We believe high standards of corporate governance will contribute to our long-term success, encourage trust and engagement with our stakeholders, and reinforce our culture. To that end, the Bank has established a clear, well-understood governance framework. We regularly review and adjust this framework to reflect changes in the Bank’s businesses, regulation, best practices and the external environment.

The Board, which consists of 11 members, met eight times in 2017. Directors received information between meetings about the activities of Board and management committees and developments in the Bank’s business. In addition, the Board held an off-site meeting in November to debate and refine the Bank’s strategy. Members of senior management were invited to all these meetings to enhance the Board’s engagement with management and understanding of the business. In addition, Board members regularly visited divisions of the Bank to enrich their knowledge of our operations.

The Board has four standing Committees, which cover: Audit & Compliance, Corporate Governance, Risk & Credit, and Nomination, Compensation & Human Resources. Each member of the Board, with the exception of Ala’a Eraiqat, the Group Chief Executive Officer, serves on at least one standing Committee. The Committees met a total of 57 times in 2017. Chairmanships and memberships of the Board Committees are reviewed on a regular basis to ensure suitability and are rotated as needed.

Directors’ remuneration is set annually by the Bank’s shareholders. Any proposals for changes are considered by the Nomination, Compensation & Human Resources Committee prior to obtaining Board and shareholder approvals. According to applicable laws and the Bank’s articles of association, Directors may not receive any remuneration in years when the Bank does not achieve net profits.

As at 31 December 2017, the Bank’s Directors were not eligible for any bonus, long-term or other incentive schemes. Directors do not receive any pension benefits from the Bank.

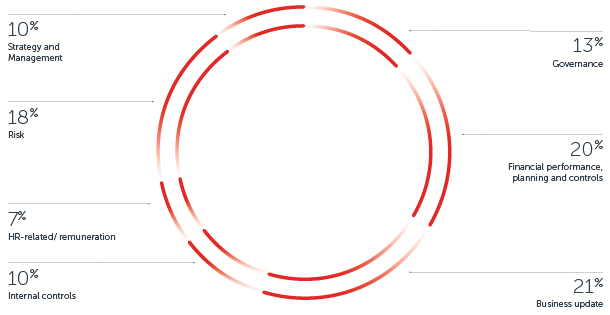

The Board of Directors regularly discusses certain items that are fundamental to the direction of the Bank, such as business performance, long-term planning, strategy, risk appetite and management, succession planning, and human resources.

BOARD AND BOARD COMMITTEE AGENDA ITEMS

During 2017, all non-executive Directors were considered independent*. In addition, all of the members of the Audit & Compliance Committee were independent. On the management side, the Group Chief Internal Auditor reports to the Board’s Audit & Compliance Committee and the Group Chief Risk Officer reports to the Board’s Risk & Credit Committee.

To ensure that the Board has the benefit of a range of independent thinking, the Bank appointed Sir Gerry Grimstone as an independent Board Adviser in January 2013. In 2017, Sir Gerry attended five Board meetings, three Board Committee meetings (NCHR) and the Board strategy session. His background and experience enriches the Board’s deliberations, particularly in the areas of strategy, board reporting and effectiveness, performance assessments for senior management and assessment of risk appetite and rewards.

*As per SCA guidelines

Risk management is a key part of ADCB’s corporate governance framework.

The Board of Directors has overall responsibility for setting our risk appetite and for ensuring risk is effectively managed. The Board Risk & Credit Committee (BRCC) oversees risk monitoring and management, and works with management to refine risk strategy as appropriate for particular sectors, geographic regions and customer types. The BRCC also reviews the suitability and effectiveness of the Bank’s risk management systems and controls, reviews stress tests and the Bank’s stress-testing methodology, oversees the management risk committees, and ensures that our risk governance supports prudent risk-taking at all levels in the Bank.

The Board and management also foster a culture of compliance. They have created an environment where employees at all levels are empowered to confront improper behaviour, raise grievances and suggest better ways to pursue the Bank’s strategic goals.

The Board undergoes a rigorous in - house performance evaluation annually and, in line with global standards, and regularly engages an independent external consultant to conduct a performance evaluation. In late 2016, the Board appointed Sir Gerry Grimstone to conduct an evaluation of the Board’s performance. Sir Gerry conducted an independent and comprehensive evaluation relying on his observation of the Board’s performance of its duties whilst complimenting those observations with individual interviews of all Board members as well as members of the senior management. The Board Corporate Governance Committee considered and discussed its outcomes including: The most effective manner to use ‘closed sessions’, evolution of the Board and management’s discussions on risk (including risk strategy), assessment of individual Board members’ performance, the need to continuously monitor skills and expertise at Board level and to plan for succession, development of the Bank’s strategy day and the form and content of management information supplied to the Board. The evaluation also addressed training requirements and the Board ensured that its members received professional development in several areas, including: regulatory developments, digitization and cyber security. The overall review concluded that the Board and its Committees are operating effectively in accordance with high international governance standards.**

*The process and goals for the Bank’s Board Performance Evaluation policy can be found on our website.

** Please see further details in the Statement of the Chairman of the Corporate Governance Committee.

All Directors are required to seek re-election by share - holders every three years, and one-third of the Board must seek re-election each year. The Abu Dhabi Investment Council has the right to elect a percentage of the Board that is proportionate to its holdings of the Bank’s share capital. As of year-end 2017, the Abu Dhabi Investment Council held 62.52% of the Bank’s issued share capital and, consequently had the right to elect six Directors and to vote a further 2.52% of the Bank’s capital at the Board elections.

In 2013, Aysha Al Hallami became the first woman to be appointed to the Bank’s Board of Directors. This is in line with international trends and the Bank’s efforts to promote greater diversity at the Board level, and it also corresponds with the Government’s efforts to empower Emirati women. The Board’s Nomination, Compensation & HR Committee is aware of the need to structure the Board to ensure that it obtains an appropriate balance of skills, experience and knowledge as well as independence.

The Bank’s Board is aware of the advantages of all types of diversity. A diverse Board is likely to make better decisions.

In 2017, the Board Audit & Compliance Committee reviewed the effectiveness of the Bank’s systems of internal control, including financial, operational and compliance controls and risk-management systems. The Board received confirmation from the Bank’s Internal Audit Group that the internal controls have been assessed to be effective and have been operating as designed, and that management has taken or is taking the necessary action to remedy any failings or weaknesses identified.

Deloitte & Touche, the external auditors, were appointed at the 2015 Annual General Meeting (AGM) and reappointed at the 2016 and 2017 AGMS. Local laws and bank policy restrict the external auditors’ tenure to no more than three consecutive renewals.

Deloitte & Touche is paid on a fixed annual fee basis, as approved by the shareholders at the AGM. In 2017, the audit fees for the Bank and its subsidiaries excluding India operations amounted to AED 1,014,650, and fees for non-audit work amounted to AED 430,542. Non-audit work comprised: a comfort letter related to the Bank’s Global Medium Term Note Programme, Prudential Returns for the Bank’s Jersey Branch, and consultancy on tax matters.

The Bank is committed to high standards of transparency and to enhancing our disclosures regularly to reflect local and international best practices. In this year’s annual report, we have focused on giving readers a clearer picture of our performance, business model and strategy and have provided more detail about how the Board allocates its time. In addition, we have refined and streamlined our risk disclosures.

In keeping with our leadership role on governance matters, we are confident the Bank is one of the most transparent institutions in the region. We publicly communicate relevant financial and non- financial information in a timely manner through this annual report, our quarterly market updates, our press releases, the Bank’s website and the Abu Dhabi Securities Market (ADX). The Bank’s Investor Relations department ensures strong communication with our investors and potential investors. Finally, we take internal communications extremely seriously: Staff are kept aware of all new developments — including the Bank’s strategic direction, objectives, ethics, risk policies, general policies and procedures, new regulations, and other relevant information — via internal channels.

In addition, management has established several working groups that cover, amongst other things, customer experience, insurances and compliance.

Mohamed Darwish Al Khoori (Chairman), Aysha Al Hallami, Khalid Deemas Al Suwaidi, Mohamed Ali Al Dhaheri, and Abdulla Khalil Al Mutawa, Rami Raslan (Secretary)

Mohamed Ali Al Dhaheri (Chairman), Sheikh Sultan bin Suroor Al Dhaheri, Khalid Deemas Al Suwaidi, Khaled H. Al Khoori, Rami Raslan (Secretary)

Mohamed Sultan Ghannoum Al Hameli (Chairman), Eissa Mohamed Al Suwaidi, Abdulla Khalil Al Mutawa, Mohamed Darwish Al Khoori, Ali Darwish (Joint Secretary), Rami Raslan (Joint Secretary)

Eissa Mohamed Al Suwaidi (Chairman), Mohamed Sultan Ghannoum Al Hameli, Khaled H. Al Khoori, Aysha Al Hallami, Faisal Suhail Al Dhaheri, Rami Raslan (Secretary)

ADCB supports levels of remuneration necessary to attract, retain and motivate employees capable of leading, managing and delivering quality service in a competitive environment. However, our remuneration structure is conservative, and we have practices and policies that promote effective risk management. To that end ADCB structures remuneration packages so they reflect duties and responsibilities, are fair and equitable, and incorporate clear and measurable rewards linked to corporate and individual performance. Rewards are based only on the results of a rigorous performance appraisal system with a robust management decision-making, review and approvals process.

As far as possible, bearing in mind market trends and constraints, our remuneration programme incorporates both short- and long-term incentives that align the interests of ADCB’s employees with the interests of shareholders and other stakeholders. Performance-related elements are designed to minimise employee turnover and to inspire employees to perform at the highest levels, consistent with effective risk management.

As shown in the following table, employees can receive three types of reward at ADCB: Fixed pay, Variable pay and retention scheme.

Fixed pay is based on the market rate for each role and is impacted by the employee’s contributions over time. Fixed-pay reviews depend on whether the employee achieved specific and measurable objectives and delivered a prescribed performance level.

Basic Salary Allowances

Benefits based on band, such as:

In 2017, Key Management (defined as the Group CEO and his direct reports) received fixed pay and cash benefits in an aggregate amount of AED 26.539 million.

Employees may receive variable pay based on their performance over the year. Because it is performance-based, variable pay is at risk, and the amount received, if any, may change each year.

Individual award amounts are dependent on three things:

For more information, see “ADCB’s Variable Pay Framework & Governance — Key Facts”.

For performance in 2016, awards to employees in 2017 consisted of cash variable pay awards of AED 136.36 million and deferred compensation plan awards of AED 43.84 million.

Key Management received AED 23.475 million in cash and AED 20.725 million in deferred compensation from the amounts set forth above.

In 2014, ADCB introduced a share-based Retention Scheme for incumbents in key positions deemed ‘mission critical’ and for UAE nationals deemed to have exceptional growth potential. The Retention Scheme, which is independent of variable pay awards, is designed to ensure business continuity by mitigating turnover risk and the related operational risk. Invitations to join the Retention Scheme are at the sole discretion of the NCHR Committee; members of the Management Executive Committee are not eligible to participate. Retention Scheme awards vest after four years from the award date.

In 2017, we awarded 2,780,000 shares with an aggregate value of AED 18.63 million. Awards were made to 95 employees, of whom 69% were UAE nationals.

Reflects individual, business function and Bank-wide performance

Yes

Distinguishes amongst different functions of the Bank to ensure alignment to the relevant market

Yes

Defers variable pay award above specified threshold

Yes

Currency of deferred compensation

Cash and shares

Duration of deferral of variable pay

3 years

Awards subject to thresholds, caps, clawback rules, malus clause, and deferral and retention provisions

Yes

Managed by remuneration professionals experienced in the governance of all types of compensation and benefits

Yes

Designed in conjunction with, and reviewed by, independent external advisors reporting directly to the Nomination, Compensation & Human Resources Committee

Yes

Relies on regular external benchmarking to ensure alignment with evolving global best practices

Yes

Incorporates constant monitoring of developments in remuneration governance to ensure all variable pay plans evolve in line with the Bank’s needs and external developments

Yes

Designed to avoid excessive risk-taking

Yes

Includes a minimum shareholding rule for Key Management

Yes

Aligns employee interests with the long-term interests of the Bank’s shareholders

Yes

ADCB Islamic Banking is the brand under which we offer retail and corporate Shari’ah-compliant financial solutions to our Consumer, Wholesale and Treasury clients.

ADCB is regulated by the Central Bank of the UAE, and its Islamic banking activities are supervised by an independent Fatwa & Shari’ah Supervisory Board (FSSB). The FSSB operates in accordance with the standards and guidelines issued by the Accounting & Auditing Organisation for Islamic Financial Institutions (AAOIFI) and Islamic Financial Services Board (IFSB), and is the final authority within ADCB regarding all Shari’ah-related matters. ADCB Islamic Banking’s Shari’ah governance is implemented and overseen by the Shari’ah Advisory Lead.

Fatwas (pronouncements and approvals) are issued by the FSSB to certify compliance with principles of Shari’ah for all products and services as well as for bespoke structured deals. The FSSB’s comprehensive review covers the product structure, the underlying Shari’ah contract, legal documentation, operational process flow and all associated product literature. Fatwas issued by the FSSB are published on the Bank’s website and are available at all branches.

ADCB Islamic Banking maintains a separate set of financial records to ensure that the accounts for the Islamic business are completely segregated from ADCB’s conventional funds. The Bank’s consolidated accounts include the results of ADCB Islamic Banking, and are separately disclosed in the notes.

The respected Shari’ah scholars listed below make up the FSSB of ADCB Islamic Banking.

Professor Jassem is the first Emirati Shari’ah scholar to lead the FSSB of ADCB Islamic Banking. He previously served as Dean of the College of Shari’ah and Law, UAE University. In addition, he chairs or is a member of many other FSSBs for Islamic banks/windows and financial institutions (FIs).

Sheikh Dr. Nizam is one of the most prominent Shari’ah scholars in the world, and is recognised globally since he chairs or is a member of the FSSB at several regional and global Islamic banks and FIs. He is known for his deep knowledge of banking and Shari’ah coupled with a progressive approach towards modern banking solutions.

Dr. Dar holds a PhD in Economics from the University of Cambridge, UK, and is an expert in the field of Islamic banking and finance. He is a member of the FSSB at several Islamic banks and FIs.

Mr. Kamran is Shari’ah Advisory Lead at ADCB Islamic Banking. He provides Shari’ah guidance on all day-to-day Shari’ah-related matters and obtains FSSB guidance and approvals in respect of each product, service, process and transaction and other Shari’ah-related matters. Mr. Kamran received a degree in Shari’ah and Law from the International Islamic University, and he has served as Shari’ah advisor to several major Islamic banks and FIs.