- Back to "Home"

- Back to "Governance"

- Back to "Corporate Governance"

Corporate Governance Chairman’s Letter

I am pleased to present the Corporate Governance Report for 2019, which demonstrates our commitment to maintaining a governance framework of the highest international standard.

Eissa Mohamed Alsuwaidi

Chairman

Strong and effective governance is vital to the long-term success of ADCB and to our goal of becoming the bank of choice in the UAE. It protects our customers, the Bank and our reputation and safeguards the interests of our shareholders.

At the start of 2019, your Board had four standing Committees, which covered: Audit & Compliance, Corporate Governance, Risk & Credit, and Nomination, Compensation & Human Resources. During the year, the Nomination, Compensation & HR Committee merged with the Corporate Governance Committee to form the Nomination, Compensation, HR and Governance Committee (NCHRG). During 2019, the Board met 8 times and the Board Committees met 46 times.

The Committees made positive progress during 2019, maintaining high standards of discussion and continuing to enhance our governance framework.

Following a gap analysis, the NCHRG Committee was pleased to note that the Bank had already implemented most of the requirements of the new UAECB Governance Regulations into its corporate governance framework.

The NCHRG Committee also reviewed ADCB’s remuneration framework alongside those of Union National Bank (UNB) and Al Hilal Bank (AHB) to harmonise and ensure best-practice across the Bank. Finally, it continued to prioritise UAE National development, focusing on the recruitment, retention and training of talented UAE National staff.

The Audit & Compliance Committee considered purchase price adjustments recommended by management following the merger with UNB and the subsequent acquisition of AHB. It also reviewed and discussed the Bank’s IFRS 9 governance process, models, and implications for the Bank’s financial statements and ensured our compliance with UAE Central Bank regulations.

The Risk & Credit Committee also looked at the implications of the Bank’s ongoing application of IFRS 9. In particular, it reviewed the Bank’s expected credit loss (ECL) levels and reporting process and staging of its most significant accounts before and after the merger to ensure adherence to the Bank’s IFRS 9 models. It also continued to regularly review the risks associated with the Bank’s various product portfolios, and to ensure that the Bank’s capital and liquidity positions are suitably stress tested.

In the pages which follow, you will find more details of the work carried out by your Board in 2019. As well as outlining how we continued to strengthen corporate governance in 2019, the report illustrates the most significant issues with which we have dealt, and some of the principal activities that have engaged us. It also includes the reports from each of the Board’s principal Committees.

REGULATION

The Bank welcomed the release of the UAE Central Bank’s new regulations on corporate governance in 2019. The regulations will strengthen risk and governance across the banking sector in the UAE. They justify our long-term commitment to governance, as a result of which ADCB has consistently led the way in adopting and embedding international standards and best practice in governance.

BOARD EFFECTIVENESS

We have a reliable and effective Board. It is our collective responsibility to ensure the long-term success of ADCB and that we continue to generate sustainable value and solid returns for our shareholders.

As I mentioned in my introduction to this Annual Report on page 20, following our merger, we have welcomed a number of new members to the Board this year as others have stepped down. This has provided us with fresh perspectives and bolstered our objectivity. I am confident that we have the right mix of skills, knowledge and experience necessary to successfully deliver our objectives in 2020 and beyond.

Our focus on enhancing Board effectiveness is continuous, and we are grateful for the valuable support and advice of Sir Gerry Grimstone, Board Adviser. Sir Gerry’s significant international governance expertise and experience serve to strengthen the Board.

Meanwhile, we remain dedicated to promoting greater clarity and transparency in our communications with management and to ensuring that communication between the Board and management is as effective as possible.

STAKEHOLDER ENGAGEMENT

By understanding the issues that most concern our internal and external stakeholders, we are better able to make informed decisions that help to address these subjects. Listening to what is being said by our investors, customers, regulators, employees, and shareholders provides valuable insight, and that is why we take every opportunity to engage with our stakeholders.

Our AGM is particularly important in this regard and allows us to meet many of our investors face-to-face. We also engage with them in a variety of other ways, which you can read about in more detail on page 96.

THANK YOU

Finally, I want to take this opportunity to thank all my colleagues on the Board for their support in this landmark year. I am confident that the strength of our commitment to corporate governance, our well-established framework, and our proven culture of accountability provide a robust foundation upon which we will continue to build.

Eissa Mohamed Alsuwaidi

Chairman

Corporate Governance Report

We maintain a world-class corporate governance framework that protects our customers, our shareholders, and the reputation of the Bank. Strong governance underpins our integrity and promotes economic growth by reinforcing the trust and confidence our investors place in us.

ADCB has a strong, well-established and world-class corporate governance framework. The framework is regularly reviewed and adjusted to reflect changes in the Bank’s businesses, regulation and the external environment. Our disciplined approach to governance at every level demonstrates our integrity and promotes greater transparency. It protects our reputation and supports our long-term success by attracting investors, customers, employees and other stakeholders.

THE BOARD: MEMBERSHIP, COMMITTEES AND MEETINGS

The Board, which consists of 11 members, met eight times in 2019. In addition, Directors received information between meetings about the activities of Board and Management Committees and developments in the Group’s business.

Members of Senior Management were invited to all these meetings to enhance the Board’s engagement with management and deepen their understanding of the business. In addition, Board members made regular visits to various divisions of the Bank to enrich their knowledge of our operations.

At the start of 2019, the Board had four standing Committees, which covered: Audit & Compliance, Corporate Governance, Risk & Credit, and Nomination, Compensation & Human Resources. During 2019, we merged Corporate Governance into the Nomination, Compensation & Human Resources Committee to create the Nomination, Compensation, Human Resources & Governance Committee.

Each member of the Board, with the exception of Ala’a Eraiqat, the Group Chief Executive Officer, serves on at least one standing Committee. The Committees met a total of 46 times in 2019. Chairmanships and memberships of the Board Committees are reviewed on a regular basis to ensure suitability. Membership is rotated as needed.

DIRECTORS’ INDEPENDENCE AND MANAGEMENT REPORTING

Independence is an important factor in our ability to serve in the best interest of the Bank and all its stakeholders. All non-executive Directors are considered independent, according to the UAE Central Bank’s regulations on corporate governance.

On the management side, the Group Chief Internal Auditor reports to the Board’s Audit & Compliance Committee, and the Board Secretary reports to the Board. The Group Chief Risk Officer has direct access to the Board Risk & Credit Committee and the Group Chief Compliance Officer has direct access to the Board Audit & Compliance Committee.

To ensure that the Board has the benefit of independent thinking and international governance expertise, Sir Gerry Grimstone was appointed as Independent Adviser to the Board in 2013. In 2019, Sir Gerry attended five Board meetings and the Board strategy session. His background and experience continue to enrich the Board’s deliberations, particularly in the areas of strategy, governance, Board reporting and effectiveness, performance assessments for Senior Management, succession planning, and evaluation of risk appetite and rewards.

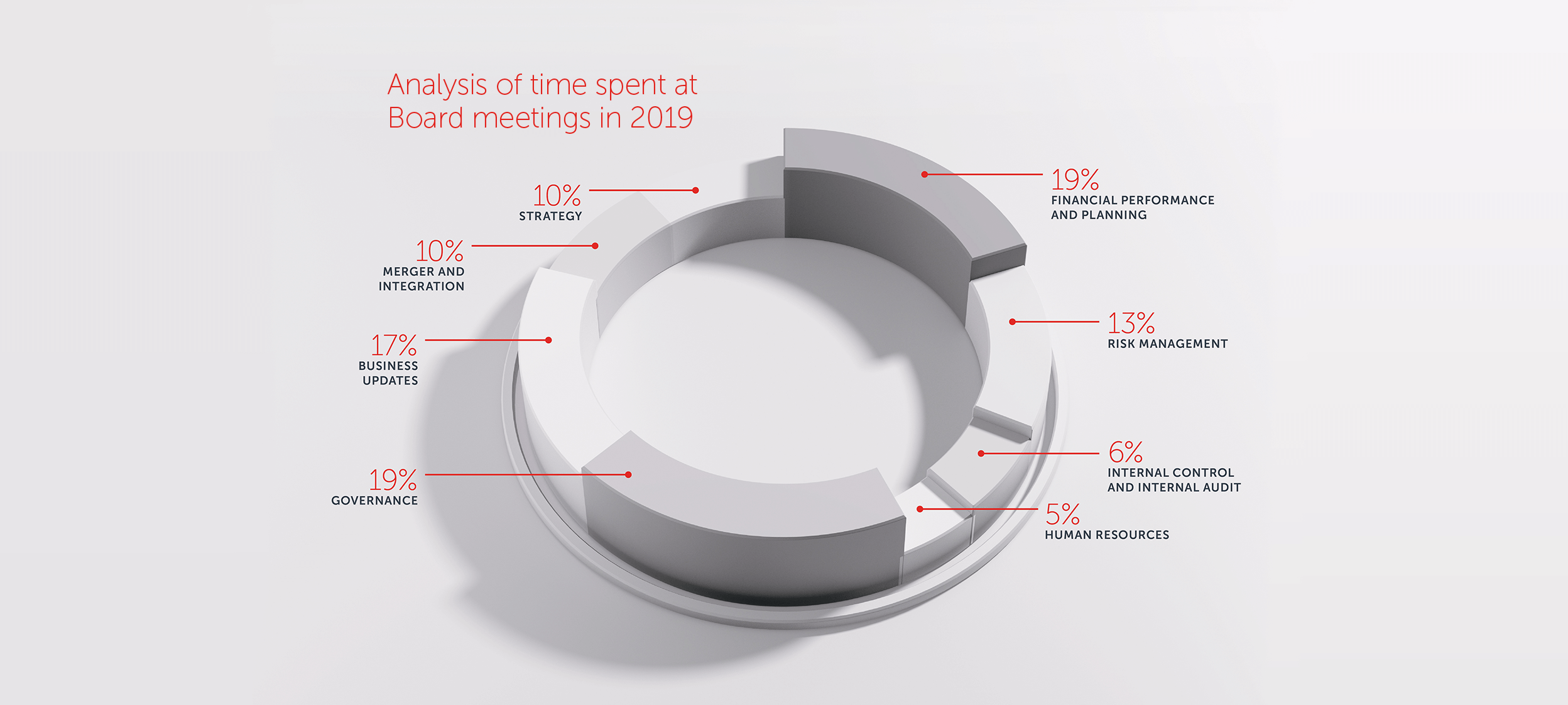

THE BOARD’S AGENDA IN 2019

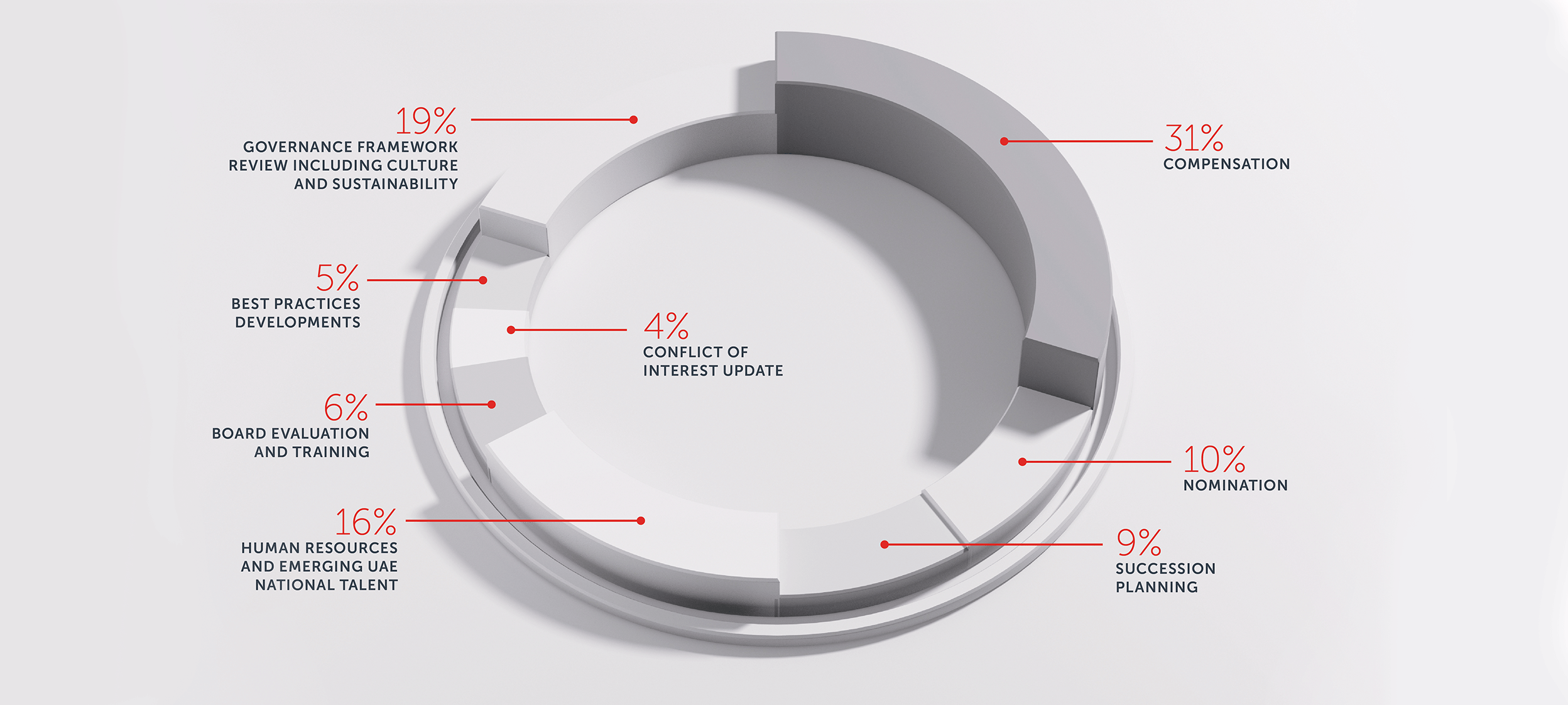

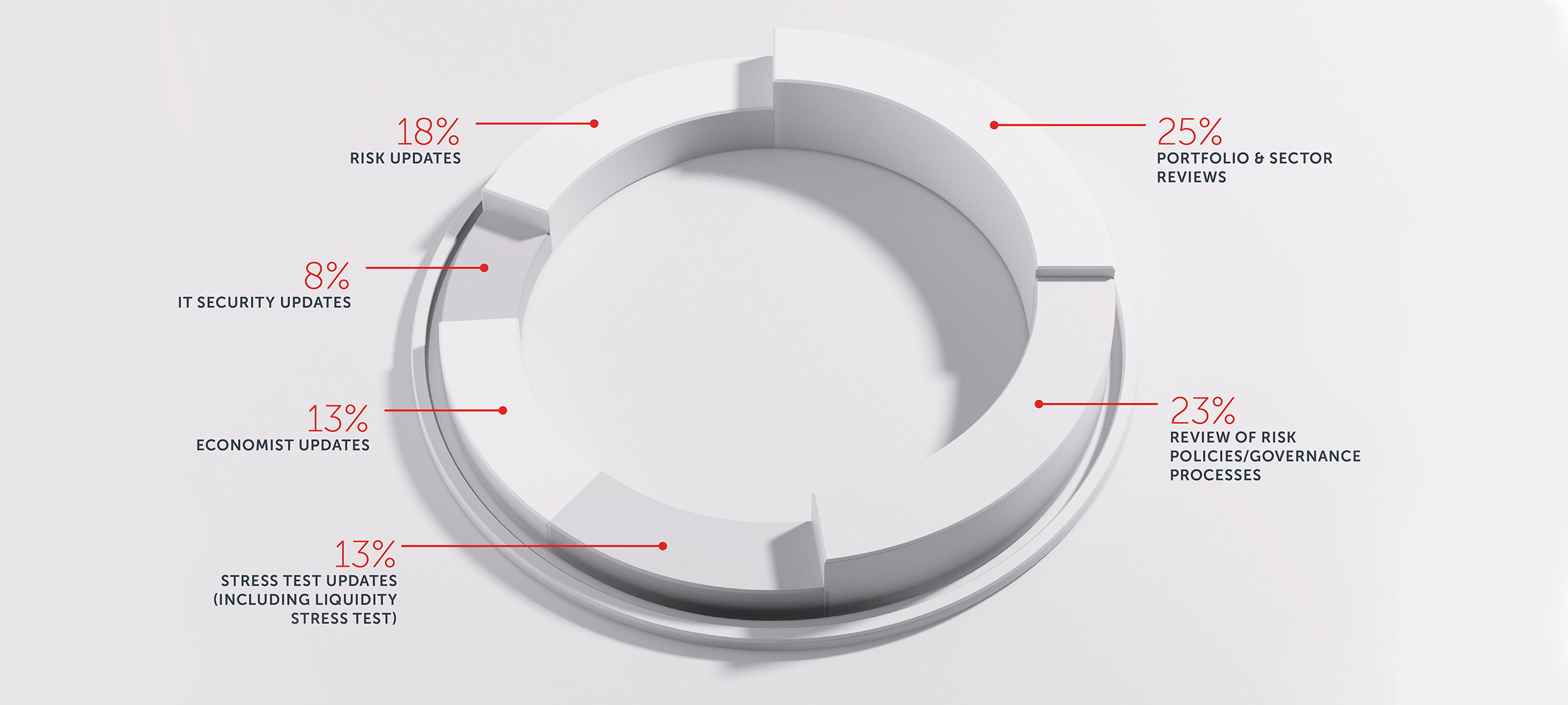

The Board of Directors regularly discusses items that are fundamental to the direction of the Bank, including business performance, long-term planning, strategy, risk appetite and management, succession planning, and human resources. Details of the agenda items discussed by the Board and its Committees during 2019 are set out on pages 122–124.

Board and board committee agenda items

| Area | Q1 2019 | Q2 2019 | Q3 2019 | Q4 2019 |

|---|---|---|---|---|

| Governance |

|

|

|

|

| Financial Performance, planning and controls |

|

|

|

|

| Business updates |

|

|

|

|

| Nomination |

|

|

||

| HR |

|

|

|

|

| Audit and internal controls |

|

|

|

|

| Risk and compliance |

|

|

|

|

| Strategic items |

|

|

|

|

PERFORMANCE EVALUATION

The Board undergoes a rigorous in-house performance evaluation regularly in line with global standards. It also regularly engages an external consultant to conduct an independent performance evaluation. These evaluations cover a wide range of topics and include an assessment of individual Board members’ performance, skills and expertise at Board level, succession planning, development of the Bank’s strategy, and the form and content of management information supplied to the Board.

The evaluation also addresses training requirements. In 2019, the Board continued to ensure that its members received professional development in several areas, including operational risk, anti-money laundering, sanctions compliance and IFRS 9.

BOARD REMUNERATION

Directors’ remuneration is set annually by the Bank’s shareholders. Any proposals for changes are considered by the Nomination, Compensation, Human Resources & Governance Committee prior to obtaining Board and shareholders approvals. According to applicable laws and the Bank’s articles of association, Directors may not receive any remuneration in years when the Bank does not achieve net profits.

As at 31 December 2019, the Bank’s Directors were not eligible for any bonus, long-term or other incentive schemes. Directors do not receive any pension benefits from the Bank. The Bank’s Group Chief Executive Officer has waived his right to receive Director’s fees. He receives variable pay as a member of Senior Management of the Bank, not as a Director.

ADCB directors’ shareholdings

| Sr. No | Members | As at 31 December 2018 | As at 31 December 2019 | Change in shareholding |

|---|---|---|---|---|

| 1 | Eissa Alsuwaidi | 0 | 0 | 0 |

| 2 | Mohamed Dhaen Alhamli | N/A | 0 | N/A |

| 3 | Ala'a Eraiqat | 2,569,797 | 2,718,064* | 148,267 |

| 4 | Aysha Al Hallami | 0 | 0 | 0 |

| 5 | Abdulla Almutawa | 2,347,277 | 0 | (2,347,277) |

| 6 | Khaled Alkhoori | 0 | 1,360,000 | 1,360,000 |

| 7 | Khalid Alsuwaidi | 0 | 14,915 | 14,915 |

| 8 | Carlos Obeid | N/A | 0 | N/A |

| 9 | Hussain Alnowais | N/A | 0 | N/A |

| 10 | Saeed Almazrouei | N/A | 0 | N/A |

| 11 | Mohamed AlMehairi | N/A | 0 | N/A |

| *Excluding 123,491 restricted units in the Bank’s LTIP scheme with a final vesting dated of December 31, 2019. | ||||

THE FOLLOWING TABLE SHOWS THE AMOUNTS PAID TO THE DIRECTORS FOR THEIR SERVICE ON THE BOARD AND ITS COMMITTEES IN 2019

APPOINTMENT, RETIREMENT AND RE-ELECTION

The Bank recognises that an effective board is crucial to the success of its business. All Directors are required to seek re-election by shareholders every three years. The Abu Dhabi Investment Council has the right to elect a percentage of the Board that is proportionate to its holdings of the Bank’s share capital.

As of year-end 2019, the Abu Dhabi Investment Council held 60.2% of the Bank’s issued share capital and, consequently, had the right to elect six Directors and to vote a further 0.2% of the Bank’s capital at the Board elections.

BOARD OVERSIGHT OF RISK MANAGEMENT

Risk management is a crucial part of ADCB’s corporate governance framework. The Board of Directors has overall responsibility for setting our risk appetite and for ensuring risk is effectively managed.

The Board Risk & Credit Committee (BRCC) oversees risk monitoring and management. It works with management to define risk appetite and strategy as appropriate for particular sectors, geographic regions and customer types. The BRCC also reviews the suitability and effectiveness of the Bank’s risk management systems and controls, and reviews stress tests and the Bank’s stress-testing methodologies. It also ensures that our risk governance supports prudent risk-taking at all levels in the Bank. During 2019, the Committee also sought assurance from Senior Management that the UAE Central Bank’s regulations relating to market risk, interest rate and rate of return risk in the banking book, as well as country risk and credit risk had been suitably addressed and reported accordingly to the Board.

The Board and management also foster a culture of compliance. They have created an environment where employees at all levels are empowered to confront improper behaviour, raise grievances and suggest better ways to pursue the Group’s strategic goals.

BOARD OVERSIGHT OF FINANCIAL REPORTING, COMPLIANCE AND INTERNAL CONTROLS

Oversight of financial reporting and integrity of the Bank’s financial disclosures are also key roles performed by your Board. In 2019, the Board Audit & Compliance Committee assessed the objectivity and effectiveness of the Bank’s financial reporting and disclosure process. This included monitoring the Bank’s choice of accounting policies, principles and judgements. The Committee also reviewed the IFRS 9 governance process and models and ensured the Bank’s compliance with UAE Central Bank’s regulations relating to internal controls, compliance and internal audit.

CULTURE

A key responsibility of your Board is to ensure that the Bank builds and maintains a healthy culture. The Bank believes that companies that attach equal importance to performance and culture achieve exceptional results over time. During 2019, the Bank engaged the services of a leading international consultancy group to assess the Bank’s organisational health. The assessment concluded that the Bank ranks in the top decile globally for organisational health, which reflects a robust culture across all dimensions of the Bank, including direction, accountability, innovation and learning, motivation, leadership and work environment.

The Board is committed to supporting gender diversity. As a result, as at December 31, 2019, women represented 10% of the Bank’s Board membership. Going forward, in line with regulatory requirements, the Bank will ensure that at least 20% of candidates considered for Board membership are female.

Management committees

| Committee name | Number of meetings held in 2019 | Responsibilities of the Committee |

|---|---|---|

| Management Executive (MEC) | 37 | Most senior management Committee; oversees all Bank businesses and operations |

| Assets & Liabilities (ALCO) | 7 | Formulates the Bank’s overall assets and liabilities strategy. Makes investments and executes asset/liability transactions within delegated limits; guides the MEC and the Board on investments and asset/liability transactions above those limits |

| Management Risk & Credit (MRCC) | 47 | Approves credits within delegated limits; considers risk appetite and strategy issues; sets and recommends risk policies; guides the Board Risk & Credit Committee and the Board on credits above delegated limits and on general risk and risk policy issues |

| Capital Expenditure (CEC) | 3 | Reviews and approves project capital expenditures within delegated limits, and makes recommendations to the MEC and the Board on project capital expenditures above those limits |

| Financial Performance Management (FPMC) | 6 | Monitors financial performance of the Bank’s business lines |

BOARD OVERSIGHT OF RELATED PARTY TRANSACTIONS

The Bank has robust processes in place to identify, assess, monitor and report the Bank’s exposures to related parties. Upon appointment, and every quarter thereafter, all Directors are required to disclose their related parties. The Board Secretariat maintains a conflicts of interest and related parties register, which is reviewed by the Board Nomination, Compensation, HR and Governance Committee every quarter.

During 2019, all related party transactions were conducted on an arm’s-length basis and approved by the Board. Directors with potential conflicts did not participate in relevant discussions or votes. The details of related party transactions are disclosed in Note 36 to the Financial Statements on page 214. These transactions were undertaken as part of the Bank’s day-to-day operations.

BOARD OVERSIGHT OF THE GROUP STRUCTURE

The Bank has robust processes for establishing and dissolving entities within the Group. The Board ensures that the Group’s legal, organisational and operational structure is suitable for its needs. During 2020, following the enlargement of the Group in 2019, the Board will address subsidiary governance, with the aim of ensuring that a framework is in place to effectively govern the enlarged Group.

The number and purpose of the Group’s subsidiaries are disclosed in Note 48 to the Financial Statements on page 254.

AUDIT ARRANGEMENTS

Deloitte & Touche, the external auditors, were appointed at the 2015 Annual General Meeting (AGM) and reappointed at the 2016, 2017, 2018, and (exceptionally due to the merger) 2019 AGMs. While local laws and Bank policy restrict the external auditors’ tenure to no more than three consecutive renewals, they allow for certain exceptions. Deloitte & Touche is paid on a fixed annual fee basis, as approved by the shareholders at the AGM. New external auditors will be appointed for the 2020 financial year.

In 2019, the audit fees for the Bank and its subsidiaries, excluding India and Egypt operations, amounted to AED 4,242,476, and fees for non-audit work amounted to AED 1,363,690. Non-audit work comprised: a comfort letter related to the Bank’s Global Medium Term Note Programme, review of IFRS 9 model, ICFR audit, prudential returns review for the Bank’s Jersey Branch, due diligence services and consultancy on tax matters.

THE BANK’S APPROACH TO DISCLOSURE

The Bank is committed to high standards of transparency and to enhancing our disclosures regularly to reflect local and international best-practice. In this year’s Annual Report, we have sought to further improve clarity around the Bank’s culture, the Group structure, and the Board’s oversight of related party transactions to align with the requirements of the UAE Central Bank’s regulations on corporate governance.

We are confident that the Bank is one of the most transparent institutions in the region. We publicly communicate relevant financial and non-financial information in a timely manner to all our stakeholder groups through several channels. As well as this Annual Report, we provide quarterly market updates, issue regular press releases, and ensure the Bank’s website is up to date. The Bank’s Investor Relations department ensures strong communication with our shareholders and potential investors.

Finally, recognising the importance of effective internal communication, we ensure all employees are kept aware of all new developments. These include the Bank’s strategic direction, objectives, ethics, risk policies, general policies and procedures, new regulations, and other relevant information.

REMUNERATION AND REWARD — GUIDING PRINCIPLES

ADCB supports levels of remuneration necessary to attract, retain and motivate employees capable of leading, managing and delivering quality service in a competitive environment.

However, our remuneration structure is conservative, and we have practices and policies that promote effective risk management. Our remuneration packages are structured to reflect duties and responsibilities that are fair and equitable, and incorporate clear and measurable rewards linked to corporate and individual performance. Rewards are based only on the results of a rigorous performance appraisal system with a robust management decision-making, review and approvals process.

Considering market trends and constraints, our remuneration programme incorporates both short- and long-term incentives that align the interests of ADCB’s employees with the interests of shareholders and other stakeholders.

Performance-related elements are designed to minimise employee turnover and to inspire employees to perform at the highest levels, consistent with effective risk management.

TOTAL REWARD — KEY COMPONENTS

As shown in the following table, employees can receive three types of reward at ADCB: fixed pay, variable pay and retention scheme.

BANK-WIDE VARIABLE PAY FRAMEWORK

The Variable Pay Framework has been designed to align employees’ interests with the long-term interests of the Bank’s shareholders and to incentivise higher performance while avoiding excessive risk-taking. It also distinguishes amongst different functions of the Bank, to ensure alignment to the relevant market.

Definition and components of pay

| Fixed Pay Definition |

Components |

2019 Key Management Fixed Pay |

|---|---|---|

|

Fixed pay is based on the market rate for each role and is impacted by the employee’s contributions over time. Fixed-pay reviews depend on whether the employee achieved specific and measurable objectives and delivered a prescribed performance level. |

Basic Salary Allowances

Benefits based on band, such as:

|

In 2019, Key Management (defined as the Group CEO and his direct reports) received fixed pay and cash benefits in an aggregate amount of AED 29.176 million. |

|

Variable Pay

|

|

|

|

Employees may receive variable pay based on their performance over the year. Because it is performance-based, variable pay is at risk, and the amount received, if any, may change each year. |

Individual award amounts are dependent on three things:

For more information, see ADCB’s Variable Pay Framework & Governance—Key Facts, on page 132. |

For performance in 2018, awards to employees in 2019 consisted of cash variable pay awards of AED 161.269 million and deferred compensation plan awards of AED 57.4 million. Key Management received AED 29.79 million in cash and AED 26.76 million in deferred compensation from the amounts set forth above. |

|

Retention Scheme

|

|

|

|

In 2014, ADCB introduced a share-based Retention Scheme for those in key positions and for high potential UAE Nationals. The Retention Scheme, which is independent of variable pay awards, is designed to ensure business continuity by mitigating turnover risk and the related operational risk. Invitations to join the Retention Scheme are at the sole discretion of the NCHRG Committee; members of the Management Executive Committee are not eligible to participate. Retention Scheme awards vest after four years from the award date. |

|

No retention award was made during 2019. |

The NCHRG Committee oversees the design, operation and effectiveness of the framework and allocation of awards, including overall amounts, distribution amongst business groups and actual awards to Senior Management (including material risk takers and senior members of the Bank’s control functions).

ADCB uses a balanced scorecard (BSC) approach to measuring employee performance, including the following KPI categories:

- Financial;

- Customer Service (minimum 30% weightage);

- Risk; and

- Learning and Growth.

EFFECTIVENESS OF THE VARIABLE PAY FRAMEWORK

Effectiveness of the Variable Pay Framework is monitored on an annual basis through a set of KPIs, including:

- Correlation between total variable pay pool and the Bank’s Net Profits;

- Correlation between individual performance and variable pay award;

- Attrition rate for the employees awarded deferred variable pay as compared to the overall attrition rate; and

- Leadership Stability-Attrition rate at Senior Management level (top 100 executives) as compared to the industry average for the same level.

In addition, in accordance with best practices and the requirements of the UAE Central Bank’s regulations on corporate governance, the Nomination, Compensation, HR & Governance Committee regularly seeks independent consultants’ views on (a) the quantum, (b) design, and (c) effectiveness of the Bank’s variable pay awards and framework. An independent review of the design and effectiveness of the Bank’s variable pay framework will take place early in 2020.

| ADCB’S VARIABLE PAY FRAMEWORK & GOVERNANCE—KEY FACTS | |

|---|---|

|

Reflects individual, business function and Bank-wide performance |

Yes |

|

Distinguishes amongst different functions of the Bank to ensure alignment to the relevant market |

Yes |

|

Defers variable pay award above specified threshold |

Yes |

|

Currency of deferred compensation |

Cash and shares |

|

Duration of deferral of variable pay |

3 years |

|

Awards subject to thresholds, caps, clawback rules, malus clause, and deferral and retention provisions |

Yes |

|

Managed by remuneration professionals experienced in the governance of all types of compensation and benefits |

Yes |

|

Designed in conjunction with, and reviewed by, independent external advisers reporting directly to the Nomination, Compensation & Human Resources Committee |

Yes |

|

Relies on regular external benchmarking to ensure alignment with evolving global best practices |

Yes |

|

Incorporates constant monitoring of developments in remuneration governance to ensure all variable pay plans evolve in line with the Bank’s needs and external developments |

Yes |

|

Designed to avoid excessive risk-taking |

Yes |

|

Includes a minimum shareholding rule for Key Management |

Yes |

|

Aligns employee interests with the long-term interests of the Bank’s shareholders |

Yes |

ADCB Islamic Banking is the brand under which we offer retail and corporate Shari’ah-compliant financial solutions to our Consumer, Wholesale and Treasury clients.

ADCB is regulated by the Central Bank of the UAE, and its Islamic Banking activities are supervised by an independent Internal Shari’ah Supervision Committee (ISSC). The ISSC is the final authority within ADCB regarding all Shari’ah-related matters. It operates in accordance with the resolutions, standards and guidelines issued by the Higher Shari’ah Authority of the Central Bank of the UAE (HSA). HSA follows the Shari’ah Standards issued by the Accounting & Auditing Organization for Islamic Financial Institutions (AAOIFI) and Islamic Financial Services Board (IFSB).

ISSC functions in line with the Shari’ah governance framework provided within the terms of reference (TOR) of the ISSC that are approved by the members of the ISSC. The TOR set out the procedures for the functioning of the ISSC such as holding of meetings, issuing of Fatawas and Shari’ah review.

ADCB Islamic Banking’s Shari’ah governance is implemented and overseen by the internal Shari’ah Advisor. Fatwas (pronouncements and approvals) are issued by the ISSC to certify compliance with principles of Shari’ah for all products and services as well as for bespoke structured deals. The ISSC’s review covers the product structure, the underlying Shari’ah contract, legal documentation, operational process flow and all associated product literature. Fatwas issued by the ISSC are published on the Bank’s website and are available at all branches.

ADCB Islamic Banking maintains a separate set of financial records to ensure that the accounts for the Islamic business are completely segregated from ADCB’s conventional funds. The Bank’s consolidated accounts include the results of ADCB Islamic Banking and are separately disclosed in the notes.

The respected Shari’ah scholars listed below make up the ISSC of ADCB Islamic Banking.

PROFESSOR JASSIM ALI AL SHAMSI, CHAIRMAN

Professor Jassim is the first Emirati Shari’ah scholar to lead the ISSC of ADCB Islamic Banking. He previously served as Dean of the College of Shari’ah and Law, UAE University. In addition, he chairs or is a member of many other ISSCs for Islamic banks/windows and financial institutions.

SHEIKH DR. NIZAM YAQUBI, EXECUTIVE MEMBER

Sheikh Dr. Nizam is one of the most prominent Shari’ah scholars in the world and chairs, or is a member of, the ISSC at several regional and global Islamic banks and financial institutions. He has a strong international reputation for his in-depth knowledge of banking and Shari’ah coupled with a progressive approach towards modern banking solutions.

MR. KAMRAN KHALID SHERWANI, ISSC SECRETARY

Mr. Kamran is Shari’ah Advisor at ADCB Islamic Banking. He provides Shari’ah guidance on all day-to-day Shari’ah-related matters and obtains ISSC guidance and approvals in respect of each product, service, process and transaction and other Shari’ah-related matters. Mr. Kamran received a degree in Shari’ah and Law from the International Islamic University and is an AAOIFI certified Shari’ah Advisor and Auditor. He has served as Shari’ah advisor to several major Islamic banks and other financial institutions.

Annual Report of the Internal Shari’ah Supervision Committee of Abu Dhabi Commercial Bank Islamic Banking Division

Issued on: 09 February 2020

To: Shareholders of Abu Dhabi Commercial Bank PJSC

(“the Institution”)

After greetings,

Pursuant to the requirements stipulated in the relevant laws, regulations and standards (“Regulatory Requirements”), the Internal Shari’ah Supervision Committee of the Institution (“ISSC”) presents to you the ISSC’s Annual Report regarding Shari’ah compliant businesses and operations of the Institution for the financial year ending on 31 December 2019 (“Financial Year”).

-

Responsibility of the ISSC

In accordance with the Regulatory Requirements and the ISSC’s charter, the ISSC’s responsibility is stipulated as to:- undertake Shari’ah supervision of all businesses, activities, products, services, contracts, documents and business charters of the Institution; and the Institution’s policies, accounting standards, operations and activities in general, memorandum of association, charter, financial statements, allocation of expenditures and costs, and distribution of profits between holders of investment accounts and shareholders (“Institution’s Activities”) and issue Shari’ah resolutions in this regard, and

- to determine Shari’ah parameters necessary for the Institution’s Activities, and the Institution compliance with Islamic Shari’ah within the framework of the rules, principles, and standards set by the Higher Shari’ah Authority (“HSA”) to ascertain compliance of the Institution with Islamic Shari’ah.

-

Shari’ah Standards

In accordance with the HSA’s resolution (No. 18/3/2018), and with effect from 01/09/2018, the ISSC has abided by the Shari’ah standards issued by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) as minimum Shari’ah requirements, in all fatwas, approvals, endorsements and recommendations, relating to the Institution’s Activities without exception. -

Works Undertaken by the ISSC During the Financial Year

The ISSC undertook Shari’ah supervision of the Institution’s Activities through review of those Activities, and monitoring through division or internal section of internal Shari’ah control, internal Shari’ah audit, in accordance with the ISSC’s authorities and responsibilities, and pursuant to the Regulatory Requirements in this regard. Works of the ISSC included the following:- Convening (4) meetings during the year.

- Providing fatwas, opinions and resolutions on matters presented to the ISSC in relation to the Institution’s Activities.

- Monitoring compliance of policies, procedures, accounting standards, product structures, contracts, documentation, business charters, and other documentation submitted by the Institution to the ISSC for approval.

- Ascertaining the level of compliance of allocation of expenditures and costs, and distribution of profits between holders of investment accounts and shareholders with parameters set by the ISSC.

- Supervision through division or section of internal Shari’ah Control, internal Shari’ah Audit, of the Institution’s Activities including executed transactions, adopted procedures on the basis of samples selected from executed transactions, and reviewing reports submitted in this regard.

- Providing direction to relevant parties of the Institution to rectify (where possible) findings cited in the reports submitted by division of section of the internal Shari’ah control, internal Shari’ah audit, and issuance of resolutions to set aside revenue derived from transactions in which non-compliance were identified to be disposed towards charitable purposes.

- Approving remedial rectification and preventive measures related to identified errors to prevent their reoccurrence in the future.

- Communicating with the Board and its subcommittees, and the senior management of the Institution (as needed) concerning compliance of the Institution with Islamic Shari’ah.

-

Independence of the ISSC

The ISSC acknowledges that it has carried out all of its duties independently and with the support and cooperation of the senior management and the Board of the Institution. The ISSC received the required assistance to access all documents and data, and to discuss all amendments and Shari’ah requirements. -

The ISSC’s Opinion on the Shari’ah Compliance Status of the Institution

Premised on information and explanations that were provided to us with the aim of ascertaining compliance with Islamic Shari’ah, the ISSC has concluded with a reasonable level of confidence, that the Institution’s Activities are in compliance with Islamic Shari’ah, except for the incidents of non-compliance observed, as highlighted in the relevant reports, including (47) of breaches that did not result in setting aside revenue. The ISSC also issued directions to take appropriate measure in this regard.

The ISSC formed its opinion, as outlined above, exclusively on the basis of information perused by the ISSC during the financial year.

Signatures of members of the Internal Shari’ah Supervision Committee of the Institution

Sheikh Dr. Nizam Yaquby

Executive Member

Professor Dr. Jassim Al Shamsi

Chairman of the Committee

AL HILAL BANK PJSC

BOARD OF DIRECTORS

(as at December 31, 2019)

- Ala’a Eraiqat*

- Siddiqa Abbas*

- Saoud Al Jassem

- Mohamed Al Jayyash

- Kevin Taylor*

- Arup Mukhopadhyay*

- Deepak Khullar*

*Please refer to pages 108–113 for the profiles of these Directors.

BOARD MEMBERS

Mohamed Al Jayyash

Mohamed Al Jayyash was appointed ADCB’s Acting Group Chief Operations Officer in December 2019. He has held senior operational management positions at ADCB, including Chief Service Officer and Branch Operations Manager. With over 15 years of experience in banking, he now leads the Group Business Services (GBS) division which includes the Operations, Customer Experience, Technology and Property Management teams. GBS is responsible for ensuring the Group has the operational, technological and property management capabilities and systems infrastructure to ensure reliable and agile business operations across the Group.

He is the Chairperson of several ADCB subsidiary companies including ITMAM Services L.L.C., Abu Dhabi Commercial Engineering Services L.L.C. and Abu Dhabi Commercial Properties L.L.C., and a Board Member of Al Hilal Bank PJSC. He is the Chairman of the Board of Directors of Emirates Digital Wallet L.L.C.

Mohamed holds a bachelor’s degree in Business Administration from Al Ghurair University in the UAE. He also holds a postgraduate certificate in Management from Ashridge Executive Education HULT in the UK and a diploma in Banking from the Emirates Institute for Banking and Financial Studies in Sharjah.

Saoud Al Jassem

Saoud Al Jassem was appointed to join the Board of Directors of Al Hilal Bank in February 2019 and was elected by the shareholders as Chairman of Al Hilal Bank Kazakhstan.

Saoud has over 17 years of experience in Corporate Banking, Wealth Management, Trade Finance and Internal Audit.

Saoud has been employed by ADCB since June 2013. He currently leads the development of ADCB’s relationship with the various local and federal governments in UAE for all their banking services and funding requirements as Head of Government Banking. Prior to this role, he managed government banking in Dubai & Northern Emirates as well as heading Strategic Accounts within Transaction Banking in the region.

Previously, at Emirates NBD, he was part of Wealth Management and Client Relationship Management. He also held various positions at Standard Chartered Bank within the Global Internal Audit Department in MENA/SA as well as Global Corporate where he started his career and spent over seven years in various assignments.

Saoud holds a Master of Business Administration degree from London Business School (UK) and a bachelor’s degree in Finance from Drexel University, Philadelphia, USA.

EXECUTIVE MANAGEMENT

1. Abdul Shakeel Aidaroos

(Chief Executive Officer)

As CEO, Abdul Shakeel is responsible for working closely with the Board of Directors of the Bank to set and implement the strategic direction of the organisation.

Abdul Shakeel has over 25 years of banking industry experience, with deep expertise in retail banking, digital innovation and risk management. He has held senior positions at ADCB for 15 years, including the last five years as Head of Retail Banking, where he managed a team of 2,000 professionals and launched many of ADCB’s award-winning consumer products and digital banking channels. Prior to joining ADCB, he spent over 10 years with Citibank in the UAE. Abdul Shakeel holds a Master of Science degree in Risk Management from NYU Stern School of Business, New York, USA.

2. Ross Baranet

(Chief Risk Officer)

Ross Baranet is Chief Risk Officer at Al Hilal Bank. He has spent 25 years in the field of risk management across nine countries and is responsible for identifying and mitigating current and emerging risks at the Bank. Before joining Al Hilal Bank and the ADCB Group, Ross held executive roles in HSBC’s global operations, including Chief Risk Officer (Philippines), Director of HSBC Retail Savings Bank (Philippines), Chief Risk Operating Officer (Middle East), and Chief Risk Officer (Korea). Previous roles include operational risk, approvals, collections, policy, audit, and governance.

3. Ian Hodges

(Senior Managing Director, Personal Banking Group)

Ian Hodges is the Senior Managing Director, Personal Banking Group at Al Hilal Bank. With over 30 years of experience across retail and digital banking, Ian is responsible for leading frontline delivery across Branches, Executive Banking and Digital; the development of products and services to enhance the customer experience; and Investment Banking, in line with the strategic objectives of Al Hilal Bank and the ADCB Group. Before joining the Bank, Ian served as the Head of Business Development at the Al Etihad Credit Bureau. He also held the roles of Managing Director, Retail Banking at the National Bank of Ras Al Khaimah, and Director, Branch Network for the UK-based Cooperative Bank. In his early career, Ian worked as Head of Call Centre at the Cooperative Bank and in a number of management roles at Lloyds TSB in the UK.

4. Sultan Al Mahmood

(Chief Human Resources Officer)

Sultan Al Mahmood is Chief Human Resources Officer at Al Hilal Bank. With almost 20 years of experience in the field of Human Resources and Relationship Management, Sultan is responsible for HR development, transformation, and strategic HR activities. Before joining the Bank, Sultan served as Senior Vice-President Human Resources at Etihad Airways. He also held the roles of Executive Director of Strategic Performance at Tourism Development and Investment Company (TDIC), and Executive Vice President and Head of Human Resources at Abu Dhabi Commercial Bank. In his early career, he worked as a Compensation and Employee Relations Manager at Amiri Flight (now Presidential Flight) and as a Relationship Manager at Citibank, UAE. Sultan holds a bachelor’s degree in Business Administration and a master’s degree in Human Resources Development from Webster University in Geneva, Switzerland. Sultan also holds a Master of Business Administration in Strategic and Security Studies from National Defense College, Abu Dhabi.

5. Abdel Karim Taha

(Chief Information Officer)

Abdel Karim Taha is the Chief Information Officer at Al Hilal Bank. With more than 22 years of experience in the field of Information Technology and Consulting, Abdel Karim leads the Information Technology team and is responsible for implementing future technologies and delivering the transformation initiatives in line with the Bank’s objectives and strategy. Before joining the Bank, Abdel Karim served as Chief Information Officer at Union National Bank. He also held senior consulting positions at Accenture. In his early career, Abdel Karim worked as a specialist in Geographic Information Systems. Abdel Karim holds a bachelor’s degree in Electrical Engineering from Jordan University of Science and Technology, and holds several Executive Certificates from MIT and other institutions.

6. Dr. Mohamed Obadah

(Head of Shari’ah Supervision)

Dr. Mohamed Obadah Adi is Head of Shariah Supervision at Al Hilal Bank. With almost 23 years of experience in the field of Shari’ah and banking, Dr. Mohamed is responsible for monitoring and supervising activities to maintain Shari’ah compliance and assist in developing and creating innovative Shari’ah investment and financing products and services. Before joining the Bank, Dr. Mohamed was a Supervisor of Islamic Studies and Arabic Language at ADNOC’s Technical Institute. Dr. Mohamed holds a Doctorate Degree (PhD) in Islamic Studies from the University of Wales in the UK and master’s degree from Al Azhar University’s Faculty of Islamic and Arabic Studies. He received his bachelor’s degree in Islamic Studies from United Arab Emirates University.

7. Rajesh Arora

(Head of Finance)

Rajesh Arora was appointed as the Head of Finance for Al Hilal Bank in November 2019, prior to which he was the Head of Finance for UNB. He has over 23 years of experience in the banking industry spread across various geographies. Before joining UNB, Rajesh was with Standard Chartered Bank for more than 18 years where he performed various roles, including Chief Financial Officer, UAE. His last role in Standard Chartered Bank was as the Global Head of Finance Transformation for financial reporting based in Singapore. Rajesh completed his ICWA in India and holds a Postgraduate Diploma in Management (Finance) from Symbiosis Centre for Management and HRD, India.

8. Nada Shadid

(Head of Treasury)

Nada Mohamed Shadid is the Head of Treasury at Al Hilal Bank. She is responsible for the management of liquidity, gaps, and regulatory ratios, as well as money markets funding, foreign exchange and Sukuk investment portfolios of the Bank. Nada joined the Bank in 2019 and has 10 years of experience in Treasury and Investments. Previously, Nada held significant Treasury positions in ADCB, where she was responsible for running the short-term investments portfolio, as well as generating liabilities from strategically important clients and markets. Nada holds a bachelor’s degree in International Management from Franklin University in Lugano, Switzerland.

9. Zsombor Brommer

(Chief Compliance Officer)

Zsombor Brommer is the Chief Compliance Officer at Al Hilal Bank. With more than 20 years of experience in global banking as a compliance and digital risk management professional, Zsombor is responsible for overseeing and managing regulatory compliance, money-laundering, terrorism financing, and sanctions compliance risks within the organisation. He ensures the Bank meets applicable regulations and policies, leading compliance activities in line with its strategy. Before joining the Bank, Zsombor served as Group Senior Compliance Manager in HSBC. Previously he worked as Head of Compliance in Citibank Hungary and had compliance responsibilities as EMEA Regional Commercial Banking Compliance Officer. He was also Chairman of the Hungarian Banking Association AML Working Group. Zsombor holds bachelor’s degrees both in Economics and Communication from Kodolanyi Janos University, Hungary.

10. Hussam Abu Aisheh

(Senior Managing Director — Internal Audit)

Hussam Abu Aisheh is the Senior Managing Director — Internal Audit at Al Hilal Bank. With more than 25 years of experience in the fields of internal and statutory audit, Hussam is responsible for leading and managing internal audit activities in the Bank. He reports to the Board Audit and Compliance Committee and has managed the internal audit function at Bank since 2012. Prior to joining the Bank, he headed the Internal Audit Function at Sharjah Islamic Bank for nine years. Previously, he managed a diversified portfolio of statutory audit clients and worked on forensic engagements for KPMG UAE. Hussam started his professional career with Arthur Andersen, Jordan office and holds a bachelor’s degree in Accountancy. He is a Certified Internal Auditor and a Certified Information Systems Auditor.

| name | Chairman/Member | Attendance |

|---|---|---|

| Ala’a Eraiqat | C | 6 |

| Siddiqa Abbas | M | 3 |

| Saoud Al Jassem | M | 6 |

| Mohamed Al Jayyash | M | 6 |

| Kevin Taylor | M | 6 |

| Arup Mukhopadhyay | M | 6 |

| Deepak Khullar | M | 5 |

BOARD COMPOSITION AND REMUNERATION

Following ADCB’s acquisition of the entire share of capital of Al Hilal Bank, a new Board of Directors was appointed in May 2019. ADCB employees who are also appointees to the Group subsidiaries’ boards do not receive board remuneration for such roles. The Board of Al Hilal Bank entirely comprises senior executives of ADCB who collectively have diverse skills and experience, including in retail banking, treasury, risk, finance, operations and customer service.

In 2019, the newly appointed board met six times. The table above shows the Board’s attendance.

THE BOARD’S AGENDA IN 2019

The Board of Directors regularly discusses various items that are fundamental to the direction of the Bank, including business performance, strategy, risk appetite and management, compliance, and human resources. Details of the agenda items discussed by the Board during 2019 are set out on pages 122–124.

OVERVIEW OF THE GOVERNANCE FRAMEWORK

Following its acquisition by ADCB in 2019, Al Hilal Bank operates as a separate Islamic bank wholly-owned by ADCB. This unique corporate structure presents Al Hilal Bank with various opportunities to benefit from the policies and business support of its parent, ADCB Group.

Al Hilal Bank’s strategy is to focus on digital retail business. To build on this strategy, its corporate book was transferred to ADCB Group, with the consent of the UAE Central Bank, in 2019. This transfer significantly reduced the complexity of the Bank’s business operations, and has also provided opportunities for Al Hilal Bank to operate under a streamlined governance structure.

BOARD’S OVERSIGHT OF RISK AND COMPLIANCE

Al Hilal Bank’s Board of Directors is responsible for setting the Bank’s risk appetite and risk management framework. The Board regularly monitors the risks inherent in Al Hilal Bank’s businesses including credit, market, liquidity, regulatory, reputational, strategic and operational risks. The risk management framework is periodically reviewed and updated to reflect changes in Al Hilal Bank’s strategy, economic environment and regulatory changes. During 2019, the Board reviewed and amended compliance policies and oversaw an update of the Bank’s fraud risk management system to further enhance its risk management and compliance frameworks. Another important area of focus was cybersecurity. The Bank successfully completed a cyber-resilience and compromise assessment and executed a privilege access management system update.

| Area | Agenda Item |

|---|---|

| Governance / Audit / Strategy |

|

| Financial performance |

|

| Group Chief Executive Officer / Business updates |

|

| HR related / Remuneration / Nomination |

|

| Risk and Compliance |

|

2019 SHARI’AH REPORT

The Fatwa and Shari’ah Supervisory Board (FSSB), supported by the Shari’ah Supervision Department, is responsible for ensuring that all of Al Hilal Bank’s products and services comply with Shari’ah principles.

Annual Report of the Internal Shari’ah Supervision Committee of Al Hilal Bank

Issued on: Thursday, 5th Jumada Al Akhirah 1441 AH, corresponding to 30th Jan 2020

To: Shareholders of Al Hilal Bank (“the Bank”)

After greetings,

Pursuant to the requirements stipulated in the relevant laws, regulations and standards (“Regulatory Requirements”), the Internal Shari’ah Supervision Committee of the bank (“ISSC”) presents to you its Annual Report for the financial year ending on 31 December 2019 (“Financial Year”).

-

Responsibility of the ISSC

In accordance with the Regulatory Requirements and the ISSC’s charter, the ISSC’s responsibility is stipulated as to:

undertake Shari’ah supervision of all businesses, activities, products, services, contracts, documents and business charters of the Bank; and the Bank’s policies, accounting standards, operations and activities in general, memorandum of association, charter, financial statements, allocation of expenditures and costs, and distribution of profits between holders of investment accounts and shareholders (“Bank’s Activities”) and issue Shari’ah resolutions in this regard, and to determine Shari’ah parameters necessary for the Bank’s Activities, and the Bank’s compliance with Islamic Shari’ah within the framework of the rules, principles, and standards set by the Higher Shari’ah Authority (“HSA”) to ascertain compliance of the Bank with Islamic Shari’ah.

The senior management is responsible for compliance of the Bank with Islamic Shari’ah in accordance with the HSA’s resolutions, fatwas, and opinions, and the ISSC’s resolutions within the framework of the rules, principles, and standards set by the HSA (“Compliance with Islamic Shari’ah”) regarding the Bank’s Activities, and the Board bears the ultimate responsibility in this regard. -

Shari’ah Standards

In accordance with the HSA‘s resolution (No. 18/3/2018), and with effect from 01/09/2018, the ISSC has abided by the Shari’ah standards issued by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) as minimum Shari’ah requirements, in all fatwas, approvals, endorsements and recommendations, relating to the Bank’s Activities without exception. -

Works Undertaken by the ISSC During the Financial Year

The ISSC undertook Shari’ah supervision of the Bank’s Activities through review of those Activities, and monitoring through internal Shari’ah supervision department and internal Shari’ah audit in accordance with the ISSC’s authorities and responsibilities, and pursuant to the Regulatory Requirements in this regard. Works of the ISSC included the following:- Convening eight meetings during the financial year.

- Providing fatwas, opinions and resolutions on matters presented to the ISSC in relation to the Bank’s Activities.

- Monitoring compliance of policies, procedures, accounting standards, product structures, contracts, documentation, business charters, and other documentation submitted by the Bank and its subsidiaries to the ISSC for approval.

- Ascertaining the level of compliance of allocation of expenditures and costs, and distribution of profits between holders of investment accounts and shareholders with parameters set by the ISSC.

- Supervision through internal Shari’ah supervision department and internal Shari’ah Audit of the Bank’s Activities including executed transactions, adopted procedures on the basis of samples selected from executed transactions, and reviewing reports submitted in this regard.

- Providing direction to relevant parties of the Bank and its subsidiaries to rectify (where possible) findings cited in the reports submitted by internal Shari’ah supervision department and internal Shari’ah audit, and issuance of resolutions to set aside revenue derived from transactions in which non-compliance were identified to be disposed towards charitable purposes.

- Approving remedial rectification and preventive measures related to identified errors to prevent their reoccurrence in the future.

- Specifying the amount of Zakat due on each of the Bank’s shares.

- Specifying the amount of Zakat due on the depositor’s reserves.

- Monitoring charity account sources and payments.

- Communicating with the Board, and the senior management of the Bank concerning compliance of the Bank with Islamic Shari’ah.

-

Independence of the ISSC

The ISSC acknowledges that it has carried out all of its duties independently and with the support and cooperation of the senior management and the Board of the Bank. The ISSC received the required assistance to access all documents and data, and to discuss all amendments and Shari’ah requirements. -

The ISSC’s Opinion on the Shari’ah Compliance Status of the Bank

Premised on information and explanations that were provided to us with the aim of ascertaining compliance with Islamic Shari’ah, the ISSC has concluded with a reasonable level of confidence, that the Bank’s Activities are in compliance with Islamic Shari’ah, except for the incidents of non-compliance observed, as highlighted in the relevant reports, including ten breaches that did not result in setting aside revenue. The ISSC also issued directions to take appropriate measures in this regard.

The ISSC formed its opinion, as outlined above, exclusively on the basis of information perused by the ISSC during the financial year.

Signatures of members of the Internal Shari‘ah Supervision Committee

Dr. Ibrahim Ali Al Mansoori

Chairman

Dr. Ali Husain Al Junaidi

Member

Dr. Salim Ali Al Ali

Member

Statement from the Chairlady

Dear Shareholders,

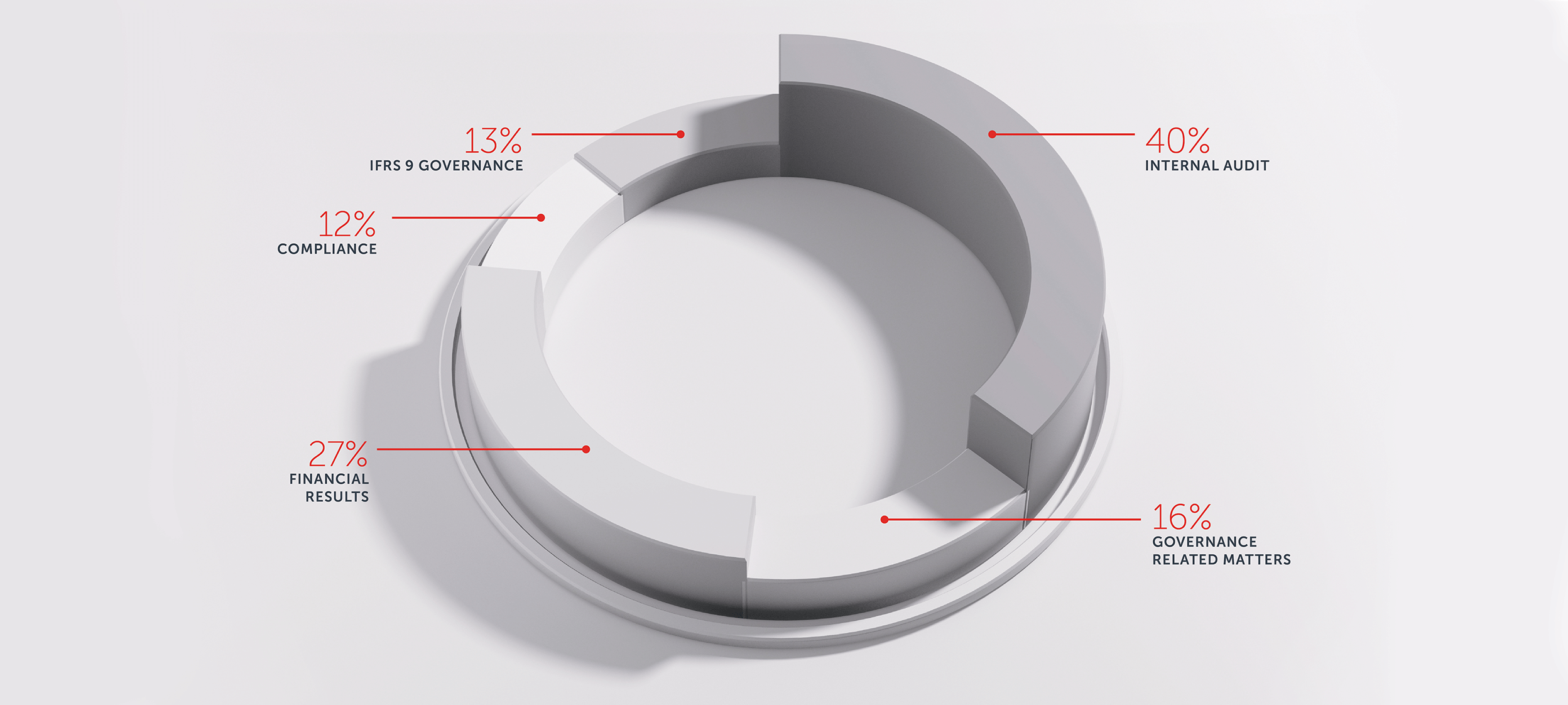

During 2019, the Audit & Compliance Committee held nine meetings, during which the Committee:

- Assessed the objectivity and effectiveness of the Bank’s financial reporting and disclosure process. This included monitoring of the Bank’s choice of accounting policies, principles and judgements;

- Reviewed and discussed the Bank’s IFRS 9 governance process, models, and implications for the Bank’s financial statements (before and after the merger with UNB) and ensured the Bank’s compliance with UAE Central Bank’s regulations relating to IFRS 9;

- Evaluated the external auditors’ qualifications, performance, independence and objectivity, reviewed the scope of work proposed by the external auditors for 2019, and exercised oversight of all non-audit work carried out by the external audit firm;

- Considered purchase price adjustments recommended by management following the merger with UNB and acquisition of Al Hilal Bank;

- Considered the performance, effectiveness and activities of the Bank’s Internal Audit function (and separately, the performance of the Head of Internal Audit) and reviewed updates to its audit plan, staffing plan, training plan, charter, manual, and strategy taking note of the new UAE Central Bank’s regulations on Internal Control, Compliance & Internal Audit;

- Oversaw the activities and assessed the performance of the Bank’s Group Compliance function and considered updates to relevant policies (including the Bank’s Group Compliance Policy) to ensure the robustness of the Bank’s compliance framework taking into account the new UAE Central Bank Corporate Governance regulations;

- Received regulatory, conduct compliance, fraud and operational risk management updates;

- Reviewed the effectiveness of the Bank’s internal controls framework and ensured the existence of an effective system of internal controls taking note of the new UAE Central Bank regulations on Internal Control, Compliance & Internal Audit;

- Reviewed the Bank’s quarterly and annual audited financial statements;

- Reviewed and ensured appropriate action against audit and review observations raised by the internal and external auditors, the UAE Central Bank, the Abu Dhabi Accountability Authority and other regulators;

- Reviewed the Committee’s terms of reference and the policies sponsored by the Committee, and ensured that new regulations were reflected in those terms of reference and policies, as appropriate;

- Received and considered Internal Audit’s report for 2018;

- Received and considered an external and independent quality assurance and assessment of the Bank’s Internal Audit function;

- Received detailed reports on certain non-performing loans and business segments and recommended suitable provisioning for those loans;

- Reviewed quarterly reports on the Directors’ shareholdings in the Bank’s shares; and

- Reported regularly to the Bank’s Board of Directors.

During 2019, the Committee continued to assess the Bank’s implementation of IFRS 9. The Committee regularly met with the Bank’s management and external auditors to ensure that the Bank’s models, methodologies, critical accounting judgements, and financial disclosures remained in compliance with IFRS 9 requirements, and to ensure that any subjective judgments had been made appropriately. We also considered the suitability of purchase price adjustments following the Bank’s merger with UNB and acquisition of Al Hilal Bank.

The Bank’s external auditor was due to be rotated in 2019. However, due to the complex accounting adjustments required by the merger, the Committee recommended that Deloitte continue as the Bank’s external auditor for the 2019 year. A new firm will be appointed for the 2020 financial year.

The Committee regularly met with the external and internal auditors without the presence of the Bank’s management to discuss issues arising. In addition, Committee members attended meetings of the Risk & Credit Committee to ensure an adequate flow of information between the two Committees.

We received confirmation from the Bank’s Internal Audit Group and external auditors that the Bank’s internal controls were assessed for effectiveness. The Committee ensured that the Bank’s internal audit plan in 2019 focused on providing assurance that, following the merger, the expanded Group’s internal controls remain robust.

The Committee considers that it made positive progress during 2019 towards meeting its responsibilities.

LOOKING INTO 2020

Our schedule in 2020 contemplates nine meetings focused on a range of key issues. These include the integrity of the Bank’s financial statements, the Bank’s provisioning and ECL models (and their appropriateness following the merger), merger-related purchase price adjustments, assessment and oversight of the Group’s Internal Audit and Compliance functions’ activities and performance, and the performance of the Bank’s External auditors.

We will also oversee the adoption and implementation of new UAE Central Bank regulations and continue to work with management and external auditors to assess the effectiveness of the Bank’s IFRS 9-related policies, governance practices, models and controls — including oversight of staging of key accounts and overrides.

The Committee will continue to coordinate its activities with those of the Board Risk & Credit Committee to ensure a free-flow of information between the two Committees. We will recommend a new external auditor for the Board’s and the shareholders’ approval, in line with local and international best practices and regulatory requirements concerning external auditor rotation.

Finally, we will also continue to ensure that the Bank’s internal audit team continues to review the controls of the enlarged Group following the merger.

Aysha Al Hallami

Chairlady of the Board’s

Audit & Compliance Committee

Composition as at 31 December 2019:

Aysha Al Hallami (Chairlady), Khalid Deemas Alsuwaidi, Carlos Obeid, Abdulla Khalil Almutawa

Secretary: Rami Raslan

OUR REMIT

The primary responsibilities and functions of the Audit & Compliance Committee are to help the Board to fulfil its duties to ensure and oversee:

- The integrity of the Bank’s financial statements;

- The qualifications, independence, performance and remuneration of the Bank’s external auditors;

- The qualifications, independence and performance of the Bank’s internal audit department;

- The Bank’s compliance with legal and regulatory requirements, and the Bank’s internal policies; and

- The Bank’s internal controls, including controls over financial reporting and disclosure.

Statement from the Chairman

Dear Shareholders,

During 2019, the Nomination, Compensation & HR Committee merged with the Corporate Governance Committee to form the Nomination, Compensation, HR and Governance Committee. The Committee focuses on the Bank’s Human Resources and remuneration strategies, the Board’s composition and diversity, various governance and compliance matters, and — following the Bank’s merger with Union National Bank (UNB) and its acquisition of Al Hilal Bank (AHB) — post-merger integration matters.

The Committee met six times during 2019 and we:

- Received regular updates from the Bank’s Human Resources team;

- Considered an internal and external assessment of the Bank’s culture and values;

- Considered a gap analysis of the Bank’s compliance with newly released corporate governance regulations issued by the UAE Central Bank;

- Assessed the Board’s selection, appointment and induction processes;

- Reviewed the Board’s composition, including its diversity and mix of skills, in relation to the UAE Central Bank’s regulations on corporate governance;

- Evaluated the Directors’ remuneration and fees;

- Evaluated the Directors’ contributions over the year;

- Assessed Board members’ independence status as per the UAE Central Bank’s regulations on corporate governance and considered institutional investors’ views about the independence of the Bank’s Board members;

- Considered the performance evaluation, key performance indicators, and remuneration of the Bank’s Group Chief Executive Officer;

- Reviewed and supervised the operation of the Bank’s remuneration framework including its fixed and variable pay schemes, retention awards and performance recognition;

- Considered the Bank’s remuneration plans and assessed the effectiveness of the Bank’s remuneration strategy following the merger;

- Approved the compensation of Senior Management;

- Reviewed the framework for, and operation of, the Bank’s incentive, commission and share schemes and considered a risk assessment of these schemes;

- Considered the Bank’s disclosure and transparency practices in relation to the UAE Central Bank’s regulations on corporate governance;

- Managed the Bank’s long-term succession strategy, assessed succession plans for key executives, and focused on talent management;

- Remained focused on the Bank’s Emiratisation strategy and emerging UAE National talent. In particular, the Committee ensured that the Bank exceeded the target set by the Central Bank in this regard for the year 2019;

- Considered and assessed the contributions of the Board Adviser to the Board’s activities;

- Engaged the Bank’s divisions and various businesses on the governance framework and provided guidance on enhancing governance practices;

- Assessed the Bank’s risk governance framework against the UAE Central Bank’s regulations on corporate governance and Basel guidelines;

- Ensured the publishing of corporate governance information, including information included in the Bank’s Annual Report and on the Bank’s website;

- Ensured adequate corporate governance disclosures were made across various disclosure channels;

- Reviewed and considered enhancements and best practices in corporate governance and made recommendations to the Board and Board Committees on governance matters;

- Assessed the Bank’s governance against the UAE Bank’s Federation (UBF) governance risk rating criteria;

- Reviewed the Bank’s key Human Resources and Corporate Governance policies and processes including, amongst others, the Bank’s ethics and compliance policy, privacy and data security policy and sustainability policy.

During 2019, the Bank’s remuneration schemes, and Emiratisation strategy remained key focus areas for the Committee.

We continued to develop KPIs to assess the effectiveness of the Bank’s variable remuneration schemes and noted that these schemes continue to deliver the desired objectives. We also considered the post-merger alignment of the Bank’s remuneration framework with those of UNB and AHB. We continue to believe that the Bank’s remuneration policies remain appropriate for the Bank’s current size and status and that its remuneration framework is in line with international best practices. In addition, in accordance with best practices and the requirements of the UAE Central Bank’s regulations on corporate governance, the Nomination, Compensation, HR & Governance Committee will seek an independent review of the design and effectiveness of the Bank’s variable pay framework early in 2020.

The Committee also continued to prioritise UAE National development, focusing on the recruitment, retention and training of talented UAE National staff. With regard to corporate governance, the Committee continued to monitor international best practices for governance and benchmark the Bank against these. We considered a gap analysis of the Bank’s compliance with the UAE Central Bank’s regulations on corporate governance, and were pleased to note that the Bank has already implemented into its corporate governance framework many of the UAE Central Bank’s regulations on corporate governance. We also considered compliance plans submitted to the Central Bank to further implement the UAE Central Bank’s regulations on corporate governance.

Finally, the Committee reviewed the overall culture of the Bank. The Committee was pleased to note that based on a survey conducted by external consultants, the Bank ranks in the top decile globally for organisational health.

The Committee considers that it made positive progress during 2019 towards meeting its responsibilities.

LOOKING INTO 2020

In 2020 we will continue to focus on the Bank’s Emiratisation strategy and HR activities. We will also review the Bank’s culture, and oversee efforts to ensure that culture is fully integrated following the merger. We will also focus on succession planning, particularly at a senior level, as well as talent acquisition and staff training.

During 2020, following the enlargement of the Group in 2019, we will also focus on subsidiary governance, with the aim of ensuring that a framework is in place which is suitable for the enlarged Group.

The Committee will continue to consider Board Committees’ memberships, the design of incentive and compensation schemes, and the Bank’s diversity policies. It will engage an independent review of the Bank’s remuneration framework in accordance with the UAE Central Bank’s regulations on corporate governance and will ensure that the Bank’s governance policies and processes are brought into full compliance with those regulations.

Mohamed Dhaen Mahasoon Alhamli

Chairman of the Board’s Nomination, Compensation &

HR Committee

Composition as at 31 December 2019:

Mohamed Dhaen Mahasoon Alhamli (Chairman), Eissa Mohamed Alsuwaidi, Mohamed Hamad Ghanem Almehairi, Saeed Mohamed Hamad Almazrouei, Hussain Jasim Naser Alnowais

Secretary: Rami Raslan

OUR REMIT

The Nomination, Compensation, HR and Governance Committee is responsible for:

- Ensuring the appropriate composition and skillset of the Board and the Board Committees

- Ensuring the appropriate diversity of the Board of Directors

- Ensuring Independent Directors remain independent on a continuous basis

- Selecting and appointing Directors

- Orienting and training new and existing Directors

- Planning the succession of Board members and Senior Management

- Selecting and appointing Senior Management

- Assessing the performance of the Board, individual Directors and Senior Management and overseeing implementation of recommendations arising from the performance review

- Developing, applying and reviewing human resources and training policies

- Developing and overseeing implementation of the Group’s HR strategy (including Emiratisation)

- Determining ADCB’s requirements for executive managers and employees

- Considering remuneration policies for management and the Board, and the Bank’s remuneration and incentive plans

- Reporting publicly on ADCB’s remuneration and governance matters

- Implementing ADCB’s governance framework and ensuring it is maintained and complies with applicable governance regulations

- Operating a framework that addresses conflict of interest and related parties transactions

- Establishing and monitoring the Bank’s corporate culture and values, including its risk culture

- Establishing the Bank’s corporate sustainability strategy

- Ensuring compliance with regulatory requirements relating to corporate governance and the Bank’s Code of Corporate Governance

- Developing corporate governance procedures and best practices within the Bank

Statement from the Chairman

Dear Shareholders,

During 2019, the Risk & Credit Committee held seven meetings focused on risk and 23 meetings focused on credit, during which the Committee:

- Assisted the Board in defining the Bank’s risk appetite and risk strategy and ensured that the Bank’s risk exposures conform to the risk appetite approved by the Board;

- Considered risks assumed as a result of the merger with UNB and acquisition of Al Hilal Bank and how to align these with the Bank’s risk appetite;

- Reviewed the Bank’s key risk limits and exposures (including combined limits and exposures resulting from the merger with UNB and acquisition of Al Hilal Bank) including liquidity, credit, market, and operational risk limits and exposures, and ensured that these were managed within the Bank’s risk framework and in compliance with UAE Central Bank’s regulations;

- Considered the Bank’s concentrations and sectoral credit exposures, and ensured that the Bank’s overall concentration and sectoral credit exposures were in line with UAE Central Bank’s regulations;

- Reviewed the effectiveness of the Bank’s market risk framework and related policies, including the Bank’s interest rate risk in banking book (IRRBB) policy;

- Reviewed the Bank’s Investment and Liquidity portfolio;

- Reviewed the Bank’s Operational Risk framework and associated policies;

- Received an update on fraud committed against the Bank and associated policies;

- Reviewed management decisions on credit exposures;

- Received and considered updates from the Bank’s Chief Credit Officer on the Bank’s credit exposures;

- Reviewed and discussed the Bank’s IFRS 9 governance policies and processes (before and following the merger with UNB and acquisition of Al Hilal Bank) to ensure that these remain prudent and in line with the UAE Central Bank’s requirements and to ensure that any subjective judgments are made appropriately;

- Reviewed the Bank’s IT, physical security and cyber risks and ensured that the Bank had implemented a proactive approach towards managing these risks;

- Kept abreast of UAE’s micro and macro-economic developments and analysed related geographic and geopolitical risks;

- Monitored the effectiveness of the Bank’s risk management functions;

- Reviewed the Bank’s vendor management practices;

- Considered the outcome of stress tests and reverse stress tests conducted on various key portfolios both before and after the merger with UNB and acquisition of Al Hilal Bank, and ensured that the outcomes of such tests were reflected in the Bank’s risk appetite, capital adequacy assessments, budgets and capital and liquidity plans. The Committee also considered the UAE Central Bank’s feedback on the Bank’s stress testing methodology;

- Considered the Bank’s enterprise-wide liquidity stress testing results;

- Reviewed the Bank’s business continuity plan and received an independent third party assessment on its adequacy; and

- Approved and oversaw the implementation or updating of key policies, including, but not limited to, the internal capital adequacy assessment policy (ICAAP) and operational risk policy, whilst ensuring that new regulations were reflected as appropriate.

During 2019, the Committee continued to focus on the Bank’s adherence to its risk appetite and strategy. In particular, the Committee reviewed the Bank’s risk appetite metrics in light of changing market conditions, regulatory requirements and the nature, size and complexity of the Group after the merger.

We regularly received updates on business sectors (including hospitality, real estate, construction and retail) and the Bank’s portfolios (including retail, commercial, mid-corporate and financial institutions) to maintain awareness of the business environment.

Along with the Board’s Audit and Compliance Committee, we oversaw the Bank’s ongoing application of IFRS 9. In particular, we assessed the Bank’s IFRS 9 expected credit loss (ECL) estimates and the reporting process and staging of its most significant accounts before and after the merger to ensure adherence to the Bank’s IFRS 9 models.

The Committee also continued to focus on ensuring that the UAE Central Bank’s requirements on stress testing were met. In collaboration with the Bank’s management, we ensured that the Bank’s stress testing methodologies and models were reviewed and remained adequate following the merger.

The Committee considers that it made positive progress during 2019 towards meeting its responsibilities.

LOOKING INTO 2020

Our schedule in 2020 contemplates seven meetings focused on the Bank’s risk strategy, appetite, and stress testing. Separately, the Committee will continue to meet to consider high value or sensitive credit decisions.

In compliance with recent UAE Central Bank’s regulations on corporate governance, the Committee will assess the performance of the Bank’s compliance function together with the Board Audit and Compliance Committee. We will also continue to ensure that effective communication between the two committees is facilitated to manage risk.

We will continue to assess the effectiveness and suitability of the Bank’s IFRS 9 policies and governance. We will also continue to dynamically review the appropriateness of the Bank’s risk strategy and limits, considering the nature, size, and complexity of the Group’s business following the merger. Finally, we will bring all of the Bank’s risk governance policies, procedures, practices and documents into a centralised Group-wide risk governance framework.

Eissa Mohamed AlSuwaidi

Chairman of the Board’s Risk &

Credit Committee

Composition as at 31 December 2019:

Eissa Mohamed Alsuwaidi (Chairman), Khaled H. Alkhoori, Aysha Al Hallami, Saeed Mohamed Hamad Almazrouei, Carlos Obeid

Secretary: Rami Raslan

OUR REMIT

The Risk & Credit Committee is responsible for:

- Development of risk management tools;

- Development and implementation of risk management strategies and limits, and the Bank’s risk appetite;

- Compliance with regulatory requirements relating to risk management;

- Public reporting on risk management matters; and

- Major credit commitments of the Bank.

GOVERNANCE DOCUMENTS AVAILABLE ON OUR WEBSITE

- Articles of Association

- Code of Corporate Governance

- Codes of Conduct for our employees and our Directors

- External Auditor’s Appointment Policy

- Board Performance Evaluation Policy

- Procedures for selecting and appointing the Bank’s Directors

- Conflicts of Interest Policy for Directors

- Directors’ Share Dealing Policy

- Committee terms of reference

OUR WEBSITE ALSO CONTAINS INFORMATION ABOUT THE FOLLOWING SUBJECTS:

- Our disclosure standards, communications with shareholders, and investor relations

- Our strategy-setting process

- The structure and composition of our Board

- Board oversight of risk management

- Our process for inducting new Directors and ensuring the professional development of all Board Members

- Matters reserved for the Board

- How we ensure Board Members are updated about important developments