Leadership Messages Group CFO's Message

Driven by ambition and guided by discipline, ADCB has once again demonstrated the leadership, strength and resilience required to deliver a strong return for our shareholders.

Deepak Khullar

Group Chief Financial Officer

By adhering to our tried and tested long-term strategy, I am pleased to report a strong set of results, with top and bottom-line growth. Against the backdrop of an exacting market, we saw our operating income rise by 3% to AED 9.181 billion, while we generated a net profit of AED 4.840 billion, up 13% on last year. The return on average equity also lifted to 16.3%, up from 15.0% last year, delivering stronger shareholder value.

ADCB has consistently maintained a strong dividend payout ratio of around 50%. This year’s recommended cash dividend of AED 0.46 per share is equivalent to a payout of AED 2.391 billion and represents 49% of net profit.

These results reflect the quality, stability and efficiency of our management, which has successfully balanced earnings generation across all our different business segments. Together with our vigilant approach to risk and our adherence to a world-class governance framework, ADCB remains resilient against any economic headwinds that come our way.

ENDURING STRENGTH AND CAPITAL RATINGS

As one of just four banks in the UAE designated as systemically important, we remain well-capitalised, with a CET1 ratio of 13.40% and a Basel III capital adequacy ratio (CAR) of 17.26%, while our return on average equity continues to improve. The marginal annual fall in our capital adequacy ratio was primarily as a result of last year’s dividend payout, IFRS 9 adjustments, an increase in credit risk weighted assets and part repayment of Tier 2 capital.

Our liquidity remains strong, with a liquidity coverage ratio (LCR) of 186%, compared to the minimum of 90% prescribed by the UAE Central Bank. Our liquidity ratio increased by 3.8% on last year to 28.3%, driven by a rise in deposits and balances due from banks and an increase in quoted investments. This year, ADCB was a net lender of AED 15 billion in the interbank markets. Despite the increased cost of carrying high-quality liquid assets to meet both liquidity coverage ratios and net stable funding ratios (NSFR), our net interest margin saw a positive lift to 3.04% from 2.91% in 2017.

LIQUIDITY

COVERAGE RATIO (LCR)

This liquidity gives us the capability to withstand the impact of any severe deterioration in macroeconomic and financial market conditions and is fundamental to our success in passing all the UAE Central Bank’s stress tests.

As a result, we remain a highly-rated bank with consistent scores and stable ratings from leading international agencies such as Standard and Poor (A) and Fitch (A+), both of which confirm a stable outlook for the Bank.

MARKET TRENDS

A lift in oil prices and production have helped to bolster the economy, creating a financial surplus for the first time in the past three years. Investment activity is strengthening as the number of project awards rise and government spending aims to reinvigorate growth.

Yet the market is deeply challenging. Consolidation continues as corporates suffer from competitive pricing and squeezed margins. Steady decline in real estate and rental prices, in a market that is already oversupplied, is also taking its toll.

Consumer spending is down, as they remain cautious, mindful of rising interest rates and wary of the lingering uncertainty in the jobs market. This careful approach, which is settling to become the new norm, is reflected in the solid rise in deposit growth which continues to outstrip credit growth.

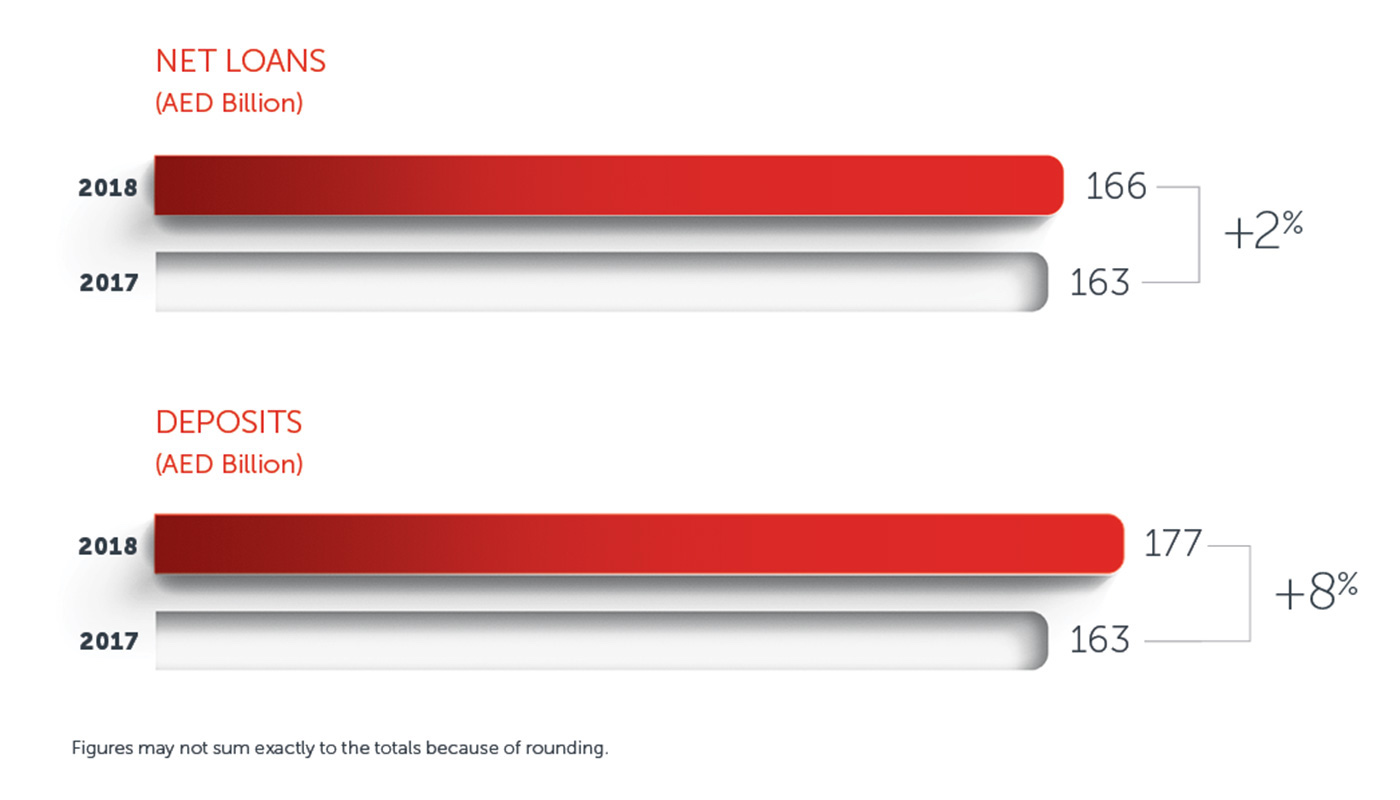

Against this backdrop, our balance sheet remains strong and healthy. Customer deposits increased 8% over 2017 to AED 177 billion. At a time of rising benchmark rates, we did not see any significant adverse impact on current and savings account deposits (CASA), which only contracted marginally. CASA deposits totaled AED 70 billion and comprised 39% of total customer deposits. Time deposits further increased to meet the LCR and the NSFR regulations. Loan-to-deposit ratio significantly improved to 94.2% from 100.1% last year.

Overall, wholesale funding, including Euro Commercial Paper, has consistently constituted around 20% of our liability base. In 2018, wholesale funding (including Euro Commercial Paper) comprised 19% of our liability base.

Meanwhile, we continued to develop diversified loan growth across all sectors, while placing a focus on increasing lending to the UAE National segment. This, combined with our ongoing drive to de-risk our unsecured retail loan portfolio, has led to an improvement in our cost of risk to 0.57% from 0.81% in 2017. Overall loan growth was at 2%, led by an increase in Wholesale Banking loans. Our profitability was bolstered by a rise in net interest rate margins and significantly lower impairment charges, which declined 24% over 2017.

PREPARED FOR TOMORROW

Our comprehensive and careful preparation in everything we do helps us to stay ahead and be ready for anything. The introduction of VAT in January, along with the implementation of IFRS 9 and new requirements for the NSFR were all challenges we were ready for and thus able to quickly embed in the business.

Meanwhile, we continue the pace of transformation across the Bank as we seek to enhance our products and services so that we are fit for the future. By continuing to invest in recruiting and retaining top talent, we are also well-prepared to create further growth and deliver ongoing improvements to our business.

At the same time, our strategic investments in customer service, operational excellence and our extensive digital programme have given greater control to our customers, empowering them to manage their money with greater speed, ease and security while securing long-term benefits for the Bank.

These accomplishments will have a short-term impact on our operating expenses, which this year increased by 5%, and nudged our cost to income ratio up to 33.6% from 33.1% in 2017. This is still well within our target range and forms part of our strategy to lay a firm and lasting foundation for significant long-term gains which will further strengthen the Bank.

Non-interest income fell by 11%, mainly driven by higher fees and commission related expenses and lower volumes. This was partially offset by a pick up in card-related fees and higher income from the merchant acquiring business along with higher trading gains.

As a result of the continuing volatility of the market and a range of economic challenges faced by corporates, our non-performing loans (NPL) increased to 2.88% from 2.12% in 2017. This was mainly driven by a few corporate accounts. Our provision coverage ratio remained strong at 130.2% as at 31 December 2018.

CREATING SUSTAINABLE VALUE

To be the number one bank of choice in the UAE, we must continue to create meaningful, long-term value for all our stakeholders, to make banking better, more accessible and safer for customers, to improve financial knowledge, to help build sustainable communities and to support both entrepreneurs and the government in creating a vibrant economy that will benefit us all.

To fulfil this purpose, we have been working tirelessly across every touchpoint of the Bank and are perfectly-placed to reap the rewards.

Our merger with Union National Bank, and the subsequent acquisition of Al Hilal Bank, will create an even more exciting future for us. The transaction, which is subject to the approval of regulators and shareholders, will create a powerful new Bank in the region which will offer significant cost synergies as well as attractive growth opportunities.

The new Bank will be in a position to provide further investment and support to its people, technology and infrastructure and, of course, to give customers an unrivalled banking experience.

Our priority now is to achieve a smooth and efficient integration, while at the same time maintaining business as usual for all our customers.

Having prepared well, we go forward into 2019 with great confidence.

Deepak Khullar

Group Chief Financial Officer

Recommended

Group CEO’s Message

I am proud to be part of an exceptional team of talented people across ADCB. Together, we have delivered a strong set of results...

Corporate Governance

ADCB is creating greater value for shareholders and making banking better for more than 800,000 customers.

Financial Overview

Our positive performance throughout 2018 demonstrates the effectiveness of our strategy and the enduring strength and resilience of the Bank.

Sustainability

As a major financial institution in the UAE, we are committed to sustainability, both within our own organisation and in the wider community.