ADCB Group Future Ready

The future belongs to those who prepare for it

In 2019, we successfully completed a landmark merger with Union National Bank (UNB) and acquired Al Hilal Bank (AHB). We set new records for the pace of integration, accelerated digital transformation and established new partnerships. We enhanced customer experience and delivered strong returns for our stakeholders. As a result, the enlarged ADCB Group has greater scale and resilience, ensuring we are ready for the future and the opportunities it brings. Today we are prepared for what is next, so tomorrow we can make ambition possible.

Delivering Customer Day One without disruption

In October 2019, just five months after the merger became legally effective, we combined the ADCB and UNB branch and ATM networks and activated branch interoperability. This meant that any customer, whether ADCB or former UNB, could access the combined network of 72 branches and over 450 ATMs across the UAE. We also rolled out the ADCB brand across all customer channels, ensuring a unified and enhanced banking experience for our customers.

This milestone was achieved seamlessly and ahead of schedule through meticulous planning and our passion for excellence.

But no matter how much activity there was behind the scenes, we made sure it was business as usual for more than one million customers.

Learn more

ATMs

Branches

Customers

Today we are a simpler, faster and more secure bank, thanks to our investment in cutting‑edge technology

By launching new, innovative products and services we have transformed the way customers interact with us, enriching their experience and empowering their ambitions. This year, as part of many digital enhancements across the Group, we launched Hayyak and Ahlan, our account-opening apps, introduced a Virtual Accounts service for corporate customers, and facilitated a multi-million-dollar blockchain transaction. Meanwhile, our partnerships with leading fintechs ensured we continued to stay ahead of the game.

Learn more

Of retail financial transactions completed digitally

Digital customer releases

To open an account in HAYYAK

Our focus on the UAE and its people will help promote a stronger and more financially diverse economy

To create a talent pipeline for the future, we actively support young Emiratis through education and experiential programmes to help prepare them for the world of tomorrow. Emiratis are already a driving force at every level of the Bank. As at 31 December 2019, the Group employed 1,479 UAE Nationals, whilst Al Hilal Bank’s Emiratisation rate stood at 48%, the highest in the banking sector. The Bank has consistently exceeded the Emiratisation targets set by the regulators.

Learn more

Emirati employees in ADCB Group

Emiratisation rate at Al Hilal Bank

Our integration milestones

Our integration journey in numbers

AED

Cost synergy annual target to be achieved by 2021, up from a previous target of AED 615 million

AED

Cost synergies realised in 2019

AED

Expected one-off integration cost

Recommended

ADCB Group at a glance

An acknowledged leader in the UAE banking sector, ADCB creates value through a range of products and services that support more than a million customers.

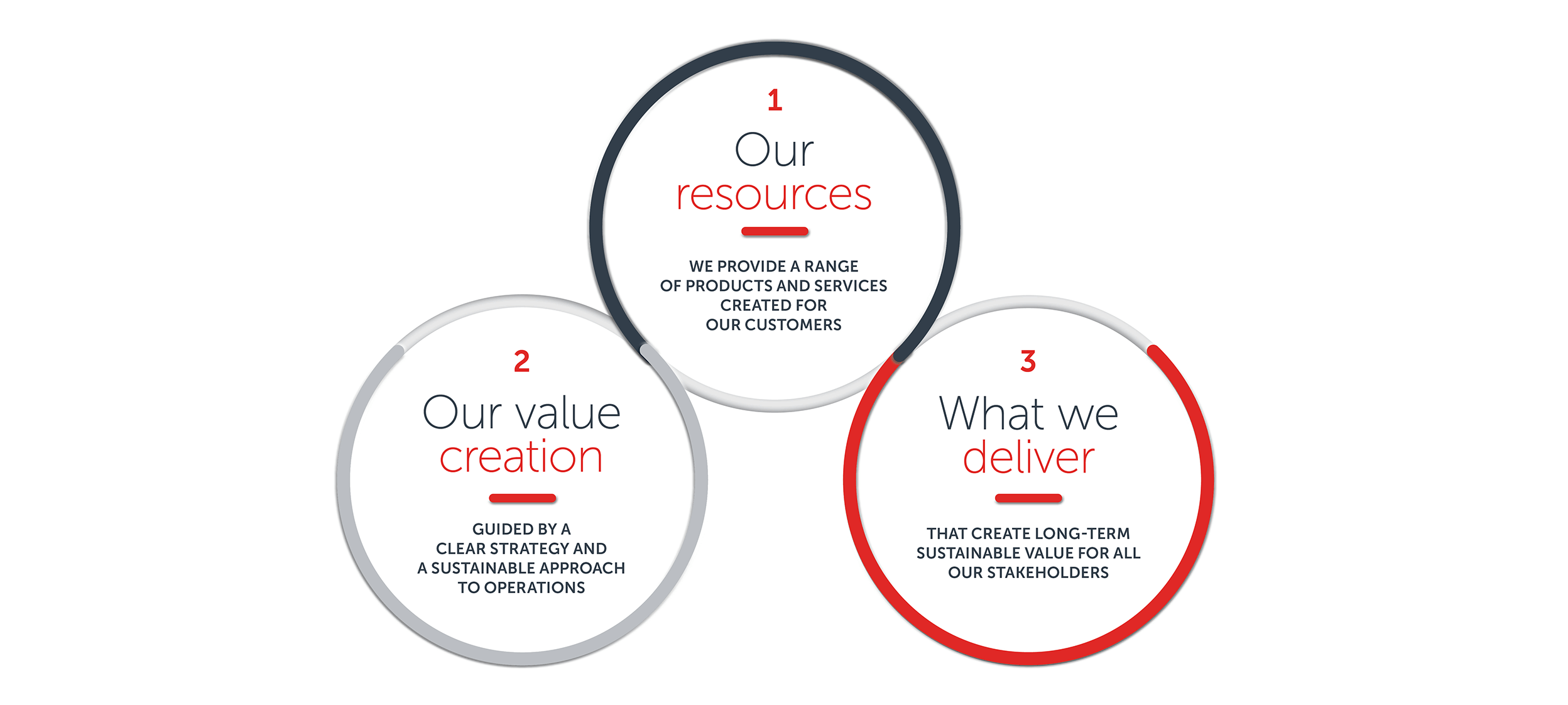

Business Model

Our longstanding and successful business model is designed to capture the opportunities that allow us to create sustainable value for all stakeholders.