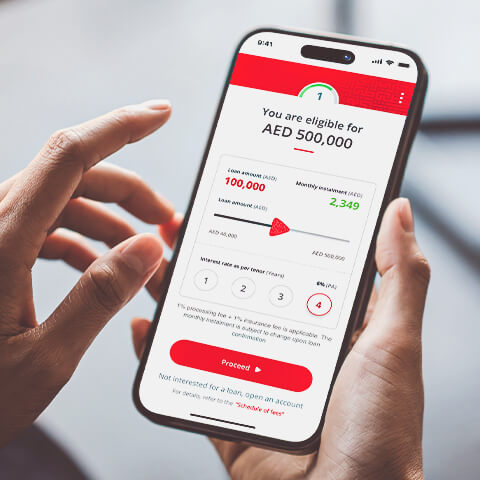

A customised solution that suits your ambitions

Our customised loan packages for UAE nationals offer attractive interest rates, higher salary multiples, extended loan tenure and flexible eligibility criteria.

Total interest paid during the loan tenure is AED 0

Disclaimer

The figures are based on indicative rates selected and are for illustrative purposes only and do not apply to your loan. ADCB rates are subject to change. The computation is based on simulated figures and a number of underlying assumptions and possible rounding-off of figures. Please consult your Relationship Manager/or visit the nearest branch or call 600 50 2030 to ensure that you receive complete information about our loan product.

Enjoy a world-class customer experience when you bank with us.

Other ways to apply

Contact centre

Call our 24-hour contact centre on 600 50 2030.

Apply through SMS

SMS 'PIL' to 2626 from your registered mobile number.

Visit us

We will be happy to welcome you at any of our branches. Find the closest branch to you

Letters spacing

Letters spacing Line height

Line height Default

Default Big

Big More big

More big Default

Default

Black & White

Black & White