We actively support the growth of SMEs, micro-businesses and entrepreneurs by providing access to finance and improving financial inclusion amongst our customers. We also promote financial education to improve skills and knowledge about sound financial planning and management.

Access to a range of affordable financial products and services makes managing day-to-day living easier – helping individuals, families and businesses to achieve their long-term goals. See below for more information on access to everyday banking and how we support SMEs and micro businesses.

Everyday Banking

‘Hayyak’ – meaning ‘welcome’ in Arabic – is our popular onboarding app. Offering easy and inclusive access to additional retail banking services, 78% of new-to-bank retail customers were onboarded digitally in 2022. The app also allows eligible low-income customers to access banking services while opening a current account.

ADCB’s subsidiary Al Hilal Bank partnered with the Higher Colleges of Technology (HCT) to improve financial education for young people in the UAE.

As part of this initiative, the Bank extended banking solutions to students, offering them a dedicated virtual debit card with differentiated rewards exclusive to the HCT student community.

Al Hilal Bank also introduced a new feature on its digital app to allow parents to open accounts for their children.

Read more about Hayyak here.

Supporting SMEs and Micro-Businesses

We are dedicated to helping SMEs and micro-businesses prosper – offering cash management services, flexible working capital, and trade and capital expenditure financing.

In 2022, we provided AED 3.4 billion in loans to SMEs and micro-businesses through digital platforms.

Our Business Choice Account (BCA) supports over 40,000 new start-ups and companies with a turnover of less than AED 5 million.

The SmartStart Business Account, a customised Dirham Current Account for SMEs and micro-businesses offers free corporate internet banking, a corporate debit card, ProCash transaction access and no minimum balance requirements.

Broader initiatives to promote SMEs in the UAE include:

- Providing credit administration services to the Khalifa Fund for Enterprise Development

- Participating in the Department of Finance Ghadan21 credit guarantee scheme

- Developing a web portal for essential products and services for SMEs with the Department of Economic Development

- Supported 70,000 customers under the UAE Central Bank’s Targeted Economic Support Scheme (TESS) with instalment deferrals depending on their financial situation

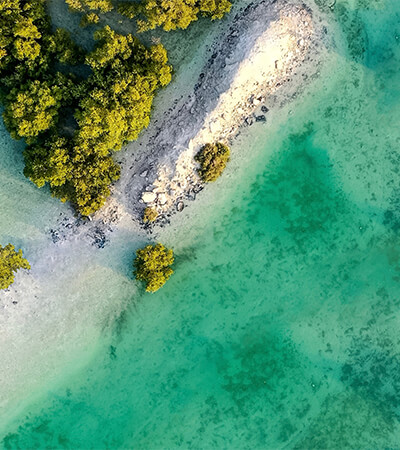

Green Mountains Environment & Transport Services

Green Mountains Environment & Transport Services

For the past two decades, ADCB has partnered with Green Mountains Environment & Transport Services to grow its business. The Emirati-owned company offers a wide range of waste management and consulting services for local government authorities and private wastewater treatment operators. We support them with their expansion plans to provide socially responsible end-to-end waste management solutions.

ADCB has been our banking partner for almost two decades, providing us with all the required banking solutions – including fleet financing, guarantees, letters of credit, along with a robust online platform to support our business in achieving our goals.

Amr Mohd Zaki,

Finance & Administration Manager, Green Mountains Environment & Transport Services

ADCB Pace Pay

ADCB Pace Pay, our digital payment app, replaces the Point of Sale (POS) terminal, providing smaller merchants with digital payment infrastructure at zero cost per transaction, without the need for any additional devices.

Through advanced data analytics, the Bank can now assess credit risk effectively, allowing ADCB to extend its products and services to micro businesses and SMEs that previously lacked access.

Read more about Pace Pay here and in our case study.

Accessibility

While digitisation is an area of strategic focus, we understand that there will always be a demand for physical access points. We have introduced a series of measures to make access to our facilities more inclusive, such as:

- The height of ATMs adjusted to ensure accessibility

- Access ramps in major branches

- Bilingual forms, posters, materials and other means of communication, such as visual monitors in branches

- Multilingual staff in all branches to assist customers in English, Arabic, Urdu and Hindi

- Our telephone banking is available in three languages (English, Arabic, and Hindi) covering a significant portion of the UAE’s population

Letters spacing

Letters spacing Line height

Line height Default

Default Big

Big More big

More big Default

Default

Black & White

Black & White

Green Mountains Environment & Transport Services

Green Mountains Environment & Transport Services