FAQ

Answers to the most

frequently asked questions.

Emirati Millionaire Savings Account

It is an account that rewards customers for their savings. Customers can access their funds at all times and withdraw any amount as and when needed.

- Offered Exclusively to UAE Nationals.

- A minimum average monthly balance of AED 5000 is required to enter the prize draw for a chance to win prizes.

- Every additional AED 1,000 saved gives you an extra chance to enter the prize draw.

- It’s a transactional account that comes with a debit card and is accessible through all digital channels (Internet & Mobile Banking, SMS Banking).

- Over the counter transactions are allowed.

- Profits are paid every quarter.

- Available in AED.

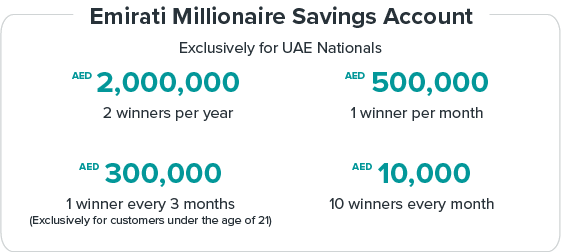

- List of prizes:

- In order to hold an Emirati Millionaire Savings Account, you must be a UAE National.

- ADCB and its subsidiaries’ employees and their immediate family members (parents, spouses, siblings and children) are not eligible to open Emirati Millionaire Savings Accounts.

- All individuals who open an Emirati Millionaire Savings Account and maintain a minimum average monthly balance of AED 5000 are eligible for the prize draw. Parents or legal guardians can open accounts for children under the age of 18.

For the first AED 5000 saved, the customer gets 1 chance and for every extra AED 1000 he/she saves over the initial AED 5000, he/she gets an extra chance in the prize draws.

E.g. if a customer has an average monthly balance of AED 10,000, he/she will get 6 chances in the prize draw.

The Emirati Millionaire Savings Account is a Shari'ah approved savings account that offers all the standard features of an Islamic savings account with the addition of monthly prizes.

Profit is calculated on the minimum average monthly balance in the account in accordance with the Shari’ah approved profit distribution mechanism and paid on a quarterly basis.

To view the fees and charges, please click here.

No, the Emirati Millionaire Savings Account is offered to individual customers only.

The main purpose of the Emirati Millionaire Savings Account is to encourage saving habits and earn rewards on savings hence salary transfers are not encouraged. However, customers can open regular Islamic savings or current accounts for salary transfers.

Yes, they should be opened by the parent of legal guardian of the minor.

Letters spacing

Letters spacing Line height

Line height Default

Default Big

Big More big

More big Default

Default

Black & White

Black & White