**Subject to approval by the shareholders at the Annual General Meeting and the UAE Central Bank.

ADCB’s leadership is consistently recognised by some of the most reputable industry publications and independent authorities. ADCB has distinguished itself in recent years by ranking among the leading banks in the UAE and achieving excellence across our businesses. These recognitions have been given for the Bank’s innovative products and services, and for best practices in corporate governance, transparency and disclosure. We are proud of our top rankings and accolades. More than anything, we believe they reflect our success and the reputation we have earned by staying close to our customers.

*Operating income for the purpose of calculating cost to income ratio includes share of profit of associates but excludes net gain on sale of investment in associate

Figures have been rounded

Disciplined cost management is among our top priorities while we emphasise revenue growth. Our cost discipline is measured by our cost-to-income ratio, which reflects how much we spend for every dirham we earn as revenue. In 2013, the cost to income ratio was 32.22%.

We manage our cost base wisely and focus our spending on opportunities that will eventually benefit our customers through better services, which in turn will help us generate more revenue for our shareholders. The success of this approach is evidenced by our achievement in procuring goods and services and driving process efficiencies, where we saved more than AED 150 mn in the last three years. We invested in state-of-the-art procurement systems which helped improve our cost efficiency through automation and strict cost control processes while significantly reducing the time to procure with better support for supplier discovery, dynamic negotiations and compliance.

Our disciplined cost management approach is central to the successful delivery of our strategy and we continue to make progress in driving cost savings and efficiencies throughout the Bank.

Visitors to any ADCB location will find themselves among the industry’s best professionals — ambitious men and women who are always on a path to greater achievement. ADCB has a high-performance culture that emphasises energy, drive and care.

At ADCB, we are proud of our entrepreneurial spirit and can-do attitude. We are driven by the fact that we are, first and foremost, a local bank. We are proud of the respect we earn in recognition of our international banking standards and our depth and breadth of experience.

ADCB employees are committed to the highest ethics and a code of conduct. How we do business is as important as the business that we do. Our employees share a common bond and a strong belief that the basic principles of corporate governance, fairness, transparency, accountability and responsibility are relevant in everything they do.

Our talent is very diverse, and we are proud of that, too. The UAE is culturally very rich, and the culture at the Bank reflects that. At ADCB, we employ more than 4,000 employees, representing some 57 different nationalities.

ADCB has established a set of core values that are designed to provide the framework for employee behaviour and foster a customer-centric culture within the Bank.

rollover or click each ring to see our core values

Consistency

ensuring that products and services are uniform and satisfactorily maintained by measuring customer-satisfaction levels.

Innovation

encouraging employees to be creative, continuously improving and lateral-thinking

Efficiency

providing customer service standards designed to reach optimum efficiency and reliability

Empowerment

creating an environment where employees are involved, recognised and rewarded for good performance

Stability

pursuing growth based on prudence, proven business principles and financial strength

Responsibility

embracing our commitment to the local community and our shareholders by nurturing and developing our employees

Integrity

honesty and transparency in everything we say and do

Giving back to the communities we serve is a top priority at ADCB, whether through direct charitable donations, fundraising, volunteering or other forms of outreach.

We take pride in working to develop vibrant and diverse communities capable of sustaining a high quality of life and economic opportunity. We strongly believe that a healthy and prosperous community is a prerequisite for a sustainable business.

Our employees contribute their time and money to support many worthwhile causes throughout the UAE. ADCB encourages everyone in the organisation to play an active role in the community and participate in meaningful ways by volunteering in community programmes.

We also work with partners throughout the emirates to deliver initiatives that promote positive social and economic outcomes for people in our markets. In 2013, ADCB entered into partnership with Emirates Foundation for Youth Development to collaborate and support programmes focusing on social inclusion, leadership, empowerment and community involvement. Partnership programmes also address culture-specific issues in financial literacy, disadvantaged females and special-needs UAE nationals.

ADCB actively participates in breast cancer awareness programmes. In 2013, we facilitated the collection of contributions that went to the Pink Caravan Initiative by Friends of Cancer Patients for Breast Cancer Awareness.

ADCB delivers superior results in a way that respects the dignity and uniqueness of individuals while observing responsible and sustainable business practices.

Sustainability forms one of the cornerstones of UAE Vision 2021 and the Abu Dhabi Economic Vision 2030, both of which emphasise the importance of numerous sustainability factors. ADCB voluntarily embarked on the sustainability journey, in recognition of international best practices to develop and maintain a prosperous and healthy society in the markets we operate in.

One of the ways we help the UAE prosper is by contributing positively to the communities we operate in. Our scale and reach through our brands and branches mean we are doing more to help communities across UAE.

The management of ADCB strongly supports investing in communities and standing by our clients and customers. Our strategy is built on our belief that disciplined growth with strong governance, solid sources of capital and liquidity ensures that we are in a position to create value for our shareholders and society over the long run. Over recent years, we have continuously delivered for our stakeholders, including our customers, shareholders and communities.

At ADCB, we foster a work environment that embraces diversity. This brings a wider range of experiences and insights to the Bank and acts as a catalyst for creativity and innovation. The employees in our workforce come from 57 countries around the world and possess diverse backgrounds. This has resulted in a highly blended workforce with great diversity of gender, age, nationality, religion and individuals with disabilities. In parallel with diversity, we focus on empowering UAE nationals, aligned with the UAE’s ‘Emiratisation’ strategy, to ensure long-term viability and development of the UAE.

ADCB has an ongoing commitment to transparent disclosure and genuine concern for social and environmental issues. In 2013, ADCB published a sustainability report that is available online at: www.adcb.com/aboutus/sustainability. Moving ahead, ADCB is furthering its strategic partnerships and initiatives focused on water usage, energy efficiency, public health, government policy and supply chain management.