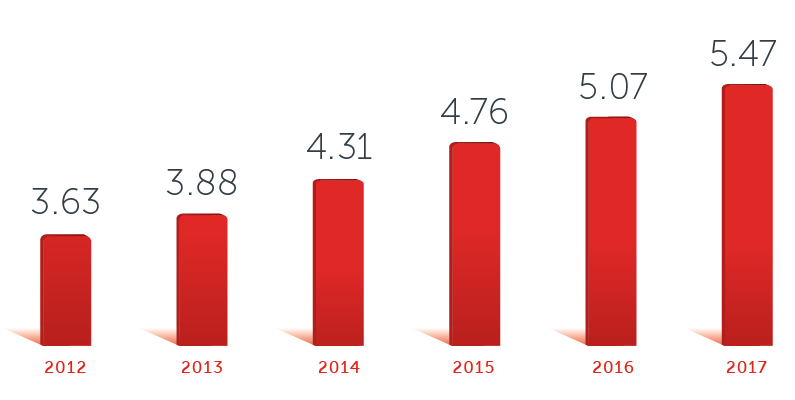

The Bank’s net profit increased 3% year on year, while operating income of AED 8.895 billion was up 5% and our return on average equity remained strong at 15%. All other significant performance metrics remain healthy.

This is a time of continuing regional and economic uncertainty in the GCC, as well as change in the banking industry. The removal of subsidies and introduction of new taxes are fundamentally altering the economy, while new regulations are strengthening the banking sector. Furthermore, digitisation is transforming the banking industry. In this environment, ADCB’s qualities of discipline and ambition will continue to serve us well. We will remain focused on the Bank’s proven strategy that has driven sustainable growth and long-term returns for shareholders.

ADCB’s strategy, with its focus on the UAE, continues to prove successful and has guided the Bank steadily towards its goal of being the most valuable Bank in the UAE.

In July, the Board reviewed and reaffirmed ADCB’s strategy and added a digital pillar. This is an important development. As the global banking industry continues to evolve, ADCB has both opportunities and challenges. We aim to take advantage of these changes by leveraging and building digital technologies designed to support growth and enhance operational efficiency.

Against this background of change, culture and governance are more critical than ever. ADCB’s strong culture and governance allow it to grow at a faster pace than the UAE’s banking market, manage risk and deliver excellent customer service. The Board reviewed ADCB’s culture during 2017, and appreciates the need for the Board and senior management to set the appropriate ‘tone from the top’. Your Board is pleased that ADCB has developed a positive culture comprising several elements including customer service excellence, risk awareness, integrity and efficiency.

This strong culture builds on ADCB’s focus on corporate governance. During 2017, the Board commissioned an independent review of ADCB’s governance framework, which judged its governance to be ‘strong and leading in the local market’.

Your Board continued to govern the bank actively during 2017. We held 65 full Board or Committee meetings and a strategy day. Both inside and outside these meetings the Board engaged constructively with management, guiding and challenging their decisions in a spirit of openness and transparency.

ADCB’s strategy, with its focus on the UAE, continues to prove successful and has guided the Bank steadily towards its goal of being the most valuable Bank in the UAE.

ADCB continues to deliver value. Since 2010, the Bank’s dividend has grown substantially and the payout ratio has remained close to 50%. For the 2017 financial year, the Board recommends a cash dividend of AED 0.42 per share, translating to a payout of AED 2.183 billion, equivalent to 51% of net profit. This dividend payment is subject to approval at the annual general meeting.

We expect to see a gradual pickup in economic growth in 2018 and beyond.

As well as the introduction of VAT, 2018 will see the introduction of Basel III regulations with implications for capital and liquidity. Additionally, new accounting regulations (IFRS9) will bring forward recognition of loan impairments. ADCB is prepared for these changes, aided by our strong capital position and conservative approach to risk management.

Your Board believes that ADCB’s strategy, with the addition of a digital pillar, will continue to drive revenue and profit growth ahead of the market and deliver solid returns for our shareholders.

We give our longstanding and stable senior management team the full support of the Board as it leads the Bank’s digital transformation.

On behalf of the Board and all at ADCB, I extend our most sincere appreciation and gratitude to His Highness Sheikh Khalifa bin Zayed Al Nahyan, the UAE President and Ruler of Abu Dhabi; to His Highness Sheikh Mohammed bin Zayed Al Nahyan, Crown Prince of Abu Dhabi and Deputy Supreme Commander of the UAE Armed Forces; to His Highness Sheikh Mansour bin Zayed Al Nahyan, Deputy Prime Minister and Minister of Presidential Affairs; and to the UAE Central Bank.

I also thank our shareholders, our valued customers and the ADCB executive management team and employees for their continued dedication and support.