ADCB’s 2017 results reflect the strength of our strategy and speak to the discipline and resilience of the Bank. The Bank’s underlying performance and fundamentals remain strong and we remain committed to protecting the long-term financial strength of the Bank in our pursuit of sustainable growth.

As part of our discipline, a prudent and robust approach to risk management is a key pillar of the Bank’s strategy. We believe this to be a differentiator that sustains us and that favours ADCB going forward, as we manage the Bank for long-term success.

Net profit for the year ended 31 December 2017 was AED 4.278 billion, an increase of 3% year on year, whilst net profit for the fourth quarter of 2017 was AED 1.072 billion, an increase of 7% year on year. The Bank’s key financial indicators remained strong with a return on average equity of 15% and a return on average assets of 1.58% for 2017 compared to 15.7% and 1.65% respectively for 2016.

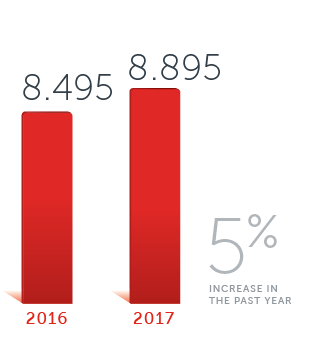

Operating income of AED 8.895 billion was up 5% over 2016, while operating profit before impairment allowances of AED 5.948 billion was up 4% over 2016, reflecting the Bank’s strong fundamentals and resilient financial performance in 2017. Each of our business segments delivered good growth and contributed to the Bank’s strong results in 2017; Consumer Banking Group comprised 46% of total operating income, whilst Wholesale Banking and Treasury & Investments Groups comprised 31% and 20% respectively.

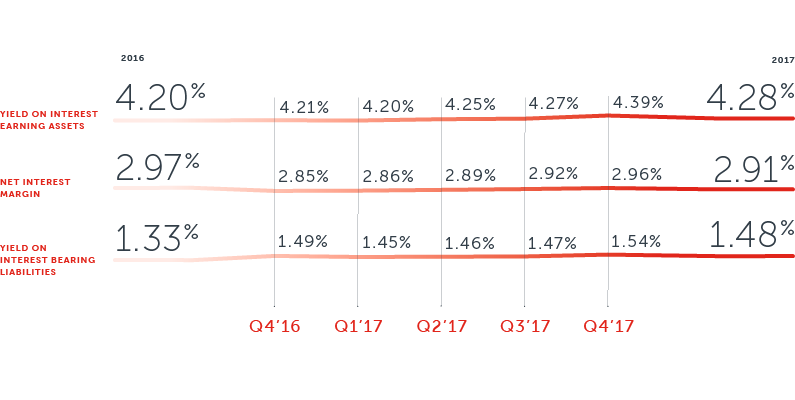

The Bank reported strong top line growth, with net interest and Islamic financing income of AED 6.701 billion for 2017, an increase of 8% year on year. Gross interest and Islamic financing income of AED 9.854 billion was up 13% over 2016, driven by a 11% increase in average interest earning assets over 2016. The prior year benefited from interest in suspense reversals which were not repeated in 2017. Average interest bearing liabilities increased 11% over the prior year, resulting in an interest expense of AED 3.153 billion, up 24% year on year. Despite a slight uptick in cost of funds in the last quarter of 2017 (in line with the rising benchmark rates), net interest margin was maintained at 2.91%, whilst asset yields remained healthy at 4.28% in 2017.

Non-interest income of AED 2.194 billion was 4% lower over the previous year and accounted for 25% of operating income in 2017 compared to 27% in 2016. This was mainly on account of weaker trading income of AED 354 million in 2017 compared to AED 522 million reported in 2016, driven by lower FX income against a very strong prior year, which benefited from opportunistic trades. This was partially offset by net fees and commission income of AED 1.507 billion, up 2% and other income of AED 367 million, up 29% over 2016.

Operating expenses for the year ended 2017 were AED 2.948 billion, up 5% over the prior year and in line with revenue growth. This resulted in a stable cost to income ratio of 33.1% compared to 32.9% in 2016. Staff expenses were up 3% at AED 1.709 billion and comprised 58% of total operating expenses compared to 59% in 2016. General administrative expenses were AED 1.073 billion, 8% higher year on year, primarily attributable to continued investment in our businesses, systems and infrastructure, including a state of the art core banking system and a set of digital initiatives to enhance operational efficiency to offer a superior customer service. During 2017, the Bank completed the migration and consolidation of its core banking system, following two years of complex programming, testing and training.

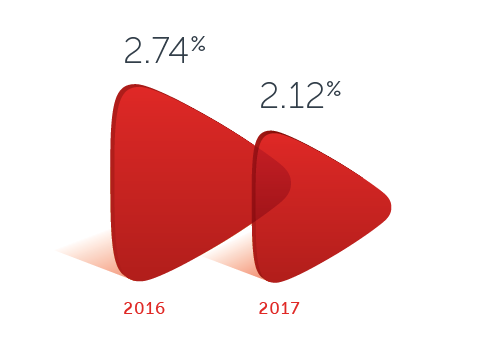

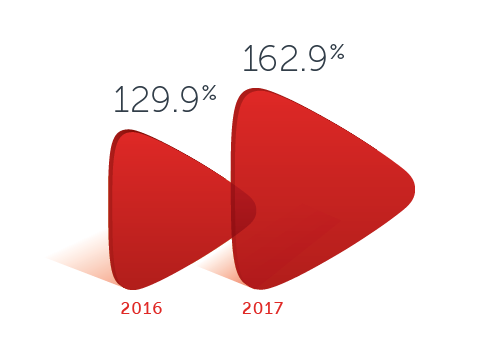

Significant improvement in asset quality indicators, with a non-performing loan (NPL) ratio of 2.1% compared to 2.7% as at 31 December 2016. Similarly, provision coverage ratio improved significantly to 162.9% from 129.9% as at 31 December 2016. Non-performing loans were AED 3.692 billion compared to AED 4.600 billion as at 31 December 2016, a decrease of 20% year on year. Cost of risk for 2017 was 0.81% compared to 0.83% in 2016.

Charges for impairment allowances on loans and advances, net of recoveries amounted to AED 1.670 billion compared to AED 1.552 billion in 2016. Whilst recoveries were stronger in 2017 at AED 259 million, compared to recoveries of AED 138 million in 2016, the prior year benefited from significant impairment allowance releases, that were not repeated in 2017, which resulted in a higher net impairment allowance charge for the year. As at 31 December 2017, the Bank’s collective impairment allowance balance was AED 3.172 billion and its individual impairment allowance balance was AED 2.862 billion. Collective impairment allowances were 1.79% of credit risk weighted assets, above the minimum 1.5% stipulated by the UAE Central Bank.

As at 31 December 2017, total assets were AED 265 billion and net loans were AED 163 billion, an increase of 3% over 2016. Consumer Banking loans increased 2%, while Wholesale Banking loans increased 4% year on year. 94% of loans to customers (gross) were within the UAE, in line with the Bank’s UAE centric strategy. Total customer deposits increased to AED 163 billion as at 31 December 2017, up 5% year on year. At year end CASA balances totalled AED 70.7 billion, an increase of 9% over the previous year, and comprised 43.4% of total customer deposits compared to 41.8% in 2016. Loan to deposit ratio improved to 100.1% from 101.9% as at 31 December 2016.

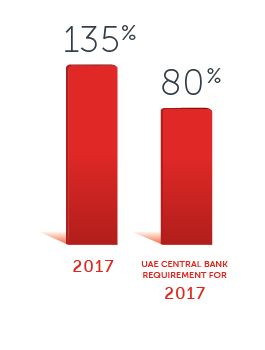

The Bank continues to maintain a comfortable liquidity position, with a liquidity coverage ratio of 135%, compared to a minimum ratio of 80% prescribed by the UAE Central Bank. As at 31 December 2017, investment securities were AED 49 billion, an increase of 49% over 2016, mainly driven by an increase in government bonds, whilst maintaining a healthy liquidity ratio of 24.5%.

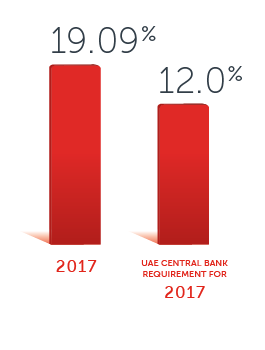

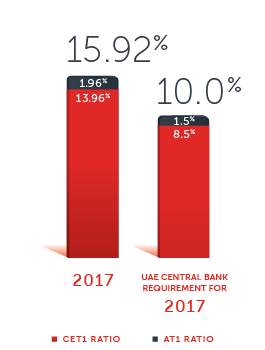

The Bank remains well capitalised with a capital adequacy ratio (Basel III) of 19.09% and a common equity tier 1 (CET1) ratio of 13.96%, well above the minimum capital requirements of 12% and 8.5% (including buffers) respectively prescribed by the UAE Central Bank.