How To Earn Select an option from the product category below to learn about how you earn TouchPoints

Partners

Careem

Joyalukkas

Kalyan

Sky Jewellery

Al Jaber Optical

Farah

Jawaher Al Sharq

Travelwings

Indus Jewellers

ADCB Cards

Classic/Standard Credit Cards

Gold Credit Cards

Platinum and Excellency Credit Cards

Excellency Visa Infinite Credit Cards

Excellency Visa Infinite Credit Cards

Private World Elite MasterCard Credit Cards

Traveller Credit Card

Classic/Standard Credit Cards

Gold Credit Cards

Platinum and Excellency Credit Cards

Excellency Visa Infinite Credit Cards

Private World Elite MasterCard Credit Cards

Traveller Credit Card

Easy Pay Debit Card

Privilege Club Debit Card

Excellency Premium Debit Card

Accounts and Deposits

Current and Savings Account

Excellency Current and Savings Account

Fixed Desposit

Insurance

Protection Plans

Savings Plans

Lumpsum

Investment

3rd Party/Proprietary Investments

Islamic Cards

Islamic Classic Credit Cards

Islamic Gold and Premium Gold Credit Cards

Islamic Platinum Credit Cards

Islamic Infinite Credit Cards

Islamic Classic Credit Cards

Islamic Gold and Premium Gold Credit Cards

Islamic Platinum Credit Cards

Islamic Infinite Credit Cards

Islamic Debit Card

Islamic Savings Accounts and Deposits

Islamic and Emirati Millionaire Savings Account

Excellency Islamic Savings Accounts and Emirati Millionaire Savings Account

Islamic Term Investment Deposit

Loans

Personal Finance

Smart Finance

Mortgage Finance

Car Finance

Islamic Finances

Salam Personal Finance

Yaqeen Salam Smart Finance

Ijarah Home Finance/ Forward Ijarah Home Finance

Murabaha Auto Finance

Ambition Education Finance

Service Ijarah Rental Finance

Takaful

Takaful Life Plans

Takaful Savings Plans

Lumpsum

External Funds Transfer

Personal Internet Banking

Mobile App

Contact Centre

Electronic Channels

Personal Internet Banking

SMS Banking

Mobile App

Contact Centre

Buy TouchPoints

Buy TouchPoints

One-Time Bonus

Personal Internet Banking

SMS Banking

Mobile App

Contact Centre

Terms & Conditions

Disclaimer

Cards

Accounts

Islamic Cards

Islamic Savings Accounts and Deposits

Loans

Islamic Finance

Trending now

Sit back, login and send money faster to 14 countries.

Get a chance to win exciting cash prizes with Xpress Money transfer.

Sending money should always feel rewarding.

Transfer AED 1000 or more and earn 0.25% cashback.

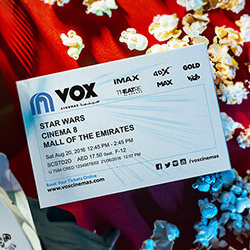

VOX Cinemas Offer

Use your ADCB card to buy a VOX Cinema ticket to get another ticket for free

Enhance your travel experience

Enjoy 20% off your flight and hotel booking, 0% foreign currency fees and much more with the ADCB Traveller Card.

Letters spacing

Letters spacing Line height

Line height Default

Default Big

Big More big

More big Default

Default

Black & White

Black & White