We can help you plan for home ownership.

Here’s what you need to know.

Home finance: A legal contract promising to repay the loan/finance plus interest/profit and other costs.

Debt-Burden Ratio (DBR): The ability to repay a loan/finance by calculating the ratio of the debt burden relative to income.

Net income: The amount earned after all deductions by your employer and your expenses.

Benefits:

Investing in an asset which may appreciate in value over time.

Save on rent.

Free to design the home as you wish.

Challenges:

A large initial financial investment for the down payment.

A significant debt for a long period of time.

Restricted mobility.

Monthly home finance repayments.

Maintenance and association fees.

Utilities (electricity, water, gas, internet, etc.).

Furnishing costs.

Landscaping and other finishing requirements.

Insurance.

Unexpected damage and repairs.

It is the most important factor.

whether finance or rent.

and choose the accommodation that best suits your needs.

to help save for the down payment.

at adcb.com or speak with a representative to learn more.

Specially designed activities that can help you prepare to own your home.

Visit our toolkit77% of home owners in the UAE say owning a home has helped them achieve their financial goals. 1

While value can fluctuate over time, home ownership increases long-term wealth versus renting.

1 National Association of Realtors NAR© Index 2015.

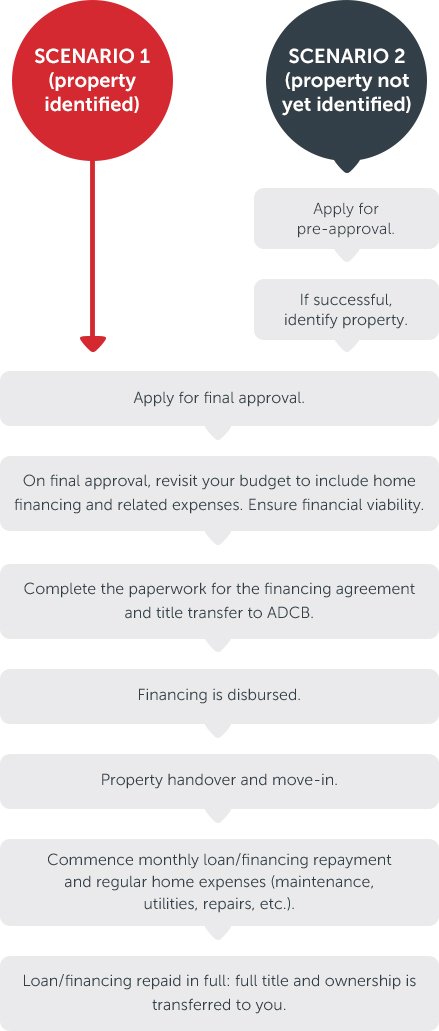

Buying a home can be a complicated and lengthy process at times.

Don’t assume that you can or cannot afford to buy a house.

Get a range of quotations from a variety of lending institutions.

Before you decide to own a home, consider these things:

- Determine if it’s the right time to buy.

- Is it for self-occupation or investment purposes? Costs vary greatly for each.

- Confirm eligibility. Our team can help you with this.

- Consider financial viability. Can you afford the down payment and the monthly instalments?

how much finance you qualify for.

before committing to home finance.

as a precondition of purchase.

to safeguard your credit rating.

at adcb.com or speak with a representative to learn more.

Specially designed activities that can help you prepare to own your home.

Visit our toolkit8 out of 10 UAE residents want to buy property in the UAE. 1

88% of homeowners in the UAE report a positive buying experience. 2

1 Report issued by compareit4me.com, November 2015.

2 National Association of Realtors NAR© Index 2015.