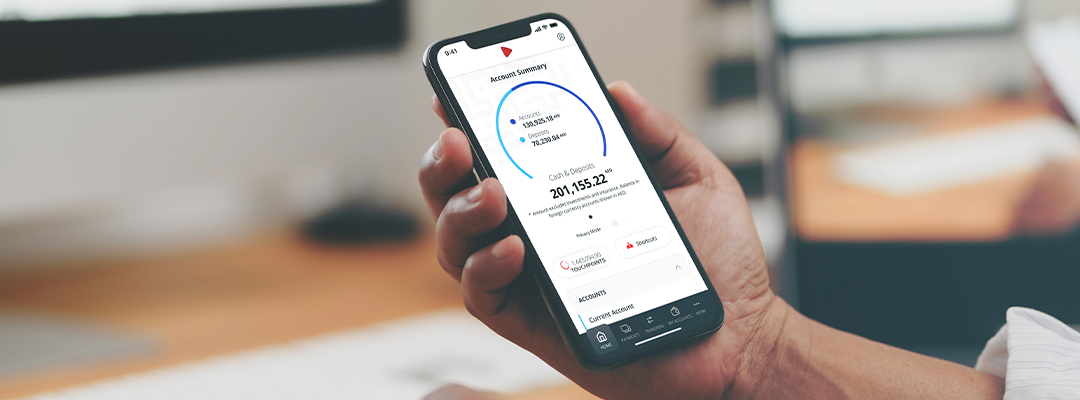

Ways To Bank Mobile Banking

More power at your fingertips.

With the ADCB Mobile App, you have a simple, secure and convenient way to access your accounts and transact using your smartphone.

Mobile platforms

The ADCB Mobile App is available for your iPhone & Android mobile handsets.

Ease of use

Check your account and card balances through your mobile on our simple, secure and intuitive mobile platform.

Ease of access

With fingerprint authentication and facial recognition (handset dependent), the ADCB Mobile App allows extra secure biometric sign-in.

Get more done

A user-friendly interface with you in mind, easily pay your bills and transfer money.

Languages

Available in English and Arabic.

You can use ADCB Mobile Banking to:

- Apply for a Personal Finance and get the funds instantly credited into your account

- Apply for Personal Payment Plan and Cash loan on your available Credit Card Limit

- Open Fixed Deposit accounts instantly with flexible tenors and competitive interest rates

- Transfer funds through Instant funds transfer to other ADCB accounts and/ or other UAE banks account

- Pay your ADCB Credit Card bills and pay other bank’s Credit Cards bills

- Pay your utility bills and school fees

- Top-up mobile prepaid accounts, NOL and Salik

- Request a cheque book and have it delivered to your mailing address

- Activate your Debit Card and Credit Card

- Set or Reset Debit or Credit Card pin

- Block your Card instantly if lost or stolen

- Request for your replacement Debit or Credit Card

- Request for E-statements

- Add Cards to Apple Pay

- Register for the ADCB MoneyBuddy App

Download now

Alternatively, scan the below QR code to download the app.

ADCB Mobile Banking App Tutorials

For videos and tutorials, please click here

How to activate

Using ADCB Credit or Debit Card

- Enter your ADCB Credit or Debit Card Number and PIN to generate the Activation Key.

- Activate the App by entering the unique Activation Key sent via SMS to your registered mobile number.

- Set up your password and you are ready to go.

Using ADCB Personal Internet Banking

- Log in and click Mobile Banking under Other Services on the left menu

- Click option “Mobile Banking App” option on the screen

- Add your device, give it a nickname and confirm.

- A one-time Activation key is sent through SMS to the registered mobile number, which has to be used to activate the App on your phone.

Through Contact Centre

- Call ADCB Contact Centre on 600 50 2030, 600 50 8008 or 600 50 2004 from within the UAE or +97126210090 from outside the UAE

- Call ADCB Islamic Contact number on +9712 600562626

- Speak to a Phone Banking officer for Mobile App activation. We will assist you with the activation process.

- We'll send the one-time activation key through SMS to the registered mobile number. This must be used to activate the App on your Phone.

Chat

Letters spacing

Letters spacing Line height

Line height Default

Default Big

Big More big

More big Default

Default

Black & White

Black & White