Performance Financial Overview

Our positive performance throughout 2018 demonstrates the effectiveness of our strategy and the enduring strength and resilience of the Bank. Despite a challenging economic environment, our underlying performance and fundamentals remain strong as we continue in our mission to deliver sustainable growth and long-term value for shareholders.

The figures and charts that feature in the following pages provide a more detailed insight into our financial performance this year. They reflect our financial discipline and the prudent approach to risk management that forms a key pillar of the Bank’s strategy.

Comparisons in this section are calculated for the year ended 31 December 2018 (“2018”) versus the year ended 31 December 2017 (“2017”), unless otherwise specified.

2018 Financial Highlights

ROBUST PERFORMANCE, SUPPORTED BY RECORD OPERATING INCOME, OPTIMAL MANAGEMENT OF COST OF FUNDS AND LOWER IMPAIRMENT CHARGES

The Bank reported a net profit of AED 4.840 billion for the year, an increase of 13% year on year, supported by a healthy expansion in NIMs driven by optimal management of cost of funds, combined with lower impairment charges. On a quarterly basis, record net profit of AED 1.357 billion was up 18% over the previous quarter and 27% over the previous year. The Bank’s key financial indicators remain strong with a return on average equity of 16.3% and a return on average assets of 1.71% in 2018 compared to 15.0% and 1.58%, respectively in 2017.

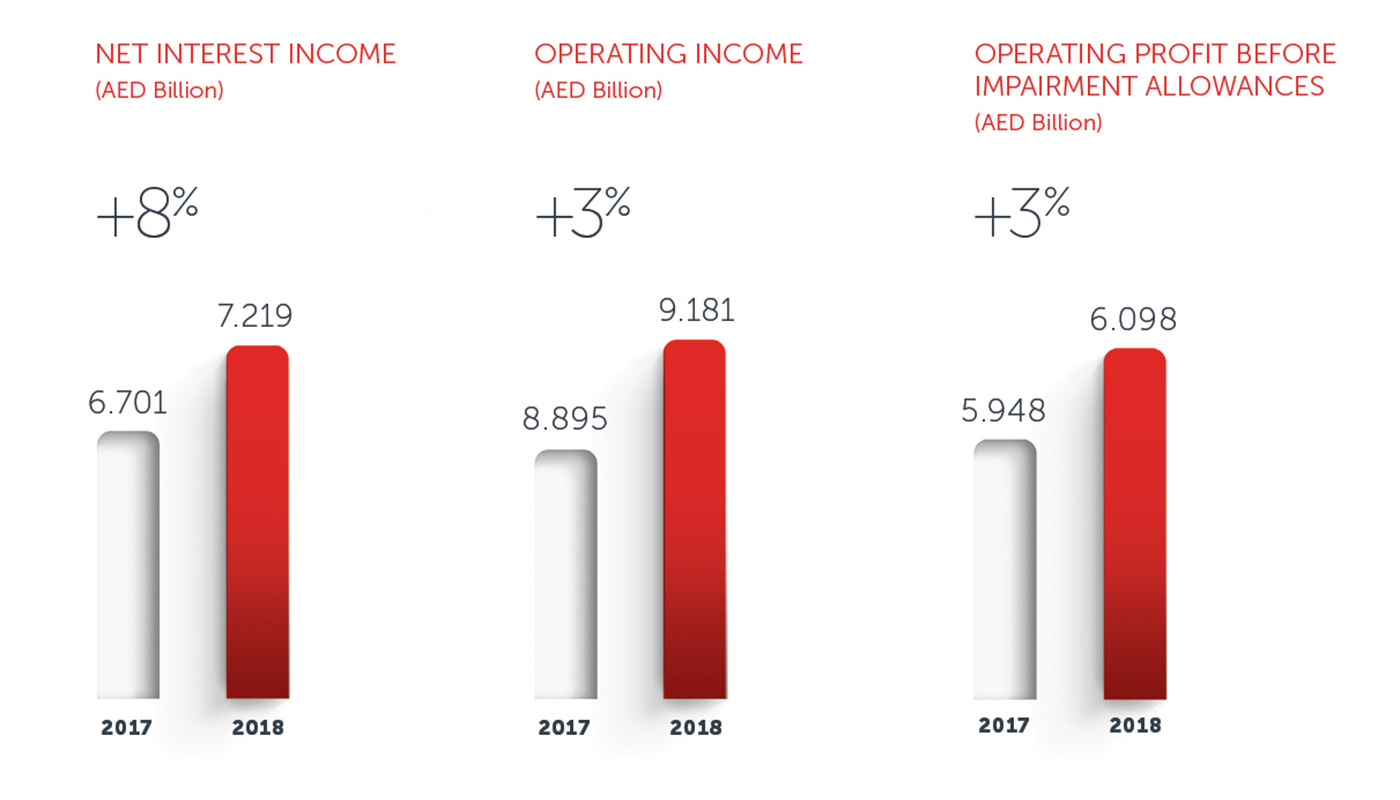

Total operating income was AED 9.181 billion, up 3% and operating profit before impairment allowances of AED 6.098 billion was up 3% over 2017, reflecting the Bank’s strong fundamentals and resilient financial performance in 2018. Each business segment contributed to the strong underlying performance of the Bank. The Consumer and Wholesale Banking groups comprised 43% and 33% of total operating income respectively. Treasury and Property Management contributed 22% and 2% to total operating income respectively.

STRONG TOP LINE GROWTH

The Bank reported strong top line growth, with a net interest and Islamic financing income of AED 7.219 billion for 2018, an increase of 8% year on year, and net interest and Islamic financing income of AED 1.803 billion for Q4’18, an increase of 5% over Q4’17. Net interest margin for 2018 improved to 3.04% from 2.91% in 2017, an increase of 14 basis points, despite the increased cost of carrying high quality liquid assets (HQLA) to meet LCR and recently introduced NSFR regulations.

Gross interest and Islamic financing income of AED 11.592 billion was up 18% over 2017, driven by higher volumes and benchmark rates, coupled with a change in the composition of the asset book towards higher yielding assets. Yield on interest earning assets increased by 60 basis points to 4.88% in 2018, supported by the repricing of assets.

Cost of funds increased to 1.98% in 2018 from 1.48% in 2017, an increase of 50 basis points year on year, compared to an increase of 91 basis points in average 3M Eibor and a 104 basis points increase in 3M Libor over the same period. Increase in cost of funds (in line with rising benchmark rates) along with higher interest bearing liabilities of 3% resulted in an interest expense of AED 4.373 billion, up 39% year on year.

NON-INTEREST INCOME IMPACTED BY WEAKER FEES & COMMISSION INCOME PARTIALLY OFFSET BY HIGHER TRADING GAINS

Non-interest income of AED 1.962 billion was down 11% and accounted for 21% of operating income in 2018 compared to 25% in 2017. The reduction is mainly on account of higher fee and commission related expenses and lower volumes. This was partially offset by a healthy pick up in card related fees, income from the merchant acquiring business and income from trade finance commission. Gross fees and commission income of AED 2.090 billion was up 1%. Trading income of AED 432 million was up 22%, primarily due to higher net gains from dealing in foreign currencies and derivatives of AED 32 million and AED 27 million respectively. The decrease in other operating income was primarily due to one-off gains recorded in 2017 and lower income from the property management business in 2018. Net losses from revaluation of investment properties were AED 56 million compared to AED 34 million in 2017, due to decline in property and rental prices.

COMMITTED TO IMPROVE EFFICIENCY, COST TO INCOME RATIO REMAINS COMFORTABLY WITHIN OUR TARGET RANGE

Operating expenses for 2018 were AED 3.084 billion, up 5% over the prior year. Staff expenses were up 8% at AED 1.838 billion, as the Bank continued to invest in recruiting and retaining top talent to further enhance business capabilities and support growth, as well as investing in significant resources to excel in customer service, operational excellence and digital transformation. General and administrative expenses were at par with prior year. Cost to income ratio of 33.6% remained within our target range.

IMPROVED COST OF RISK

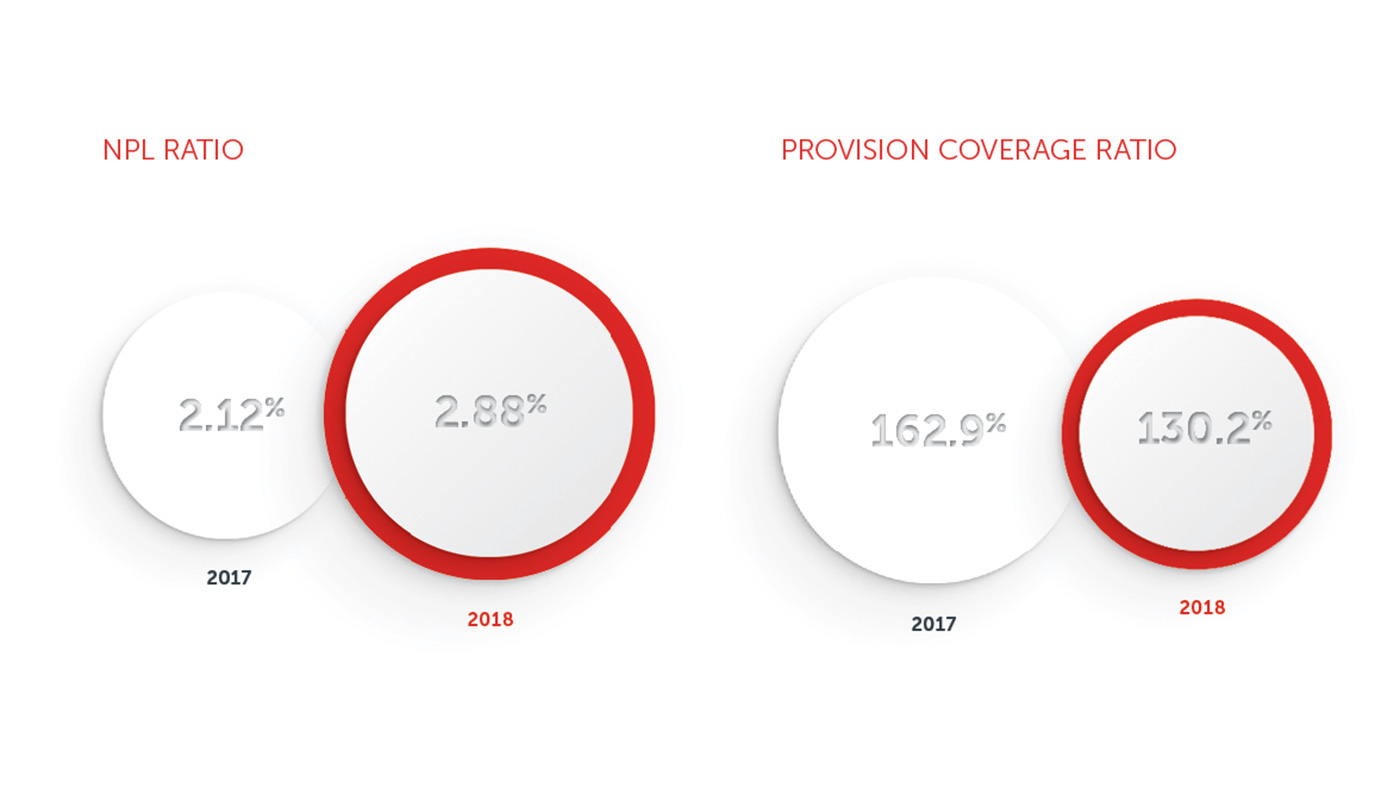

Net impairment charges were AED 1.266 billion, 24% lower than 2017, translating to an annualised cost of risk of 0.57% compared to 0.81% in 2017. The continued de-risking of the unsecured retail portfolio resulted in a much improved cost of risk for 2018.

As at 31 December 2018, stage 3/non-performing loan ratio (NPL) was 2.88% compared to 2.12% as at 31 December 2017. Non-performing loans increased to AED 5.191 billion from AED 3.692 billion as at 31 December 2017, led by a few corporate accounts. Effective 1 January 2018, the Bank successfully transitioned to the IFRS 9 accounting standard. Under IFRS 9, impairment allowances against loans and advances were AED 6.761 billion, with a provision coverage ratio of 130.2%. Stage 1 and 2 expected credit loss allowances were 2.32% of credit risk weighted assets, well above the minimum 1.5% stipulated by the UAE Central Bank.

COMFORTABLE LIQUIDITY POSITION

Net loans and advances to customers increased to AED 166 billion, up 2% year on year. Total customer deposits increased to AED 177 billion, up 8% year on year, outpacing the system wide growth of 6%* driven by an increase in corporate time deposits. At a time of rising benchmark rates, the Bank did not see any significant adverse impact on CASA deposits, which contracted only marginally and time deposits further increased to meet the LCR and the NSFR regulations. As at 31 December 2018, CASA balances totaled AED 70 billion and comprised 39% of total customer deposits. Loan-to-deposit ratio significantly improved to 94.2% compared to 100.1% last year.

The Bank continues to maintain a comfortable liquidity position, with a liquidity coverage ratio of 186%, compared to a minimum ratio of 90% prescribed by the UAE Central Bank. Liquidity ratio was 28.3% compared to 24.5% as at 31 December 2017, led by an increase in deposits and balances due from banks and an increase in quoted investments.

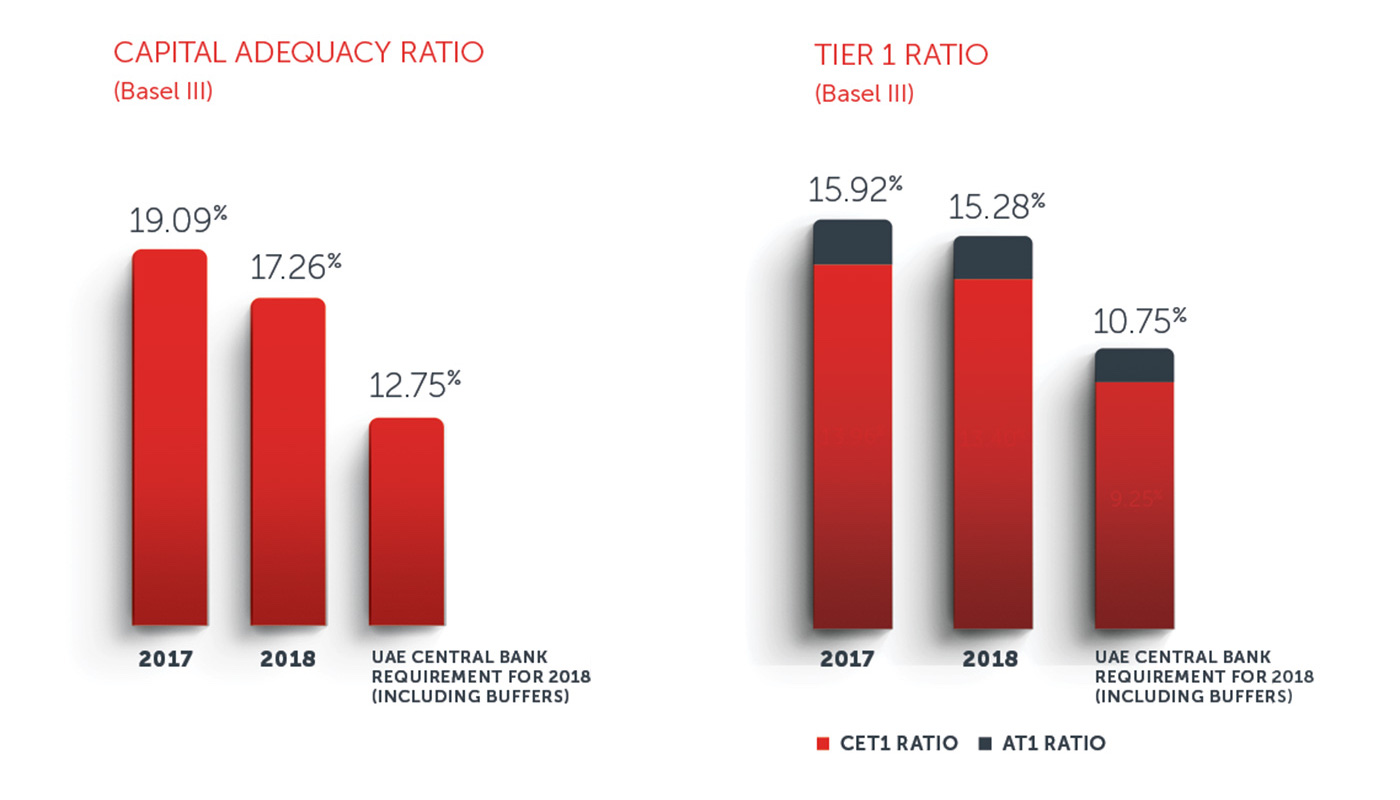

STRONG CAPITAL POSITION AND COMFORTABLE LIQUIDITY LEVELS

The Bank remains well capitalised with a Basel III capital adequacy ratio (CAR) of 17.26% and a common equity tier 1 (CET1) ratio of 13.40%, well above the minimum capital requirements of 12.75% and 9.25% (including buffers) respectively, as prescribed by the UAE Central Bank. The reduction in CAR compared to December 2017 was primarily on account of the 2017 dividend payout, IFRS 9 adjustments, increase in credit risk weighted assets and part repayment of tier 2 capital.