I am pleased to report that our solid franchise and strong fundamentals in 2017 meant we delivered a net profit of AED 4.278 billion with a return on average equity of 15%.

Thanks to our unwavering adherence to our long-term strategy, our prudent attitude to risk, and our robust commitment to world-class governance, the Bank was shielded from the economic volatility the region has faced.

While oil prices appear to be on the rise again and prospects for the global economy are looking more optimistic every day, we are by no means complacent. The geo-political climate in the region continues to present regular challenges as we witness a general shift in the financial philosophy of customers. With less economic certainty, and concerns about consumer confidence, spending and saving patterns for individuals are changing as are the trends for businesses, both large and small.

While our cost of risk remained stable in 2017, reflecting this challenging operating environment, the Bank has moved more towards secured lending, which, in time, should help to reduce the cost of risk. We saw a significant improvement in our Non-Performing Loans (NPL), which were 20% lower than 2016 at AED 3.692 billion.

The Bank is on very solid foundations in terms of its compliance with evolving Basel III and UAE regulatory requirements. Notably, the bank is also well-prepared to transition to the IFRS 9 accounting standard, introduced in 2018.

Our Capital Adequacy Ratios (CAR) reflect this preparedness. Under Basel III, our CAR was 19.09% compared to minimum capital requirement of 12% prescribed by the UAE Central Bank for 2017. Meanwhile, our Tier 1 and common equity tier 1 (CET1) ratios were 15.92% and 13.96% respectively, compared to the Central Bank’s minimum requirements of 10% and 8.5% (including buffers).

Having a robust and liquid balance sheet is a priority and we believe that long-term profitability cannot be achieved without it. ADCB is a very liquid bank, with a liquidity coverage ratio (LCR) of 135% as at 31 December 2017, compared to the 80% minimum requirement ratio prescribed by the UAE Central Bank. Additionally, we have a liquid pool of investment securities of AED 49 billion, primarily invested in government bonds. Finally, ADCB was a net lender in the interbank markets every day in 2017, as it has been for many years.

It is reassuring to see the overall liquidity conditions in the UAE improve as deposit growth continues to outpace credit growth.

Our balance sheet remains resilient with healthy and diversified growth in loans backed by a disciplined and selective lending strategy.

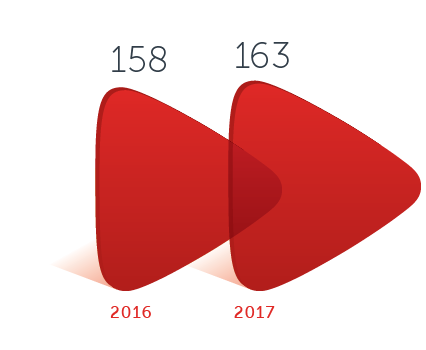

Against a backdrop of limited growth across the UAE banking sector, our net loans increased by 3%, driven by a 4% rise in Wholesale Banking loans and a 2% rise in Consumer Banking loans. Loans to SMEs rose by 6% as those to our MCD (mid-sized corporates) portfolio grew by 12% year-on-year.

Customer deposits were up by 5%, while our CASA deposits increased by AED 5.8 billion to AED 71 billion, an increase of 9% year-on-year. CASA balances now represent 43.4% of total customer deposits compared to 41.8% in 2016. We have been concentrating on CASA deposits because they provide stable, low-cost deposits that help to hold down the overall cost of funding. They also create opportunities for cross-selling ancillary products and services.

Our credit ratings remain strong. Standard & Poor’s, Fitch and RAM reaffirmed our ratings at A, A+, and AAA respectively.

Each of our business segments demonstrated a strong underlying performance. Total operating income was AED 8.895 billion, up 5% year-on-year. Operating income for Consumer Banking was up 3%, Wholesale Banking was up 6% and Treasury and Investments delivered an increase of 11% year-on-year.

Gross fee and commission income grew 9%, reflecting a consistent trend. As we have diversified, our fees are no longer linked to lending only. The majority of our fees are driven by spending on our card base, trade finance, asset management fees and insurance commission.

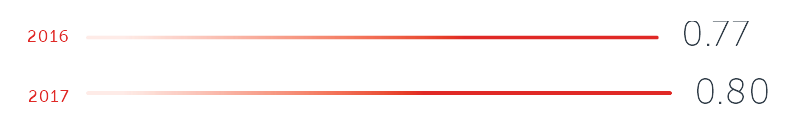

Across the competitive landscape of the UAE banking industry, margins have been under pressure. However, ADCB’s net interest margin remained consistent at 2.91%, slightly down from 2.97% in 2016 — a notable achievement in a tough environment — while asset yields increased to 4.28% in 2017.

We have maintained solid discipline in managing costs and increasing operational efficiency across the Bank. Our cost to income ratio of 33.1% was stable over 2016 and has consistently remained in this range for the past five years. While the increase in staff costs was modest, there was an increase in depreciation reflecting the Bank’s investment in technology, which included the commissioning of a new, state-of-the-art core banking system.

“Each of our business segments demonstrated a strong underlying performance. We enter 2018 with confidence. ADCB continues to demonstrate strong momentum.”

In line with our strategy, we remain focused on the UAE, supporting our customers and the economy by creating and delivering sustainable value through our products and services. For example, we are investing heavily in digital — from the systems we use in the Bank, to the innovative apps and services we offer our customers.

This is helping to make us more efficient, to reduce costs and to make banking safer, faster and easier for all.

At the same time, we are continuing to invest in attracting and retaining the best people and ensuring they are well-trained in matters of compliance and good governance, encouraging first-class risk management.

This solid performance positions us well to tackle the financial challenges and opportunities that lie ahead.

We enter 2018 with confidence. The UAE stands out as one of the strongest economies in the GCC and ADCB continues to demonstrate strong momentum. We remain well-capitalised and liquid, making the investments needed to grow in a changing environment. Together with our laser-like focus on enhancing our customer journey, new and better banking through our ongoing digital initiatives, and our continued drive for sustainable growth, we expect to deliver greater value for all our stakeholders.